Our Terms & Conditions | Our Privacy Policy

China Driving Force Behind Renewable Energies in Latin America

Development & Aid, Economy & Trade, Editors’ Choice, Energy, Featured, Globalisation, Green Economy, Headlines, Latin America & the Caribbean, TerraViva United Nations, Trade & Investment

Energy

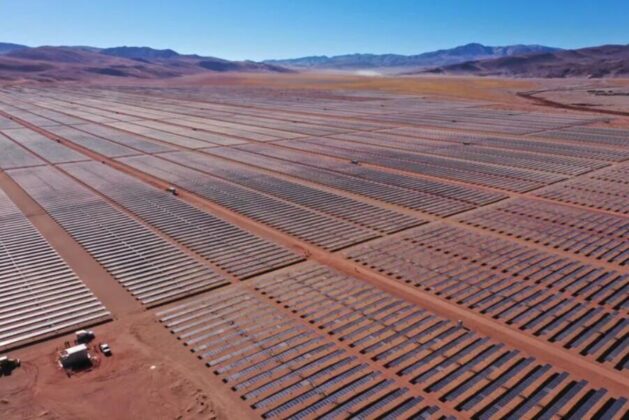

The Cauchari Solar Plant in Jujuy, Argentina, located 4,000 meters above sea level with over one million panels, was built with Chinese capital, engineering, and materials. Credit: Casa Rosada

CARACAS, Jul 18 2025 (IPS) – China, with its investments, products, technology, and innovation focused on solar and wind farms in Latin America and the Caribbean, as well as on electricity networks and services, stands out as a driving force for the region’s shift toward energy less reliant on fossil fuels and increasingly cleaner and greener.

Between 2010 and 2024, China invested US$33.69 billion in renewables in the region, with 70 transactions for as many projects, 54 of which were in non-hydroelectric energy, totaling US$13.138 billion.

These figures alone “highlight China’s importance in supporting the region’s energy transition, both through investments and infrastructure projects,” Enrique Dussel Peters, coordinator of the Latin America and the Caribbean Academic Network on China (RedALC-China), told IPS from Mexico City.

“For China, Latin America as a whole is a market that geographically presents many opportunities; first, due to the availability of natural resources, which include critical minerals, and features such as access to water and natural and renewable energy sources”: Ana Lía Rojas.

Beyond money, China “has the capacity to develop technology, implement it, and scale it at the required speed,” said Ana Lia Rojas, executive director of the Chilean Association of Renewable Energies and Storage (Acera).

In a dialogue with IPS in Santiago, Chile, Rojas cited American economist Jeffrey Sachs, director of the Center for Sustainable Development at Columbia University and a United Nations advisor, who has argued that, in short, “the energy transition is Chinese.”

Sachs views China as a “leader in key technologies that will be essential over the next 25 years: photovoltaics, wind, modular nuclear, long-distance energy transmission, 5G (now 5.5G), batteries, electric vehicles, and others.”

The movement toward Latin America has been relentless. While there were no Chinese investments in renewable energy in the region between 2000 and 2009, eight emerged from 2010 to 2014, totaling US$3.298 billion and generating 6,000 jobs, according to RedALC’s Investment Monitor.

Between 2015 and 2019, 25 projects with Chinese financing materialized, totaling US$19.568 billion and creating 9,300 jobs. In the 2020-2024 period, 37 transactions were completed, amounting to US$10.824 billion and generating 15,000 jobs.

Investment volumes dipped in 2020 amid the COVID-19 pandemic. However, a revealing contrast emerged: 35 of the 37 renewable energy transactions during this five-year period went to non-hydroelectric projects.

The Lagoinha Solar Complex, inaugurated in July this year and owned by the Brazilian subsidiary of Chinese group CGN. Spanning 304 hectares in Ceará state, northeastern Brazil, it features 337,000 panels that will provide electricity to 240,000 households. Credit: Government of Ceará

Interests and challenges converge

The International Energy Agency (IEA, representing major industrialized consumers) reports a “soaring increase in Chinese clean energy investments globally, particularly in renewables,” surpassing US$625 billion in 2024—nearly double 2015 levels and accounting for 30% of the world’s total, cementing China’s leadership.

Traditionally dominated by state-owned enterprises backed by public funding, China’s energy investment landscape is shifting, with the government increasingly encouraging private sector participation.

Meanwhile, Latin America and the Caribbean saw roughly US$70 billion invested in renewables from 2015 to 2024, of which over US$30.3 billion (43%) came from China, according to the IEA.

Yet the agency notes that despite steady growth in renewable investments, the region represents just 5% of global privately funded clean energy investment—a reflection of high interest rates, scarce long-term financing, and costly public debt.

This highlights the intersection between the region’s needs and challenges and what Dussel Peters describes as China’s strategic focus on technological development and disruptive innovations, from nanomanufacturing to aerospace, including new energy sources.

Chinese investment in renewables “delivers multiple benefits by advancing energy sustainability, supporting the transition to a low-carbon grid, providing critical technology, and creating skilled jobs,” Chilean academic Rodrigo Cáceres told IPS in Santiago.

A researcher at Diego Portales University’s Center for Energy and Sustainable Development, Cáceres observes China’s “sustained commitment” in areas like energy storage, smart grids, and green hydrogen, framing the China-Latin America relationship as “strategic and long-term.”

A key factor enabling this enduring partnership is the vast territorial, demographic, and resource potential Latin America and the Caribbean offers China. “If we look at the per capita income we have in the region and compare it with China’s, we have more or less the same. But Latin America has half the population of China and twice the territory of China,” observed Rojas.

Twice the territory “means that projects can be deployed differently than in the rest of the world,” noted the director of Acera.

According to Rojas, “it is evident that, for China, Latin America as a whole is a market that geographically presents many opportunities; first, due to the availability of natural resources, which include critical minerals, and features such as access to water and natural and renewable energy sources.”

“Second, because it is clearly a less densely populated region, which provides a certain degree of flexibility or freedom to develop projects in the territory that will aid the energy transition, not only for local or national economies but for the world,”she said.

The Tanque Novo Wind Complex in Bahia, Brazil, developed by Chinese group CGN. It consists of seven parks with 40 wind turbines, an installed capacity of 180 MW, and can serve 430,000 residents. Credit: Tanque Novo

Brazil, a leading hub

In Brazil, China’s presence in the electricity sector “is deep and strategic, the result of more than a decade of investments by large state-owned companies such as State Grid and China Three Gorges (CTG),” said Tulio Cariello, research director at the Brazil-China Business Council.

“In fact, it has become the main destination for these companies’ assets outside China. Both State Grid and CTG have the majority of their international investments in Brazil, reflecting the country’s structural importance in their global projection,” Cariello told IPS in Rio de Janeiro.

State Grid is now a major electricity transmission operator in Brazil, and its massive entry into that market was solidified with the acquisition in 2016-2018 of CPFL Energia (formerly Companhia Paulista de Força e Luz), one of the country’s leading power distribution companies.

Another flagship project led by State Grid was the construction of ultra-high-voltage transmission systems, connecting the Belo Monte hydroelectric plant in the Amazon (11,200 MW) with the Southeast region, which has the highest electricity demand.

Combined, solar and wind energy sources account for a quarter of Brazil’s electricity matrix, according to its National Energy Balance.

By the end of 2024, Brazil’s installed wind power capacity—over 16% of the national electricity matrix—reached 33.7 gigawatts, with 1,103 wind farms and 11,720 wind turbines. By 2032, cumulative new installed capacity is projected to reach 56 GW.

Chinese wind turbine manufacturer Goldwind established its first factory outside China last year in Bahia, in Brazil’s Northeast, with an investment of over US$20 million to produce 150 turbines annually, ranging from 5.3 MW to 7.5 MW. This decision demonstrates strong confidence in the Brazilian market.

The volume of Chinese investment in Brazil between 2007 and 2023 reached US$73.3 billion—US$33.2 billion in the electricity sector—with 264 confirmed projects, and is on track to reach US$123.2 billion with 342 projects.

Regarding the impact of investments in renewable energy, “it can be seen on several fronts: increased generation and transmission capacity, modernization of critical infrastructure, greater stability in power supply, and job creation and technology transfer,” said Cariello.

The Los Cururos Wind Farm in Ovalle, Chile, is one of dozens of installations generating electricity in Chile thanks to the constant winds in this Pacific-facing region. Credit: Orlando Milesi / IPS

Advancing Across the Regional Map

In Argentina, with initial financing of US$390 million from the China Export-Import Bank (Chexim), construction began in 2018 on the Cauchari solar park—one of the largest in Latin America—in the northwestern province of Jujuy.

Some 4,000 meters above sea level and equipped with 1.2 million panels, Cauchari has an installed capacity of 315 MW (with an expansion planned to add another 200 MWh) and reduces carbon emissions by 325,000 tons.

There are other solar developments with Chinese involvement, while Goldwind has acquired wind farms in the central province of Buenos Aires and the southern province of Chubut.

Researcher Juliana González Jáuregui from the Latin American Faculty of Social Sciences (Flacso) has highlighted Beijing’s participation in Argentina’s renewable energy projects, focusing on its provinces—even before the country joined China’s Belt and Road Initiative in 2022.

In contrast, “Europe and the United States have yet to grasp the importance of engaging at the subnational level in Argentina, something China achieved quickly and significantly. The provinces hold natural resources, so the subnational component is essential,” González told Dialogue Earth.

Meanwhile, in Chile, “what has happened in the last two years is that Chinese companies have bet on the country as a gateway to Latin America and have set up several companies that create jobs,” said Rojas.

“They are interested in showcasing the quality and technological advancements they’ve achieved in these sectors, focusing on storage, inverter systems, and everything that helps stabilize power grid flows,” she stated.

In this way, China “has increasingly strengthened its presence in the electricity sector, where we have decarbonization efforts and which represents 22% of the country’s energy consumption,” particularly in the distribution segment through the acquisition of key companies to supply the population, explained Rojas.

A notable example is the Chinese group State Grid, which in 2020 acquired Chile’s Compañía General de Electricidad (CGE) from Spain’s Naturgy for US$3 billion and purchased Chilquinta, another electricity distributor in Chile, from the American company Sempra Energy for US$2.23 billion.

Additionally, it holds a stake in Transelec, the largest distributor, giving it a dominant majority position in Chile’s electricity distribution market.

Areas of Lima illuminated by the growing integration of renewable energy into electricity generation. The former Enel Perú, now Pluz Perú, was acquired by China’s CSG and serves over 1.5 million subscribers in the metropolitan area. Credit: Perú Inkas Tours

In Peru, China Southern Power Grid (CSG) acquired Enel Peru from Italy’s Enel Group in 2024 for US$3.1 billion. The company, now called Pluz Peru, operates in the market with 1,590 MW of generation from various sources and also participates in distribution.

The Peruvian firm includes a solar complex in the southern municipality of Moquegua, with 560,000 panels spread over 400 hectares, capable of generating 440 GWh annually, and a wind farm in the southwestern province of Nazca, with 42 turbines producing up to 600 GWh per year.

In Colombia, another Chinese giant, CTG, promoted the construction of the Baranoa solar plant in the northern department of Atlantico. With an investment of US$20 million and 36,000 modules, it can add 20 MW to the grid.

Though a small project far from major economic and urban centers, it reflects shared interests with Colombia, where President Gustavo Petro champions renewable energy and the decarbonization of the economy and society.

In Nicaragua, it was announced that China Communications Construction Company will build a 70 MW solar plant in the municipality of Nindirí, south of Managua, with 112,700 panels at a cost of US$80 million.

The Managua government—which recently restored relations with China in 2021 after cutting ties with Taiwan—hopes the project will not only feed into the power grid but also support drinking water supply and sanitation in the country.

In a leap across the Caribbean, China’s International Development Cooperation Agency delivered a batch of donated supplies to Cuba last March to support a photovoltaic park project with Chinese assistance in Guanajay, about 50 kilometers west of Havana.

According to data gathered by IPS in Havana, the project includes seven solar parks and will contribute 35 MW to the island’s electricity system. The remaining parks, to be developed by China’s Shanghái Electric and Cuba’s Unión Eléctrica, will add another 85 MW. Cuba’s power demand stands at 3,500 MW, with a deficit sometimes exceeding 1,500 MW.

“We hope to leverage this project as an opportunity to contribute China’s strength in ensuring energy security and promoting sustainable social development in Cuba,” said Hua Xin, China’s ambassador in Havana.

A production gondola at the new wind turbine factory in Camaçari, northeastern Brazil, installed by Chinese firm Goldwind. Wind energy is the second-largest renewable source in Brazil’s electricity supply, after hydropower. Credit: Goldwind

The Ball on the Roof

Chilean expert Rojas noted that Chinese companies obviously aim to promote their own brands but also establish research centers or technology transfer hubs to help countries accelerate their energy transition.

“They have cutting-edge technologies that we currently see in PowerPoint presentations—but they’re already implementing them in their own cities,” she pointed out.

Experts agree that, alongside territorial potential, population, and resources, the regulatory framework of the electricity business—which varies across borders—is a key investment attraction.

This becomes even more relevant as major investors like China shift from merely selling products and technology to acquiring more assets, immersing themselves in the complexities of service networks, costs, and pricing.

For many countries in the region, the observation Jorge Arbache, an economics professor at the University of Brasilia, makes about Brazil may resonate. He analyzes how the advantages and resources enabling the energy transition are being mobilized.

He argues that “while China has used the energy transition as a pillar of its national development policy,” Brazil still treats its advantages “mainly as primary, short-term, and predatory assets—with low added value, institutional fragmentation, and a lack of coordinated strategy.”

“What China shows us is that the energy transition and natural capital, when well-coordinated, are more than just a shift in the energy matrix: they are a development strategy, a tool for sovereignty, and a source of geopolitical power,” concluded Arbache.

With reporting by Mario Osava (Brazil), Orlando Milesi (Chile) and Dariel Pradas (Cuba).

$pictures_for_story = ips_pictures_for_story();

echo $pictures_for_story;

// pictures of story para mostrar en sidebar

?>

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.