Our Terms & Conditions | Our Privacy Policy

Crypto Tax Cuts Could Unleash Bitcoin Buying Spree In Japan

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

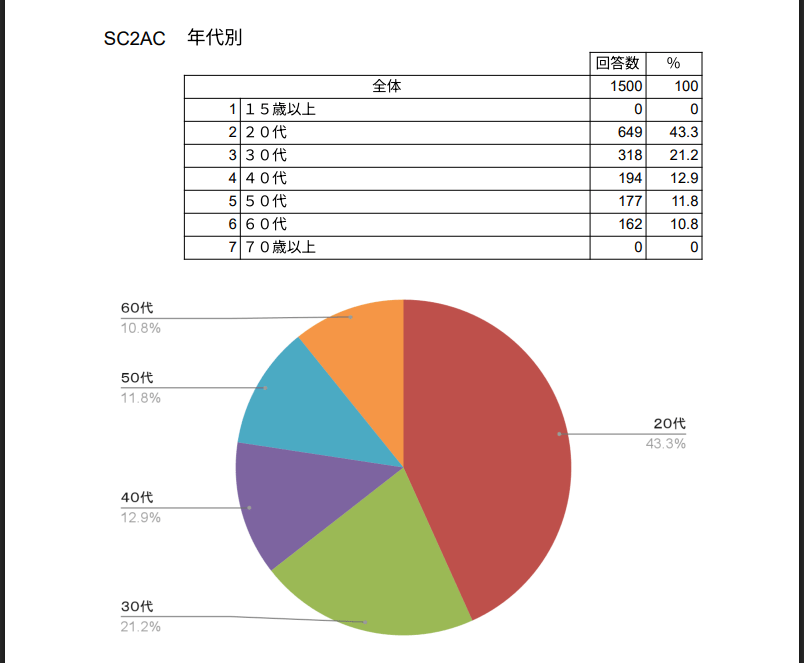

Japan’s tough approach to crypto taxes is holding back both buyers and sellers. A survey of 1,500 adults in April found that just 13% currently own Bitcoin, Ethereum or other cryptoassets. Many say they’d be ready to dive in—if only Tokyo eased the tax burden.

Majority Back Flat Tax

According to the Japan Blockchain Association, 84% of the 191 people who already hold crypto would buy more if profits faced a flat 20% levy.

And 12% of the 1,309 non‑holders said they’d start buying bitcoin or other cryptos under the same rule. That’s a big shift from today’s system, where crypto gains land under “other income” on tax returns.

Source: JBA

Right now, profits from bitcoin or crypto can be taxed at rates up to 55%, depending on your bracket. That’s far higher than the 10–20% flat rate that applies to stocks in many other countries.

Based on reports, the JBA is pushing to move crypto into the same capital gains category, arguing it would boost trading volumes on local exchanges.

Survey Shows Simple Rules Appeal

Three quarters of survey participants said they’d rather have taxes withheld at the source when they sell bitcoins, instead of filing separate paperwork.

The JBA has asked Tokyo to let traders choose whether to pay at the point of sale or when they file their annual return. That flexibility could ease headaches for both hobby investors and pros.

BTCUSD trading at $118,826 on the 24-hour chart: TradingView

The poll looked deeper into why some people still won’t touch crypto. Just 8% blamed high taxes, while 61% said they don’t feel they know enough about digital coins.

The sample was 60% male and 40% female, with an average age of 38. Students made up 5.3% of the group, and 213 people said they were unemployed.

Image: Canva

Image: Canva

FSA Considers Broader Reforms

According to reports from the financial regulator, the Financial Services Agency is weighing a proposal to shift bitcoin under the Financial Instruments and Exchange Act.

If approved, that would officially treat digital assets as financial products—and could pave the way for a unified 20% tax by as early as next year.

Exchanges like bitFlyer already see Ethereum trades account for almost half of their volume. Any change could reshape Japan’s crypto market—by making it simpler to trade, and by bringing more people into the fold.

Featured image from Travel+Leisure, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.