Our Terms & Conditions | Our Privacy Policy

China’s Instant Retail Goes Global

1. Why Go Global? Overseas Markets as the Second Growth Curve

This summer, China’s food delivery market hit a fever pitch.

On July 12, Meituan reported 150 million instant retail orders in a single day—a record-breaking number. Just two days later, Alibaba’s Taobao Flash Sales and Ele.me declared they had surpassed 80 million daily orders, including over 13 million in non-food categories. JD.com, a latecomer in the food delivery game, launched its “Double Hundred” initiative on July 8, pledging over 10 billion RMB to support high-quality restaurants, and already counts nearly 200 brands with over one million orders since launching just four months ago.

As the domestic war intensifies, all three platforms are accelerating their overseas expansion—converging on instant retail as the format of choice:

In Saudi Arabia, supermarket chain Othaim has been integrated into Alibaba’s AliExpress platform. Since June, local users can order groceries, condiments, household items, and electronics via the app and receive them in as fast as one hour.

Also in June, JD.com launched its new delivery brand JoyExpress in the Middle East, offering same-day delivery services.

In May, Brazilian President Lula met Meituan CEO Wang Xing in Beijing to announce a $1 billion investment to bring Meituan’s local services ecosystem to Brazil over the next five years.

This wave of synchronized global expansion is not just about chasing new revenue—it’s a strategic response to hitting a traffic ceiling in China. And instant retail is no coincidence. In markets like Saudi Arabia, Brazil, and Indonesia, mobile internet is booming, urban density is high, and traditional retail infrastructure is underdeveloped. Chain supermarkets and convenience stores are sparse; local shops still dominate.

This allows instant retail to potentially leapfrog traditional models and positions China’s finely-tuned local service capabilities as a system-level export for the first time.

Meituan’s experience in Saudi Arabia is proof. Its Keeta platform launched in September 2024 and, within just four months, grabbed 10% of the local market, with 750,000 daily orders—an impressive feat even by Chinese standards.

2. How to Go Global: From Delivering Meals to Delivering Everything

This new phase of expansion isn’t just about exporting goods—it’s about exporting an integrated, on-demand infrastructure. In China, companies like Meituan, JD, and Alibaba have spent years building near-field service ecosystems centered around instant dispatch, warehouse coordination, and digital logistics. Now, they are packaging and replicating these systems abroad, extending from food delivery to all forms of consumer demand.

Instant retail, at its core, promises one thing: “whatever you need, delivered instantly.” It combines the speed of food delivery with the product variety of traditional retail. Whether it’s a hot lunch, a forgotten phone charger, or a spontaneous craving for ice cream, the goal is to deliver within 30 minutes to a few hours.

From a consumption perspective, instant retail turns traditional shopping—once a physical act—into a digitally optimized behavior. Thanks to dispatch algorithms and front-end warehouses, the efficiency now exceeds even offline experiences.

Unlike traditional e-commerce, which focuses on price and selection, instant retail revolves around urgency and frequency. Its success depends on three pillars: high-frequency demand scenarios, local inventory, and ultra-fast fulfillment powered by rider networks and warehouse density. In emerging markets where infrastructure gaps are prominent, this model becomes not only viable—but often superior.

3. Who’s Going Global: Three Approaches from JD, Alibaba, and Meituan

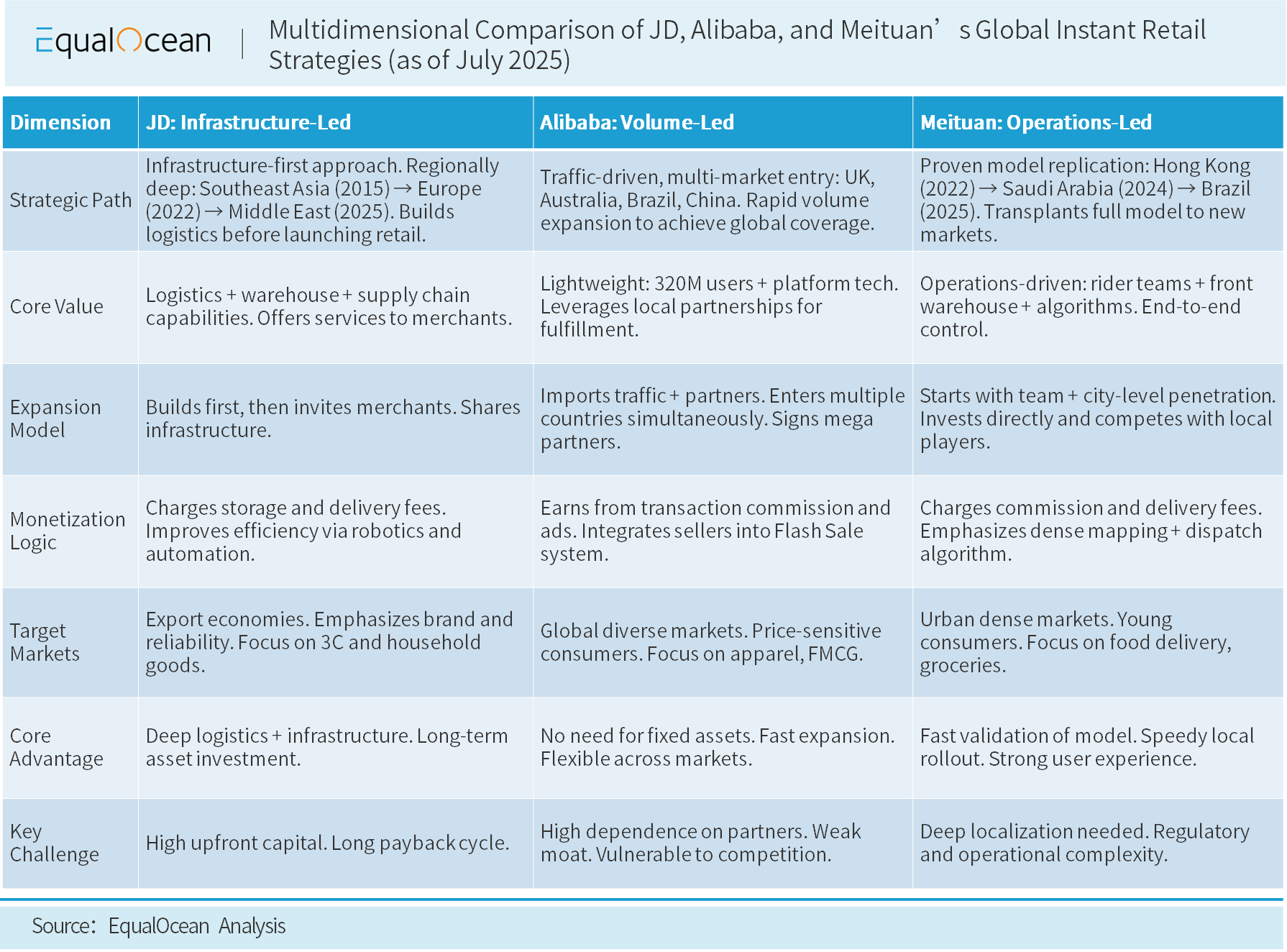

Though all three Chinese platforms are betting on the same formula—instant delivery and localized supply—they approach globalization very differently, based on their corporate DNA and global strategy.

JD.com: Heavy Infrastructure First

JD remains true to its asset-heavy DNA, building infrastructure first and layering retail services on top.

Between 2017 and 2020, it systematically built warehouses in Southeast Asia, including in Indonesia, Thailand, and Vietnam. In 2022, JD entered Europe via its Ochama brand, establishing automated warehouses in the Netherlands, France, and Poland. These facilities now serve 24 European countries.

In June 2025, JD launched JoyExpress in Saudi Arabia—its first real-time delivery brand in the Middle East. This B2C logistics service offers same-day delivery using JD’s own warehousing and fleet, marking a shift from logistics export to local retail implementation.

JD’s retail brand JoyBuy has also relaunched in London, after pivoting to B2B in 2021. Now operating as a self-operated e-commerce platform, it sells household goods, 3C electronics, cosmetics, and even some fresh products. First-time users are offered attractive coupons and free same-day or next-day delivery.

Alibaba: Lightweight Integration via AliExpress

Alibaba has opted for a lighter model, relying on its global marketplace AliExpress and deep integration with local merchants and delivery providers.

AliExpress is evolving beyond cross-border e-commerce into a “global local services platform.” Its aim is to make 1-hour delivery a standardized capability.

In Australia, AliExpress has partnered with leading Asian grocers Ebest and Umall to deliver fresh produce and fast-moving consumer goods. AliExpress provides traffic and system integration, while local stores handle fulfillment.

In Saudi Arabia, AliExpress works with supermarket chain Othaim, enabling users to order local goods with one-hour delivery or in-store pickup.

In Brazil, AliExpress collaborates with retail giant Magalu, leveraging its warehouse network to offer same-day or next-day delivery of electronics and household items.

In London, AliExpress launched its “1-Hour Delivery” service in July 2025. It partners with local delivery app HungryPanda for last-mile fulfillment, allowing users to order snacks, groceries, and beverages via app.

Meituan: Full-Stack Replication, End-to-End Control

Meituan, by contrast, is essentially cloning its domestic playbook—app interface, rider network, front-end warehouses, and all.

It launched Keeta in Hong Kong in 2022 and quickly captured nearly half the market. In September 2024, Keeta expanded to Riyadh, Saudi Arabia, where Meituan quickly built up its rider network and order fulfillment system. Within months, it hit 750,000 daily orders, becoming one of the top three local platforms. By the end of the year, Meituan launched Keemart, a localized version of its grocery delivery brand, combining fresh produce and general retail into its service portfolio.

In 2025, Meituan set its sights on Latin America. After a high-profile meeting between CEO Wang Xing and President Lula in Beijing, Meituan committed $1 billion over five years to replicate its twin-engine model—Keeta + Keemart—in Brazil, aiming to take on dominant local player iFood.

4. What Comes Next: Short-Term Losses, Long-Term Stakes

This wave of outbound expansion marks a turning point. China is no longer just exporting goods—it’s exporting systems.

These are highly integrated, digitized operating systems: dispatch algorithms, on-demand logistics, service design, and urban retail infrastructure. The shift from “Made in China” to “Operated by China” is well underway.

But replication is far from simple. First, regulatory environments in foreign markets—particularly around labor practices and data governance—pose serious challenges. The flexible labor models and centralized data systems that enabled rapid growth in China often run afoul of stricter overseas laws.

Consumer behavior is another hurdle. Chinese consumers are conditioned to expect 30-minute delivery. Many foreign users are still adjusting to the idea of instant fulfillment. To succeed, platforms must localize not only technology, but also merchant ecosystems, payment interfaces, and customer service networks—building an entirely new end-to-end operating loop.

All of this demands heavy, long-term capital investment.

According to Goldman Sachs’ Q2 2025 report, Meituan, Alibaba, and JD together invested nearly 25 billion RMB ($3 billion) in instant retail and delivery services during the quarter. For the 12-month period through June 2026, Alibaba is projected to lose 41 billion RMB, JD 26 billion, and Meituan will see a 25-billion-RMB decline in EBIT.

This is not just a money-burning contest—it’s a war of endurance and localization. The winner will not be the one who delivers the fastest, but the one who integrates most deeply into local consumer routines. Whoever earns that final kilometer of trust will own the next phase of global commerce.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.