Our Terms & Conditions | Our Privacy Policy

BlackRock Loads Up on Bitcoin, Files For Premium ETF to Increase BTC Yield

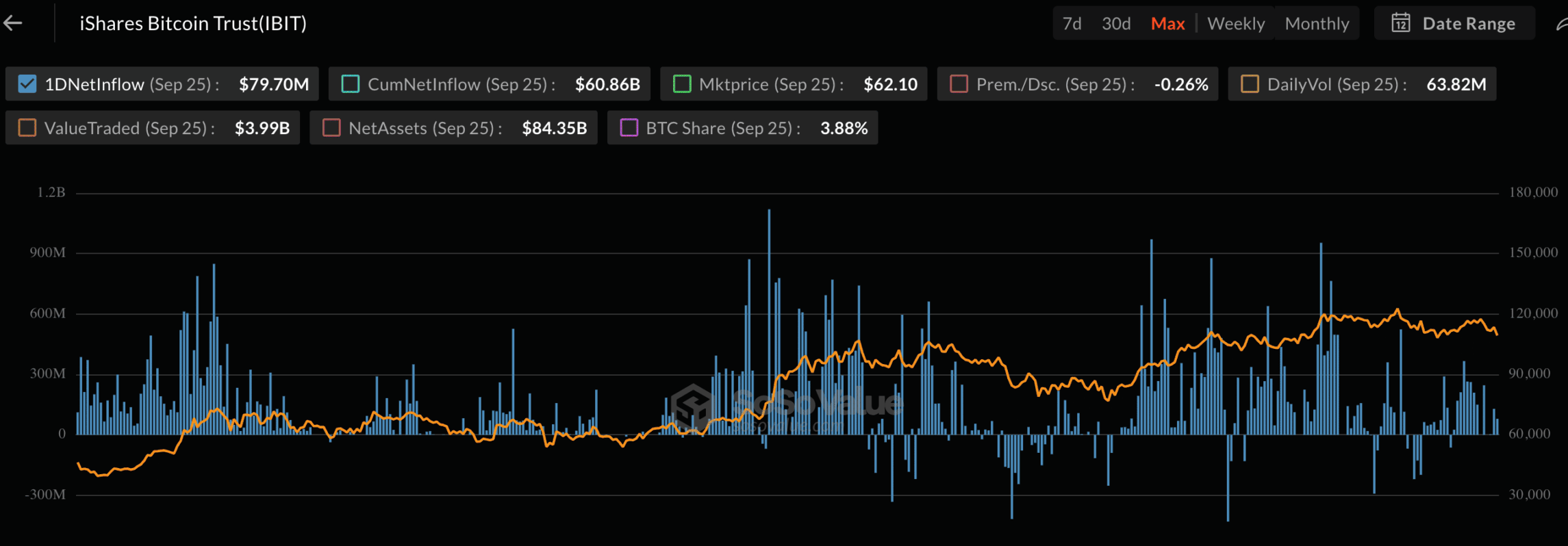

BlackRock has purchased $77 million for its BTC holdings through its flagship iShares Bitcoin Trust (IBIT). This comes as they also filed for a Premium ETF designed to deliver yield alongside price exposure.

BlackRock Steps Up BTC Accumulation Despite Downturn

SoSoValue data confirms that BlackRock recently purchased 703.7 BTC, worth $79 million, through its IBIT Bitcoin ETF. The acquisition continues to accumulate despite the recent market downturn.

Source: SoSoValue

Source: SoSoValue

The crypto market has been witnessing a downturn in the derivatives market. As CoinGape previously reported, about $17 billion in Bitcoin options are set to expire on Deribit, with 152,000 BTC contracts at stake. The put-to-call ratio stands at 0.75, reflecting mildly bearish sentiment,

Traders are betting on potential downside pressure, though the coin’s current trading price remains above $111,000. This backdrop makes the firm’s sustained accumulation all the more notable, as institutional inflows appear to counterbalance short-term market pessimism.

The new purchase involved multiple transfers of approximately 300 BTC each. The funds were routed through Coinbase Prime. Arkham Intelligence had reported yesterday that the firm added more than $125 million worth of the coin in separate transactions.

BLACKROCK JUST BOUGHT OVER $125M OF BITCOIN

INSTITUTIONS ARE BUYING THE DIP ON $BTC pic.twitter.com/Srp8nQVG9R

— Arkham (@arkham) September 25, 2025

Notably, the asset manager appears to favor Bitcoin over Ethereum. In previous transactions, BlackRock dumped ETH to purchase more BTC. The move resulted in $366.2 million in net inflows for the pioneer cryptocurrency, while its iShares Ethereum Trust reported $17.39 million in outflows.

BlackRock Files for “Premium” Bitcoin ETF

In a significant development, the company has filed to launch the iShares Bitcoin Premium ETF. The fund is designed to generate income from its exposure through covered call strategies. Unlike IBIT, which simply tracks the coin’s price, the new product aims to provide a steady yield for income-focused investors.

Source: X

Source: X

Bloomberg analyst Eric Balchunas described it as a “sequel” to IBIT. He suggested it reflects the company’s intent to expand its suite rather than diversify into a broad mix of altcoins. The company also framed the product as a way for investors to benefit from the coin while reducing volatility.

BlackRock registered the name iShares Bitcoin Premium ETF, filing coming soon. This is a covered call bitcoin strategy in order to give btc some yield. This will be a ’33 Act spot product, sequel to the $87b $IBIT. pic.twitter.com/IR7hJ59m6q

— Eric Balchunas (@EricBalchunas) September 25, 2025

This follows the success of its iShares exchange-traded product. The IBIT ETF became the fastest ETF in history to hit $80 billion in assets under management. Achieved within just 374 days, IBIT shattered the previous record set by Vanguard’s S&P 500 ETF. This product took nearly five years to reach the same milestone.

Furthermore, the firm’s success has encouraged it to expand deeper. Reports suggest that BlackRock will tokenize ETFs on-chain. The company plans to use blockchain to represent traditional assets, such as equities, in a tokenized form.

However, the firm has faced setbacks in other products. The U.S. SEC delayed its ETH ETF staking request. The regulator extended its review period to October 30, leaving uncertainty around next steps.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.