Our Terms & Conditions | Our Privacy Policy

Bitcoin Accumulation Strategy Under Threat As Stock Prices Plummet, Says VanEck

VanEck’s Matthew Sigel raises concerns over the risks of public companies’ Bitcoin accumulation strategy. Sigel warns companies to scale back their Bitcoin buying spree if stock prices falter.

VanEck Warns BTC Buying Firms to Reassess Strategy

In a recent X post, VanEck Crypto Research Head Matthew Sigel raised a red flag on public companies’ Bitcoin accumulation strategy. Sigel alerts that these companies should abandon the BTC tactics if their stock prices experience a significant decline.

Urging platforms to reevaluate their strategies, Sigel stated, “That might include a merger, spinoff, or sunset of the BTC strategy.” He also asserted that one prominent firm is nearing a critical point. He wrote on X,

No public BTC treasury company has traded below its Bitcoin NAV for a sustained period. But at least one is now approaching parity. As some of these companies raise capital through large at-the-market (ATM) programs to buy BTC, a risk is emerging: If the stock trades at or near NAV, continued equity issuance can dilute rather than create value.

Notably, Sigel advises companies accumulating Bitcoin to tie executive compensation to net asset value per share growth, rather than the size of their Bitcoin holdings or share count. He emphasizes the importance of disciplined decision-making while companies still have strategic flexibility. He added, “Once you are trading at NAV, shareholder dilution is no longer strategic. It is extractive.”

Further, Sigel recommends safeguards for companies with Bitcoin treasury strategies to mitigate potential risks.

- Suspension of ATM issuance- ATM issuance shall be suspended if the stock price falls below 0.95 times net asset value (NAV) for an extended period, say, for example, 10+ trading days.

- Share buyback prioritization: Share buybacks could be prioritized when Bitcoin’s value surges, but the company’s stock price doesn’t follow suit.

- Strategic review- A review shall be conducted if the NAV discount persists, potentially exploring options like mergers, spinoffs, or discontinuing the Bitcoin strategy.

Semler’s Bitcoin Bet Backfires, Stock Price Falls 45%

In a subsequent thread, the VanEck Head revealed that Semler Scientific, a medical technology firm, is the company that is “approaching parity.” Since May 24, Semler has been accumulating Bitcoin, now holding 3,808 BTC worth $404.6 million. As of now, Semler is the 13th largest BTC holder among public firms.

Other prominent companies, such as MicroStrategy and Metaplanet, are increasingly accumulating Bitcoin. Earlier today, Japanese firm Metaplanet added 1,112 BTC, bringing its total holdings to 10,000. Michael Saylor’s Strategy has also hinted at its next Bitcoin purchase, with its current holdings totaling 582,000. As per VanEck head’s statement, these companies are poised to face increased risks if their stocks plummet.

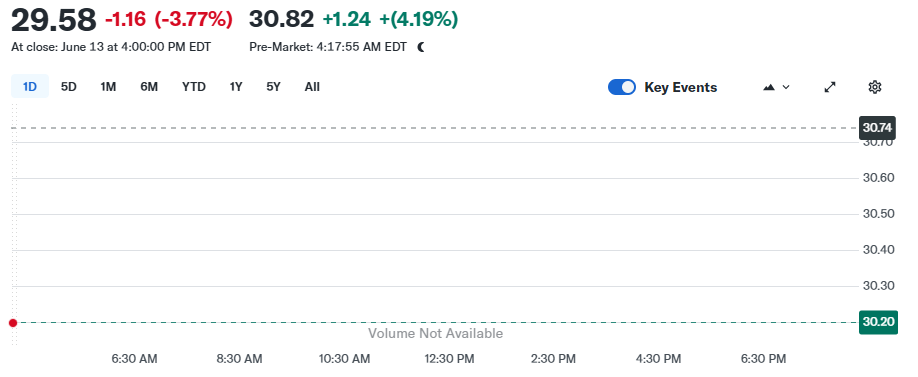

In contrast to Bitcoin’s straight ascendance, Semler’s (SMLR) stock price has fallen sharply by about 45% this year, returning to levels seen when the company first began accumulating Bitcoin. As a result, its market capitalization has dropped to approximately $434.7 million. Reportedly, Semler’s market capitalization relative to its Bitcoin holdings, measured by its multiple of net asset value (mNAV), has fallen to approximately 0.821x, dipping below 1x.

Source: Yahoo Finance; MSLR Stock Price Dips

Source: Yahoo Finance; MSLR Stock Price Dips

Semler Scientific, Inc. (SMLR) closed at $29.58 on June 13th, 2025, which was a decrease of $1.16 or 3.77% from the previous closing price. However, during pre-market trading, the stock price rose to $30.82, showing an increase of 4.19%.

✓ Share:

Nynu V Jamal

Nynu V Jamal is a passionate crypto journalist with three years of experience in blockchain, web3, and fintech spheres. She has established herself as a knowledgeable and engaging voice in the cryptocurrency and blockchain space. Her experience as an Assistant Professor in English Language and Literature has further added to her quest for crafting informative, well-researched, and accessible content.

Why trust CoinGape: CoinGape has covered the cryptocurrency industry since 2017, aiming to provide informative insights to our readers. Our journalists and analysts bring years of experience in market analysis and blockchain technology to ensure factual accuracy and balanced reporting. By following our Editorial Policy, our writers verify every source, fact-check each story, rely on reputable sources, and attribute quotes and media correctly. We also follow a rigorous Review Methodology when evaluating exchanges and tools. From emerging blockchain projects and coin launches to industry events and technical developments, we cover all facets of the digital asset space with unwavering commitment to timely, relevant information.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.