Our Terms & Conditions | Our Privacy Policy

Bitcoin Price All-Time High Likely As Tether Mints $1 Billion USDT on Tron

Bitcoin price could soon hit fresh all-time highs as the largest stablecoin firm Tether, has mined $1 billion worth of USDT on the Tron blockchain network. Such a massive minting comes nearly three weeks after the last instance, and this massive liquidity pump could help BTC break free from the ongoing consolidation. Interestingly, this minting happens just ahead of the US CPI release this week, for the month of May.

Tether Mints Additional $1 Billion USDT, Bitcoin Price ATH Soon?

As per the data from Arkham Intelligence, Tether has minted another $1 billion USDT on the Tron blockchain, marking its second significant issuance in less than a month. The latest mint follows a $2 billion USDT issuance on May 21, which coincided with a major market movement.

Notably, just a day after the previous mint, Bitcoin price surged past $111,000 to set a new all-time high. If history repeats once again, we could probably see BTC hitting new highs very soon. Interestingly, today’s massive minting comes just ahead of the US CPI inflation numbers for May, releasing this week ahead.

Tether on USDT Minting Spree

In 2025, Tether minted a net total of 16.7 billion USDT across the Tron and Ethereum networks. Historical trends, as illustrated in the chart below, suggest that Tether’s USDT minting often correlates with upward movements in BTC’s price.

There have been two previous instances where BTC has rallied after massive USDT minting. Between April 23 and May 7, Tether minted a total of 6 billion USDT, which coincided with Bitcoin price surging past $100,000 for the first time in three months. On May 15, Tether minted an additional 2 billion USDT, shortly after which BTC broke through the $105,000 mark.

Over the past two weeks, Bitcoin has been consolidating around $105,000 with no major catalyst in sight. Today’s USDT minting on Tron could serve as a massive liquidity boost, driving Bitcoin and the overall market higher.

As of press time, BTC price is trading 1.53% up at $106,750 level with daily trading volumes surging 18% to more than $41 billion. Besides, the open interest is also up 3% to $73.5 billion, showing growing optimism among traders.

Michael Saylor to Provide Additional Catalyst

In a message on the X platform, Strategy executive chairman Michael Saylor has already hinted at a fresh Bitcoin purchase announcement coming on Monday. The probable announcement could lead to activating the BTC bulls once again, driving BTC price higher.

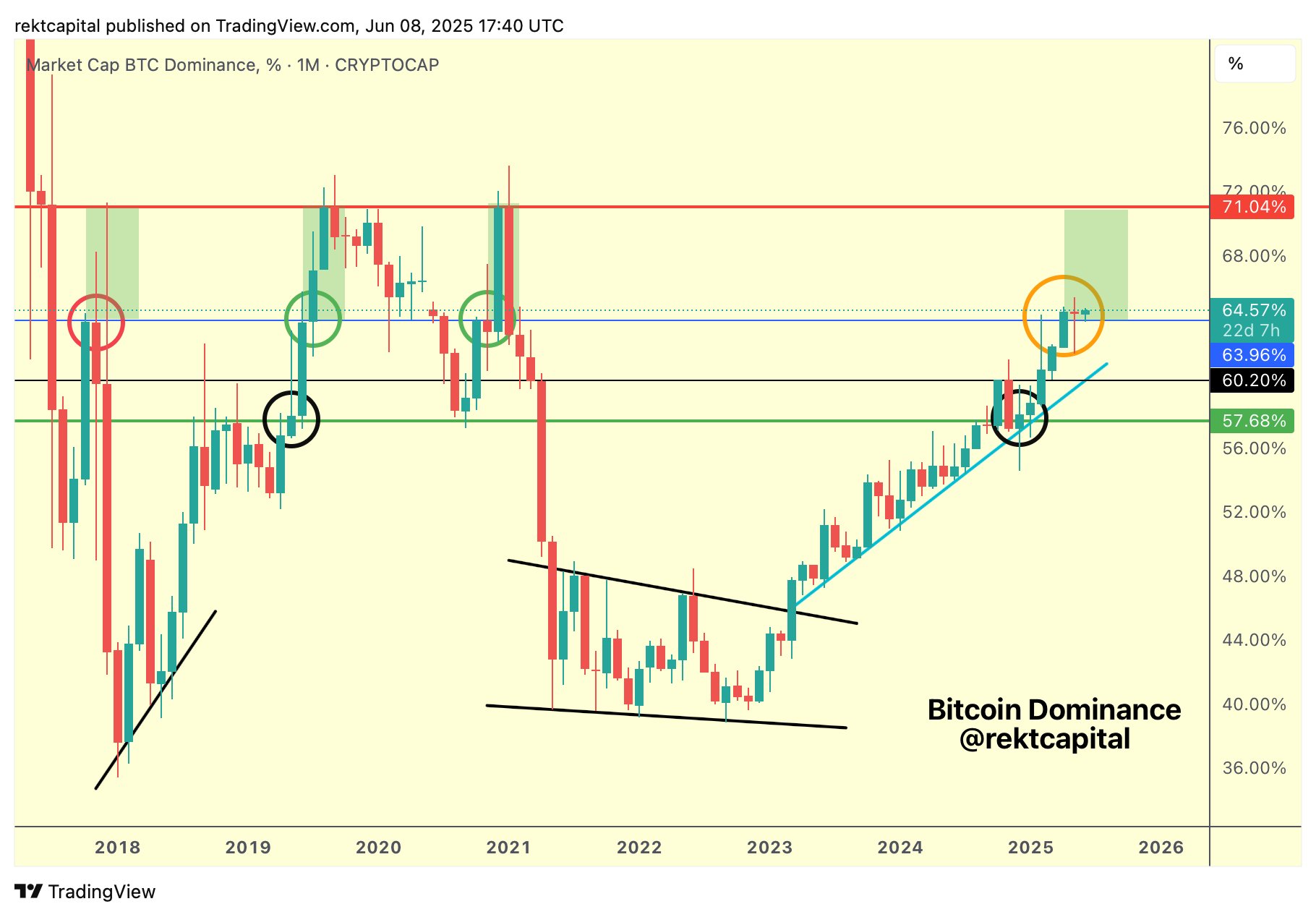

As of now, the Bitcoin dominance is forming a base at 64%. Popular market analyst Rekt Capital expects the BTC dominance to climb further to 71% before the capital rotation begins into altcoins.

Source: Rekt Capital

Source: Rekt Capital

✓ Share:

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Why trust CoinGape: CoinGape has covered the cryptocurrency industry since 2017, aiming to provide informative insights to our readers. Our journalists and analysts bring years of experience in market analysis and blockchain technology to ensure factual accuracy and balanced reporting. By following our Editorial Policy, our writers verify every source, fact-check each story, rely on reputable sources, and attribute quotes and media correctly. We also follow a rigorous Review Methodology when evaluating exchanges and tools. From emerging blockchain projects and coin launches to industry events and technical developments, we cover all facets of the digital asset space with unwavering commitment to timely, relevant information.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.