Our Terms & Conditions | Our Privacy Policy

ASX snaps three-day winning streak, Rivers to be shut down completely — as it happened

11h agoWed 22 Jan 2025 at 11:15pm

Market snapshot

- ASX 200: -0.6% to 8,379 points

- Australian dollar: Flat at 62.69 US cents

- Wall Street: Dow (+0.3%), S&P 500 (+0.6%), Nasdaq (+1.3%)

- Spot gold: +0.1% at $US2,753/ounce

- Brent crude: -0.3% at $US78.75/barrel

- Iron ore: Flat at $US103.70/tonne

- Bitcoin: -1.8% at $US102,201

Prices current at 4.35pm AEDT

5h agoThu 23 Jan 2025 at 5:33am

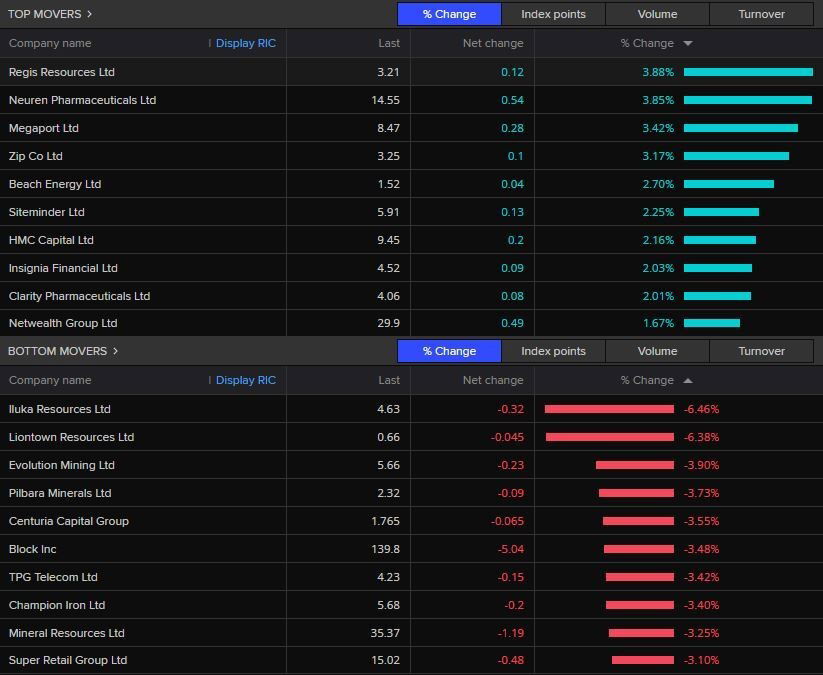

ASX closes lower

The ASX 200 closed lower Thursday, dropping -0.61% to 8,379-points after setting a new 20-day high.

Regis Resources ended the session +3.9% higher after a strong quartley production report, followed by Neuren Pharma, Megaport, and Zip Co.

Iluka Resources and Liontown finished the day -6.5% and -6.4% lower.

Other major miners that ended in the red were Evolution, Pilbara Minerals and MinRes.

The Aussie dollar also finished down, losing -0.1% to 62.70 US cents.

Gold was down to $2,751 (-0.1%) and Bitcoin dipped by -2% to $102,028.

5h agoThu 23 Jan 2025 at 5:13am

Thanks for your comments on ColesWorth

Being the most distrusted brands in Australia will mean little to Woolworths and Coles. Without any viable alternatives consumers are stuck with them.

– Peter

The ACCC’s report into the supermarket sector and whether it has enough competition is due out next month.

The consumer watchdog has already noted that it thinks the sector is an oligopoly.

6h agoThu 23 Jan 2025 at 4:30am

Myer up, Premier down

Myer shares have pushed higher in late trade off the back of more than 96% of shareholders voting to merge the department store with Premier Investments.

Myer Holdings was up +5.5% at 3.30pm to 96 cents.

Premier Investments on the other hand was down -0.8% to $26.85.

6h agoThu 23 Jan 2025 at 4:27am

Stage 3 tax cuts are being saved, not spent

That’s according to recently released analysis from Westpac, which has looked at the last six months of consumer behaviour.

The Westpac-DataX Consumer Panel, released earlier today, shows households are only spending 25% of the income boost given to them by the Stage 3 tax cuts — meaning the remaining 75% has gone straight into savings.

Westpac economist Jameson Coombs said that the data firmly debunks concerns that households would splash their cash during the Black Friday, Cyber Monday and Boxing Day sales.

“After a significant squeeze on household incomes over the past few years, not even the allure of a festive season and aggressive discounts could persuade consumers to part ways with their hard-earned dollars,” he wrote.

“In dollar terms, households have received an average cumulative tax benefit of roughly $830, of which $205 has been spent and the remaining $625 has been saved.”

So what does this mean going forward?

“The low passthrough of Stage 3 tax cuts to spending should have a bearing on the near-term decision-making of the RBA and more broadly to the outlook for consumption and growth,” he said.

He also noted that the RBA had some concerns about card transaction data suggesting a boost in spending in October and November, but Westpac believes it was only temporary in the lead up to Christmas — and that’s potentially good news where interest rates are concerned.

“That should in turn bolster the RBA’s confidence that disinflation progress is continuing and is sustainable,” he said.

“On its own, this would support an earlier rather than later rate cut from the RBA. However, whether that eventuates clearly depends heavily on forthcoming inflation updates and how the RBA assesses recent labour market data.”

We’ll get those inflation updates next week, with the December Consumer Price Index figures dropping on Wednesday.

6h agoThu 23 Jan 2025 at 4:11am

Time to break out the calculator

If the government is sincere about about keeping Rex flying, becoming the biggest creditor will perhaps be the cheapest way of bringing the airline into public ownership. If my memory of insolvency law is accurate, becoming the biggest creditor will mean they will control the administration & at some point the government could come to a deed of arrangement to payout the remaining creditors for cents on the dollar to gain ownership. Just how much they get the credits to take a haircut will be an interesting political calculation.

– allan

If you’re feeling like crunching some numbers Allan, please be our guest!

Loading

6h agoThu 23 Jan 2025 at 4:01am

Woolworths and Coles the most distrusted brands in Australia, pollster says

Pollsters Roy Morgan have been tracking the levels of trust and distrust in Australia’s biggest brand names since 2017.

The market research firm says Woolworths has set an unwanted record, after unseating Optus as Australia’s most distrusted brand.

Woolworths and Coles (the second most distrusted brand) have recorded the highest distrust ratings in the survey’s eight-year history.

“Distrust has a far more potent impact on consumer behaviour than trust,” said Roy Morgan CEO Michele Levine.

“While trust creates loyalty, distrust can drive customers into the welcoming arms of more trusted brands. The reputational fall of Woolworths and Coles is a powerful reminder of the fragility of trust in today’s environment.”

Roy Morgan’s data shows that during the COVID-19 pandemic, Woolworths and Coles earned record levels of trust.

However, their role in the cost of living crisis has quickly eroded that goodwill.

“The pandemic placed the major supermarkets at the centre of Australian lives,” Ms. Levine explained.

“But the goodwill they built during that period has been reversed by perceptions of too profit-motivated and unaffordable pricing.”

In figures released in October 2024 Woolworths had fallen 239 places to become the most distrusted brand, with Coles following closely dropping 237 places.

My colleague Dan Ziffer wrote an excellent analysis about brand reputation recently.

6h agoThu 23 Jan 2025 at 3:56am

Both sides of politics are on board with Rex

do you think the oppostion cross bench will support that, the public owing another airline, and will it go through before the election or after, I say the oppostion minor parties will be mad not to support it

– Justin

It certainly seems like it would have support, Justin.

Peter Dutton was asked earlier today about whether he supports the federal government’s move to take on the $50 million debt.

He didn’t mince his words either — and stressed that Rex needs to remain in the air.

“We would be happy to support the government [in] a bipartisan way to see Rex Airlines fly again,” he said.

“It’s important for regional areas and it’s very important for competition in this country as well.”

While he didn’t go into specifics about whether that means the Coalition would back the potential nationalisation of the airline, he’s made it pretty clear he wants Rex to stay up and running. (Or flying, in this case.)

As for when it could happen? That’s unclear, but we do know that Rex’s administrators at EY have been given the all clear to keep the airline’s voluntary administration going until June 30.

(And while we’re not a politics blog, the latest possible date the federal election can be held is on May 17.)

7h agoThu 23 Jan 2025 at 3:41am

Is the government’s lifeline to Rex politically motivated?

It very well could be, according to UTS economist Tim Harcourt.

He says the move by the federal government to become the airline’s largest creditor and taking on PAG’s $50 million debt can help curry favour in regional areas which rely on Rex.

“The government’s got a close eye on the next election and the importance of regional seats to the outcome of the next government election,” he said

“Anything that gets a politician in front of a camera with a big cheque, you tend to see around election time.”

You can read more here:

7h agoThu 23 Jan 2025 at 2:52am

Will Rex end up as a government airline?

Hi all.

The latest move on REX makes it clear the government has decided not to let the airline go under. They’ve said it is profitable without the inter capital city routes.

That being the case maybe we could ask the minister why they don’t quit messing about , buy out the airline , thereby getting rid of the administrators (who will be charging millions for their work ) , fire the board , hire a CEO who knows how to run an airline , and recoup taxpayers money over time from the profits?– Phillip

Hi Phillip, you raise an interesting question.

If Rex can’t find a buyer and the government doesn’t want to allow it to be liquidated, to ensure key regional routes keep operating, then one possible end game must logically be public ownership or a heavily subsidised private operation.

We’ll keep looking into it and asking the questions.

8h agoThu 23 Jan 2025 at 2:40am

More background on the Mosaic collapse and Rivers closure

As just reported, the chain Rivers is being shut down by mid-April with 650 jobs to be axed as a result.

It follows tough trading conditions and the collapse of Rivers’ parent company Mosaic.

“Unfortunately, a sale of Rivers was not able to be achieved,” David Hardy, receiver and KPMG partner said.

“This means the receivers have made the difficult decision to wind down this iconic Australian brand.”

They are still trying to find buyers for Mosaic brands Millers and Noni B to keep them going.

“The closure of the Rivers brand will impact 136 Rivers stores and approximately 650 employees,” the note adds.

“The timing of individual store closures will vary and be largely dependent on stock levels and sell through.”

More on the company’s collapse here and how it will be felt more acutely in regional Australia and with senior shoppers.

8h agoThu 23 Jan 2025 at 2:34am

Govt wants $50m back from Rex sale

Minister for Transport & Regional Development Catherine King fronted journalists in Melbourne this morning about the government buying $50 million of debt from Rex Airline’s largest secured creditor PAG.

“That is necessary in order to make sure we don’t have adverse outcomes for regional communities,” Ms King said.

“The largest creditor could have, at any stage, put the company into liquidation and we have been doing everything we can to avoid that.”

The government, as the largest creditor, can now order administrators to try and sell the company for a second time. It failed in its first push to sell last year.

Ms King said if the company is bought the government “will be seeking to get that debt back”.

How do you feel about this move by the government? Send me an email at: clayton.rachel@abc.net.au

8h agoThu 23 Jan 2025 at 2:30am

All Rivers stores to be closed with 650 people to lose jobs

Mosaic Brands, which owns Rivers, went into administration last year.

Its receivers have now said they’ve failed to sell the chain, and now all of the brand’s 136 stores will be closed.

And 650 people will lose their jobs.

“Unfortunately, a sale of Rivers was not able to be achieved,” David Hardy, receiver and KPMG partner said.

“This means the receivers have made the difficult decision to wind down this iconic Australian brand.”

The receivers already announced last year that it was winding down the Katies brand under Mosaic and shutting dozens of stores under Rivers, Millers and Noni B.

They are still trying to find buyers for Millers and Noni B to keep them going.

Are you a Mosaic worker? How are you feeling about the closure of Rivers? Or are you a customer?

Send me an email on terzon.emilia@abc.net.au

8h agoThu 23 Jan 2025 at 2:24am

Solomon Lew talks with ABC News about Myer merger

Emilia here with you again. I’m finally back in the ABC office here in Melbourne after a busy morning covering the Myer merger.

To catch you up on all the big notes of the deal:

- Myer will takeover Premier’s 700+ fashion stores including Just Jeans, Portmans and Jay Jays from January 27

- The vote from both companies’ shareholders for this merger was overwhelming with 95% plus in favour at both

- It will see Premier’s founder Solomon Lew become the biggest shareholder in both entities and rejoin Myer’s board

- Myer gets Premier’s leaders from those brands to keep running them as separate trades to Myer (at least for now)

I had a chat with Mr Lew for ABC News just after Premier’s shareholder meeting where he was obviously very chuffed.

“I’m feeling very happy for the corporation,” he told me.

“I’m feeling very happy about Myer and the two companies getting together, and obviously shareholders have voted beyond my expectation.

“So you can’t do much better than almost 100% of the vote.

“It’s an incredible vote. When I was told about the result, I said, Did you go back and check it again?

“It’s this big challenge. There now big opportunity.”

Mr Lew shortly after his shareholders voted in favour of the Myer merger. (ABC News)

Mr Lew shortly after his shareholders voted in favour of the Myer merger. (ABC News)

Mr Lew used to be on the board of Myer many years ago, he had this to say when I asked why he’s so keen to go back.

“Our attachment is what’s in the best interest of shareholders, and we’re going to end up as the largest shareholder,” he said.

He also disclosed to me that he was wearing socks from Myer.

10h agoThu 23 Jan 2025 at 12:25am

Record high land prices hindering home building

It may come as no surprise that rising land prices make home building harder, but it’s interesting to put some numbers around it.

According to the peak national home building body the HIA and CoreLogic, land price growth is running ahead of inflation and building costs.

In the HIA-CoreLogic Residential Land Report, it says the median price of land sold nationally was up 7.6 per cent in the year to September, when compared to the previous year.

In the September quarter 2024 it was at a record high of $366,510,

CoreLogic economist Kaytlin Ezzy says

Affordability continues to be a major hurdle in bringing new housing stock online. The continued uptick in land prices, coupled with upward pressure on construction costs and the higher for longer interest rate environment, has moved new home ownership further out of reach for some Australians.

The report looks at sales activity in 52 housing markets across Australia, including the six state capitals.

Kaytlin Ezzy says building activity is not keeping pace with government targets

Over the year to November, the ABS counted approximately 169,000 new dwelling approvals. While up slightly (0.5%) compared to the previous year, this is -17.8% below the decade average and almost -30% below the 240,000 a year needed to meet the government’s target.

10h agoWed 22 Jan 2025 at 11:49pm

Mining stocks weigh on ASX, Insignia Financial receives improved takeover offer

The Australian share market has fallen slightly in morning trade, with the ASX 200 down 0.5% to 8,390 points.

Today’s worst performing stocks include:

- Miners: Iluka Resources (-3.2%), Evolution Mining (-2.4%), Sandfire Resources (-1.8%), Nickel Industries (-1.8%)

- Block (-3.5%)

- Ampol (-2.5%)

- Goodman Group (-2.2%)

On the flip side, here are the companies experiencing the biggest gains to their share price:

- Emerald Resources (+2.7%)

- Coronado Global Resources (+2.5%)

- Insignia Financial (+2.4%)

- Xero (+1.7%)

Insignia is a wealth management firm, formerly known as IOOF.

Its share price jumped because it’s currently a takeover target, and the bidding war is heating up.

Bain Capital has increased its takeover bid to $4.60 per share (essentially matching the offer that CC Capital Partners also made).

At that price, both private equity firms are valuing Insignia at $3.07 billion.

11h agoWed 22 Jan 2025 at 11:35pm

Australian share market drops 0.4pc in early trade

It’s been a shaky start for the ASX, with most sectors lower and mining stocks (in particular) weighing heavily on the share market.

The ASX 200 had slipped 0.4% to 8,397 points by 10:30am AEDT, despite a strong performance on Wall Street this morning.

So far, the worst performing sectors are real estate (-1.6%), materials (-1.1%), industrials (-1%) and energy (-0.9%).

Around 130 out of 200 stocks are trading lower (ie. most of them).

11h agoWed 22 Jan 2025 at 11:24pm

What’s it like being unemployed in Australia right now?

That’s the question I put to you recently, dear readers, and you came back with your stories of the tough job market. One was featured in my recent story on unemployment data.

Watch Kelsey’s story :

11h agoWed 22 Jan 2025 at 11:17pm

Market snapshot

- ASX 200: -0.4% to 8,396 points

- Australian dollar: -0.1% to 62.65 US cents

- Wall Street: Dow (+0.3%), S&P 500 (+0.6%), Nasdaq (+1.3%)

- Spot gold: +0.4% at $US2754/ounce

- Brent crude: -0.4% at $US78.97/barrel

- Iron ore: +0.7% at $US104.65/tonne

- Bitcoin: -0.1% at $US103,953

Prices current at 10:15am AEDT

Live updates here:

11h agoWed 22 Jan 2025 at 10:54pm

Premier’s proxy votes also overwhelmingly in favour of Myer merger deal

This just went up on the ASX.

It shows almost close to 100% votes from proxy shareholders at Premier are in favour of selling the company’s apparel brands to Myer, further showing this deal is a fait accompli.

Premier’s AGM is being held in just over an hour, also at a live meeting in Melbourne at 11am.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.