Our Terms & Conditions | Our Privacy Policy

FIIs have sold $23 billion in stocks, but don’t panic. Here’s the real story – Global India Insights News

The news stories on foreign investors selling are true.

However, just as the nuance that I detailed in the FDI exit story, there is similar contextual analysis here as well.

In this column, I will look at whether foreign investors are indeed exiting India on the Foreign Portfolio Investor (FPI) side.

The $23 Billion Headline: A Look at the FPI Sell-Off

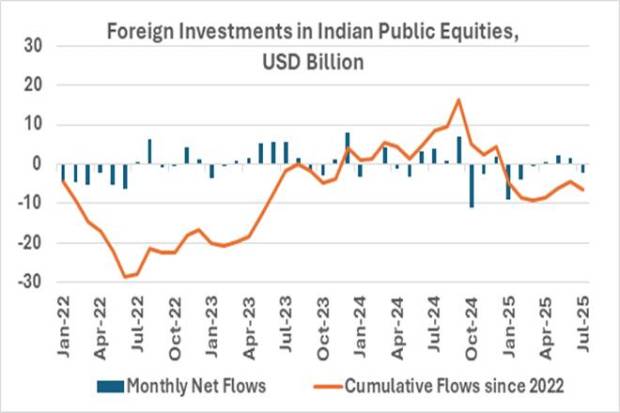

Since September 2024 till July 2025, foreign investors have net sold ~USD 23 billion of Indian public equities. As the chart below shows, in 6 out those 10 months, FPIs have been net sellers.

The orange line tracks the cumulative flows since the start of 2022. Despite, some strong inflows in 2023, cumulative net buying on Indian equities is negative as of July 2025.

Foreign Portfolio Investors have been cumulative net sellers over the last three years.

(Source: NSDL FPI Monitor, Monthly Data from January 2022 to July 2025 in US Dollars)

(Source: NSDL FPI Monitor, Monthly Data from January 2022 to July 2025 in US Dollars)

The most obvious reason for this sell-off seems to be India’s relative outperformance and relative over-valuation over other Emerging Markets. This is leading to Global investors ‘booking profits’ and taking some money away from the Indian markets.I noted the same reason for Global MNCs and Private Equity Funds selling their stakes in Indian firms and taking capital out which was visible as FDI outflows.

This trend as I had argued earlier is a good outcome. Foreign Investors exiting/selling their India investments because it has performed well and the markets giving them the opportunity to exit is always better than foreign investors selling because of being disappointed.

Of course, in the overall selling, there would be investors who may have sold because they made wrong investment decisions, took undue risks and were disappointed with their outcomes.

However, as the chart below depicts, in public equities, it seems to be a clear case of foreign investors ‘booking profits’ on their India holdings.

Foreign Investors selling since September 2024 is only ~2.3% of its then market value.

They are sitting on unrealised gains of over USD 600 billion dollars.

Source: NSDL FPI Monitor, Calendar Year Data till July 2025, Data in US Dollars

Source: NSDL FPI Monitor, Calendar Year Data till July 2025, Data in US Dollars

As at the end of September 2024, the total market value of Foreign Portfolio Investors in India public equities was estimated at ~USD 940 billion. Since then, FPIs have sold ~USD 22 billion as mentioned above. This makes it a sale of only 2.37% of its market value as at September 2024.

Of course, this selling and other issues have led to a correction in the Indian stock markets, and the effective market value of FPIs have dropped to ~USD 820 billion as of July 2025.

On average, between September 2024 and July 2025, the Indian stock markets are down ~5% in rupee terms and ~10% in US Dollar terms.

The net sale and the correction in the market in dollar terms explains the fall in FPI’s overall value of its holdings.

So, although the chart 1 on cumulative net sales has a negative reading over the last 3 years, it is indeed a miniscule portion of their overall net market value.

Profit-Booking, Not Panic-Selling: Why Context is Key

It is thus not at all a case that foreign investors are exiting India. They are ‘booking profits’ on their India allocations given its relative outperformance over a long period.

And that they have more than USD 600 billion in unrealised gains on their India equity holdings.

However, what is though true, is that they are not net investing.

And from the data that I maintain on market flows since 2003, a remarkable thing happened in July 2025.

For the first time in that data series, it showed that cumulative investments in Indian equities by Indian Mutual Funds at cost is now higher than cumulative investments by foreign investors.

In 11 years from 2014, Indian retail investors have showered their love on Indian mutual funds who have invested USD 190 billion into the Indian stock markets.

Is this the biggest success of Narendra Modi. The confidence boost to the Indian investor to take risk!

Source: NSDL FPI Monitor, Calendar Year Data till July 2025, Data since 2003, in US Dollars

Source: NSDL FPI Monitor, Calendar Year Data till July 2025, Data since 2003, in US Dollars

Foreign Investors have invested only ~USD 44 billion in the same period.

The ‘orange’ Indian mutual fund buying line is like a hockey stick.

The ‘blue’ Foreign Portfolio Investor’ line has plateaued.

The Indian markets seem to be gyrating on – ‘we don’t need no foreign investor’ for its performance.

Sidelined, Not Exiting

Foreign Investors are not ‘Exiting’ India. But they have been sidelined

The profit booking and selling should not be of much concern.

However, the fact that we have attracted such meagre flows over the last 10 years from global investors who are already under invested in India is an issue worth pondering about.

In a future column, I will detail the nature and categories of flows that India receives from foreign investors, and examine whether the lack of dedicated investments in India is a reason for this persistently low allocation.

Arvind Chari is a Chief Investment Strategist and has been with Quantum Advisors India group since 2004. Arvind has over 20 years of experience in long-term India investing across asset classes. Arvind is a thought leader and guides global investors on their India allocation.

This article is for educational and discussion purposes only and is not intended as an offer or solicitation for the purchase or sale of any investment in any jurisdiction. No advice is being offered nor recommendation given and any examples are purely for illustrative purposes. The views expressed contain information that has been derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness, or reliability of the information.

The views and opinions expressed in this article are my personal views and should not be construed of the Firm. There is no assurance or guarantee that the historical result is indicative of future results and the future looking statements are inherently uncertain and cannot assure that the results or developments anticipated will be realized.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.