Emerging economies push for alternatives as the dollar’s supremacy faces new geopolitical and structural challenges.

CareEdge Global’s latest report highlights that while the U.S. dollar continues to dominate international trade and finance, its long-held supremacy is being gradually tested. Growing geopolitical tensions, diversification of reserves, and rising interest in local currency settlements indicate a slow but steady move toward a multipolar monetary framework.

De-dollarisation: A Gradual but Noticeable Transition

The Bretton Woods Agreement of 1944 established the U.S. dollar as the world’s reserve currency, a status it has maintained for over seven decades. However, global events such as the 1971 Nixon Shock, the 2008 financial crisis, and recent geopolitical conflicts have periodically reignited debates on dollar dependency. The latest wave of discussion gained traction following the Russia–Ukraine conflict, where sanctions and currency weaponisation highlighted the risks of over-reliance on the dollar.

Emerging economies are now taking measured steps to reduce exposure to dollar-driven shocks. Nations such as China are promoting local currency settlements, expanding swap lines, and pushing mechanisms like the Cross-Border Interbank Payment System (CIPS). Similarly, discussions within BRICS and other blocs on alternative payment systems reflect an increasing preference for a more balanced monetary order.

Despite these shifts, the U.S. dollar’s strength continues to rest on deep financial markets, institutional trust, and its central role in global trade invoicing and debt issuance. Though diversification of forex reserves has begun, CareEdge Global notes that de-dollarisation will evolve progressively, not abruptly.

Dollar’s Enduring Role and Emerging Challenges

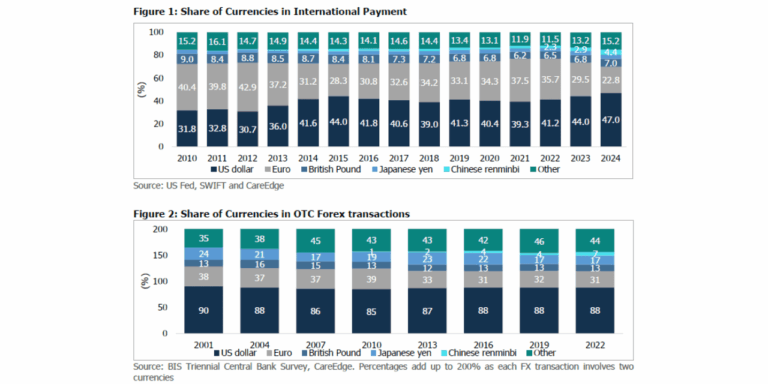

The dollar continues to dominate as both a unit of account and medium of exchange. Its share in international payments rose from 32% in 2010 to 47% in 2024, outpacing other currencies such as the Euro (22.8%) and the Chinese yuan (4.4%). Similarly, 88% of global forex trades involve the dollar, a figure largely stable for two decades.

However, the dollar’s position as a store of value is slowly eroding. The share of dollar-denominated assets in global forex reserves fell from 66% in 2015 to 56.3% in 2025. In parallel, central banks have accelerated gold accumulation since 2022, signaling diversification efforts.

Limited Alternatives but Growing Momentum

While currencies like the Euro and Renminbi are expanding their global footprint, neither yet rivals the dollar’s dominance. Structural challenges—such as Europe’s fragmented bond markets, limited fiscal integration, and China’s capital controls—continue to constrain their global roles.

China’s multi-pronged push to internationalise the Renminbi includes regional currency swaps, Belt and Road financing, CIPS expansion, and petroyuan initiatives. Yet, restricted convertibility and governance concerns prevent the RMB from emerging as a full-fledged reserve currency.

India’s internationalisation of the rupee remains at an early stage but shows steady progress. Initiatives such as bilateral trade settlements via Special Rupee Vostro Accounts, UPI integration with countries like Singapore and the UAE, and broader use of rupee-based instruments are enhancing its global presence.

The Road Ahead

Despite global efforts, CareEdge Global emphasises that a complete replacement of the dollar appears unlikely in the medium term. However, the trend toward diversification—marked by increased gold holdings, regional payment systems, and local currency trade—suggests that the global financial order is gradually becoming more multipolar.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.