Our Terms & Conditions | Our Privacy Policy

Daiwa Security eyes Asian cross-border M&A growth

DC Advisory claims to be the market’s most successful adviser on Asian cross-border mergers and acquisitions. Its Asia Access team, which specialises in these deals, has acted on 15 in the past 12 months.

DC Advisory is the wholly owned M&A arm of Daiwa Securities, Japan’s oldest and second-largest investment bank. It has “east-meets-west” in its DNA, having started as Close Brothers Corporate Finance, a Europe-wide network of M&A boutiques acquired by Daiwa in 2009 for £75mn.

The adviser’s Asia Access team is devoted to the origination and execution of Asian cross-border transactions. It has completed more than 260 of them since it was set up in 2011, with around half involving Europe, 70 in or out of the US, and the balance intra-Asia.

Bridge between east and west

The key people in Asia Access also embody east-meets-west. London-based managing director Tosh Kojima, global head of Asia Access, was born and raised in Japan, but has a university degree from Oxford. He worked for Nomura and Lehman Brothers before joining DC Advisory in 2011.

The unit’s China lead is Endong Zhai, also London-based. According to DC Advisory, Zhai was one of the earliest Chinese M&A practitioners to be based in Europe, where he has more than 18 years of relevant experience. He has a degree from Cambridge and earlier worked for Deloitte Corporate Finance in London.

DC Advisory focuses on middle market deals, ranging in size from $100mn to $1bn. “That fits well with Asia Access,” says Kojima, because that’s what Asians are buying and selling.

It was not always this way. When DC Advisory began it was nearly impossible to do inbound M&A deals into Japan, Kojima recalls. “There were no outbound deals and there was no private equity,” he adds. “Today it’s the exact opposite.”

M&A traffic into and out of Japan has been stimulated by a number of factors, the bankers say. One is what they call the Buffett effect. Five years ago, Warren Buffett’s Berkshire Hathaway began buying significant stakes in big Japanese companies, citing their undervalued potential and the broader transformation of the Japanese corporate landscape.

Buffett’s strategic bet on Japan has already borne fruit, with the investments showing considerable unrealised gains. This has not been lost on other international investors, who now regard Japan as an increasingly attractive proposition. A favourable yen exchange rate has done nothing to dim their enthusiasm.

The fragmentation of Japanese industry has led to oversupply of similar products and a need for consolidation and global expansion. M&A is finally catching up to provide solutions. “One key catalyst is the emergence of private equity in Japan, both homegrown and imported,” says Kojima.

He points to Hitachi as a prime example of the corporate restructuring taking place among over-diverse Japanese conglomerates. “Half of the formerly [Tokyo Stock Exchange]-listed Hitachi subsidiaries taken private in recent years have been acquired by western private equity firms,” he says.

M&A is now more widely accepted as a corporate tool, not least because of cultural shifts in the employment market. Decreased “job loyalty” and increased labour market liquidity have made smaller, independent businesses more attractive to employees.

Change in Japan

In many boardrooms, shareholder value is challenging the preservation of domestic employment as the number-one priority. While Japanese corporate governance reforms have made management more sensitive to capital costs, increased investor activism has been pressing for the sale of non-core assets. Legacy cross-shareholdings, which inhibited inbound M&A, are being unwound.

The result has been a surge in inbound and domestic M&A. Kojima points out that by 2024 Japan was the only major market in the world to be enjoying M&A growth, according to Mergermarket figures.

“We also see Japanese companies, particularly those with large cash reserves, having a strong interest in outbound M&A,” says Kojima. Their aim is to seek global markets with more favourable growth prospects and opportunities to develop new revenue streams.

Japanese strategic buyers have historically been hamstrung by their inability to match the speed with which private equity can move, even when they can offer premium prices. Kojima reckons the tables have now been turned as the increased cost of capital for private equity hands an advantage to strategic Japanese buyers.

What is more, in this corporate marketplace private equity is no longer exclusively non-Japanese. The domestic private equity market has grown significantly over the past decade, with the emergence of Japanese firms as well as local branches of global firms. Kojima notes that global firms have achieved markedly higher-than-elsewhere returns from their Japanese investments.

Last year, DC Advisory advised US-based Electronics for Imaging, and its sole shareholder Siris Capital, on the $591mn sale of its Fiery business unit to Japan’s Seiko Epson. Fiery says that it is the print industry’s leading innovator of digital front-ends and workflow software. “Epson is one of the world’s largest printer manufacturers but hardly ever does M&A,” Kojima observes.

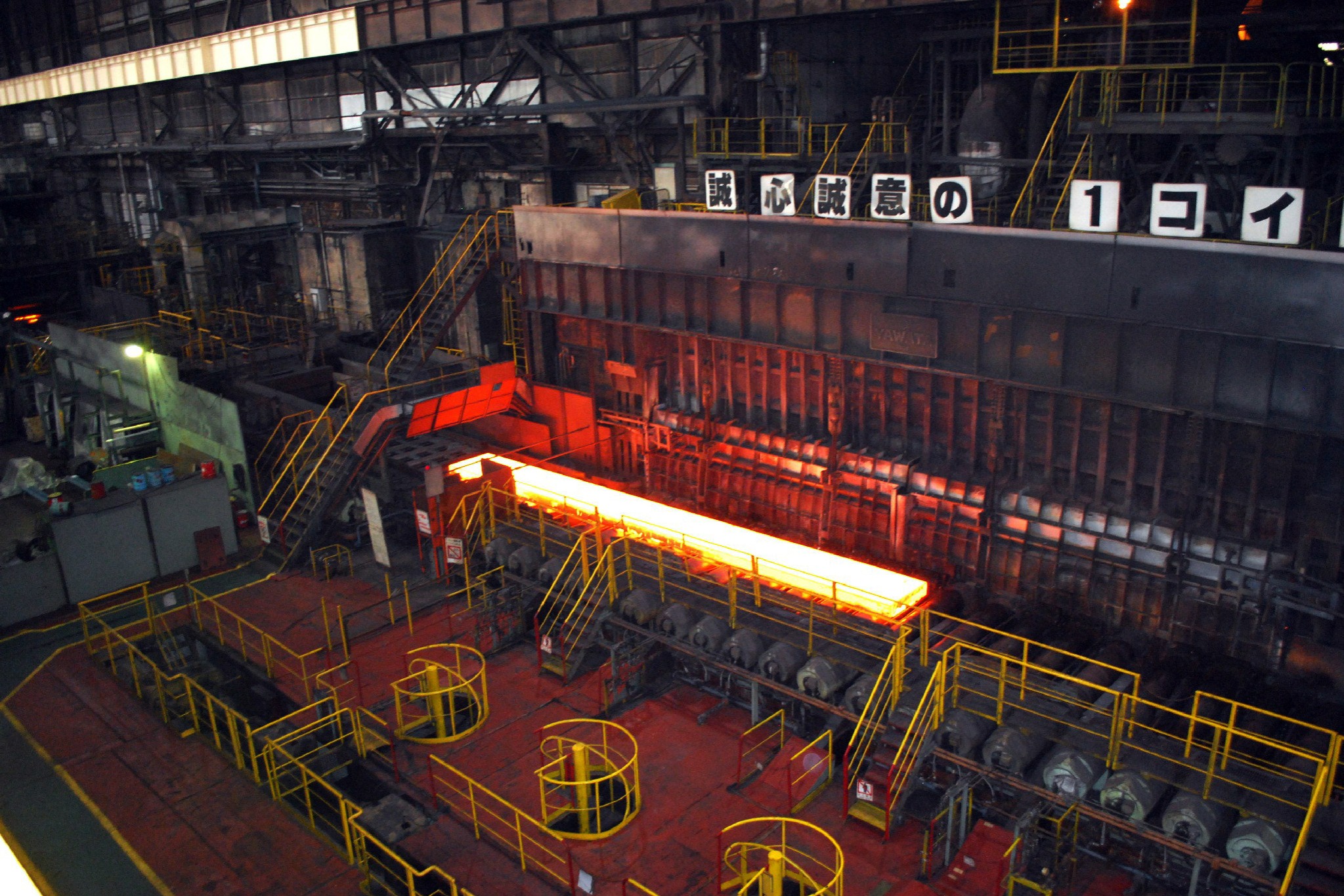

Nippon Steel’s Kimitsu iron mill plant © AFP via Getty Images

DC Advisory was exclusive financial adviser to Spanish-based steel trader Network Steel Resources on the sale of a minority stake to Japan’s Marubeni-Itochu Steel. The buyer is a major sales and distribution channel for Nippon Steel, so the deal provides an insight into the latter’s evolving international strategy, given its frustrated attempts to buy US Steel.

In a more complex deal, DC Advisory helped to find two separate buyers for Diamond Tools Group, owned by Dutch private equity house Torqx Capital Partners. DTG’s cutting tools have two distinct markets in camera lenses and automotive electronics.

Each business went to a different Japanese buyer. Esteves, the automotive element, was acquired by Sumitomo Electric Industries, a long-term commercial partner. Tokyo-listed tools manufacturer OSG bought Contour, the optics operation. “Contour and OSG did not know each other until we introduced them,” says Kojima. “That’s interesting, because the Japanese don’t do blind dates. They usually work on a relationship for years.”

Chinese PE

Private equity also plays an important part in China’s growing investment into Europe, which has been outpacing other markets such as the Middle East over the past year. Zhai points out that the constant tension between China and the US drives more Chinese companies to seek expansion in Europe, where political dynamics are more stable.

“This trend is driven by the expansion of Chinese private equity firms, which are increasingly deploying capital into European markets,” says Zhai. He notes that Chinese investors are seeking not only financial returns but also strategic growth opportunities — distribution channels, for example — in western markets.

Chinese private equity has amassed substantial funds in recent years, Zhai adds, mainly from western or Middle Eastern investors. Changing dynamics in China’s domestic market, deflationary pressures and the need for diversification are diverting a growing proportion of this capital into western markets, notably Europe.

Sectors that are especially attractive include technology (including electric vehicles, LED lighting and battery technology), healthcare, industrial products and consumer brands.

Those consumer brands may play to the Chinese domestic market. Rossignol, for example, is the world’s oldest ski equipment brand, with a market that tends to track GDP. In China, however, growth is substantially higher thanks to middle class aspirations and the excitement generated by the 2022 Beijing Winter Olympics.

Asia Access proposed to Rossignol’s majority-owner, Swedish private equity house Altor Equity Partners, that it should find a Chinese investor to help grow its Chinese business. DC Advisory then advised Rossignol on the sale of a 20 per cent stake to a Chinese private equity specialist, IDG Capital.

“Our team has been trained in a western M&A environment,” says Zhai. “But we speak local languages, we know both sides of the culture and we know how to get deals done.”

The team’s secret sauce, according to Kojima, is the ability to design and run what he calls “mixed process” transactions — “mixed” in that east-meets-west, and the buyers and sellers, may be private equity or strategic.

“Not everyone can do that,” he says. “We ourselves are the product of mixed cultures. We are able very effectively to align buyers and sellers so that transactions happen in a western timeframe.”

[ad_1]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

[ad_2]

Comments are closed.