Our Terms & Conditions | Our Privacy Policy

From railways to renewables, this PSU is quietly powering India’s clean-energy dream

One name that’s chugging ahead of the pack is Rail Vikas Nigam Ltd (RVNL). Whether it’s electrification, metro expansions or station makeovers, the company is quietly powering some of the biggest infrastructure projects that will shape the future of Indian Railways.

But is RVNL simply riding the PSU frenzy or does it have the horsepower to deliver consistent, long-term gains? In this article we dive into RVNL’s business model, order book and financials to see what could be on the horizon.

What is RVNL?

Incorporated in 2003 under the ministry of railways, RVNL’s mandate was to accelerate the implementation of critical railway infrastructure projects.

Acting as the ministry’s primary construction arm, the RVNL of today is responsible for building new railway lines, conducting electrification, constructing major bridges and workshops and even metros and other urban transport systems.

The company has mastered leveraging extra-budgetary resources, especially through the formation of special purpose vehicles (SPVs), highlighting its ability to mobilise capital beyond traditional government allocations.

Its consistent performance earned it Miniratna Category-I status, recognition that conferred greater operational autonomy. But the real game-changer came in April 2023, when RVNL was awarded Navratna status.

This recognition has further boosted its financial independence and strategically positioned the company to compete for larger, more complex infrastructure projects.

What has RVNL built?

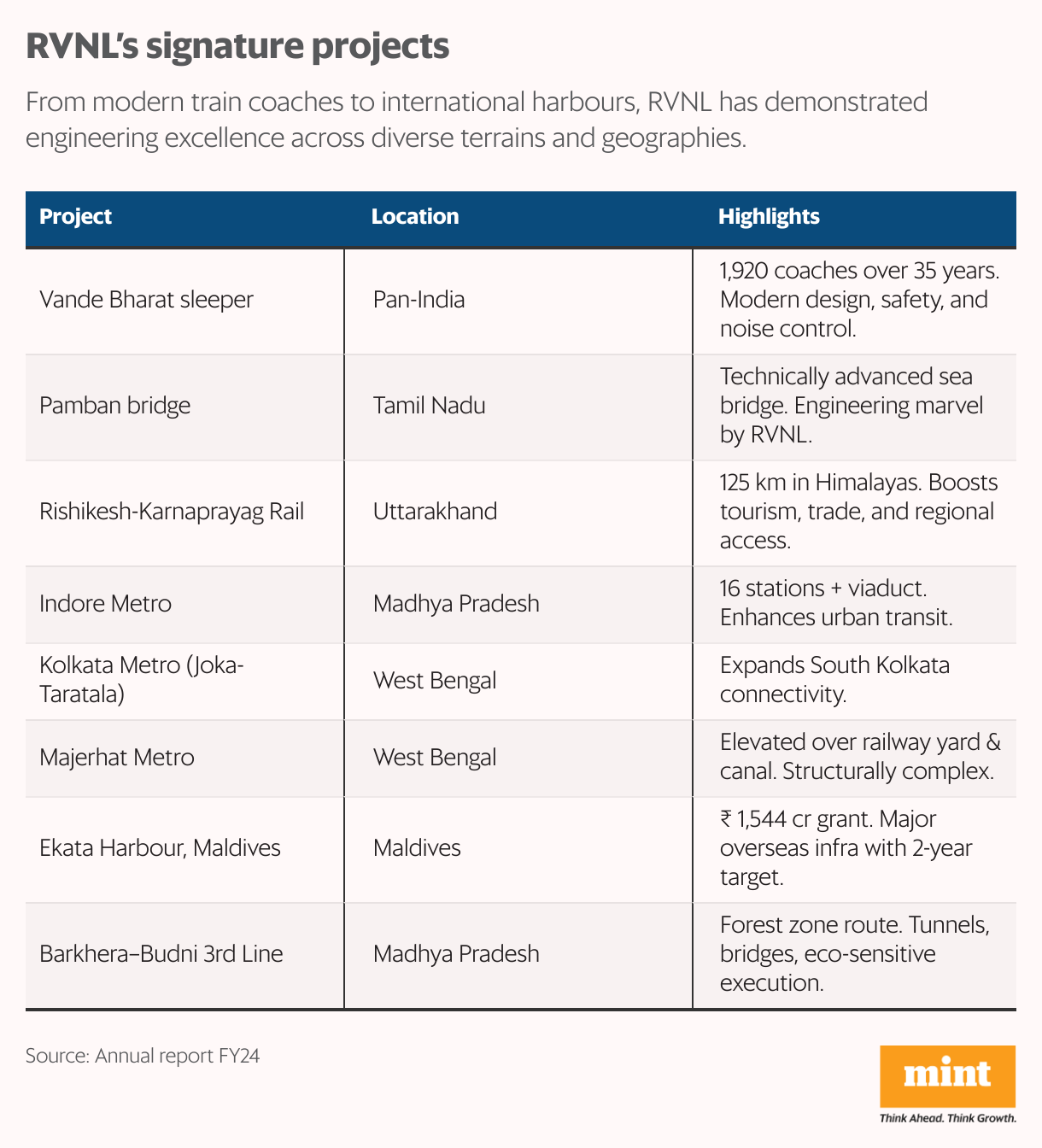

Here’s a snapshot of RVNL’s track record from its FY24 annual report.

View Full Image

Source: Annual report FY24

And here’s a quick overview of what makes the company a silent force in India’s infrastructure story:

- Railway lines: More than 70 km of new lines and 560 km of doubling commissioned in FY24 alone. Projects such as Wardha–Nanded and Bilaspur–Korba exemplify its scale.

- Railway electrification: Recent high-impact projects include the electrification of the Salem-Coimbatore section and major upgrades for heavy freight handling.

- Metro rail: Projects in Pune, Nagpur, Indore, and key stretches of the Kolkata Metro are now under its belt. With 11.3 km commissioned in FY24, this vertical is emerging as a margin-friendly growth driver.

- Station redevelopment: Through flagship initiatives such as Gorakhpur and Jabalpur station modernisation, RVNL is shaping the future of passenger-centric, world-class station infrastructure.

- Complex structures: From the engineering marvel that is the new Pamban Bridge to challenging terrain works in the Rishikesh-Karnaprayag Rail Line, RVNL’s civil engineering acumen is on full display.

Revenue model

RVNL primarily earns through engineering, procurement and construction (EPC) contracts, but what’s interesting is its evolving model.

While EPC accounted for more than 80% of revenue, the rest came from project management consultancy (PMC) and other high-margin services. Fees typically range from 8.5-10%, depending on the type of project, and the company is transitioning from nomination-based to competitive bidding models. RVNL is intricately tied to India’s macro-infra goals, particularly the PM Gati Shakti National Master Plan.

Competitive landscape

RVNL operates in a competitive environment. Its key competitors include:

- IRCON International Ltd (IRCON): Another prominent railway PSU, IRCON specialises in railway, highway, and bridge construction, with a significant international project portfolio. Its business model also encompasses EPC and PMC services.

- RITES: Another PSU heavyweight, RITES dominates the consultancy and engineering space, especially in railways and urban transport. It’s more consultancy-oriented than EPC-focused like RVNL.

- Larsen & Toubro: L&T’s infra-arm executes massive railway, metro, and high-speed rail projects. With deep pockets, it’s a formidable competitor.

From building multi-modal logistics parks to streamlining freight corridors, RVNL’s contributions go far beyond laying tracks; it’s building India’s next-gen logistics and trade infrastructure.

RVNL’s financials

The company has demonstrated a strong and consistent growth over the past five years. Turnover increased steadily at a compound annual growth rate (CAGR) of 10.6%. Net profit expanded to ₹14,63 crore in FY24, nearly doubling in five years.

It is supported by stable operating margins and a controlled cost structure. The operating profit margin has remained steady at 6%, indicating consistency in operational efficiency despite scaling up. The growing earnings per share (EPS) reflects management’s effective capital deployment.

The balanced dividend payout suggests the company rewards shareholders while also retaining some profits for future growth.

Clean-energy ambitions

RVNL now aims to power the trains for which it once built tracks. With Indian Railways targeting net-zero emissions by 2030 and needing 10,000 MW of power, RVNL is stepping into clean energy. It’s developing solar parks, battery storage systems, and even small hydro projects in states such as Uttarakhand and Himachal Pradesh.

Drawing on its tunnelling and civil construction expertise, RVNL sees solar-plus-battery and small hydro as natural extensions of its skill set. It’s also exploring compact nuclear energy solutions in partnership with Russia’s Rosatom, potentially using railway land for setup.

While battery costs and evolving policies pose challenges, RVNL counts Indian Railways as a reliable anchor customer, which helps reduce market risks. The company’s ₹1 trillion order book is steadily expanding beyond rail, with clean energy expected to play a bigger role in the coming years.

If these are executed well, RVNL could soon be known not just for kilometers of track but megawatts of green power.

Sectoral tailwinds: India’s railway infrastructure boom

- Capital outlay on Indian Railways: FY25 railway capex stands at ₹26,520 crore, with ₹25,220 crore from gross budgetary support, reflecting unprecedented government commitment to railway infrastructure. By January 2025, 76% of this outlay had already been used.

- Focused investments in core infrastructure: Capital is being invested in capacity expansion (new lines, doubling/tripling), complete electrification, modern rolling stock (Vande Bharat), and freight enhancement, all directly aligning with RVNL’s core competencies.

- PM Gati Shakti: With 434 projects worth ₹11.17 trillion, this master plan promotes integrated infrastructure planning. RVNL is involved, especially in multi-modal logistics parks, which are crucial for handling freight.

- Amrit Bharat Station Scheme: 1,309 stations are being redeveloped into commercial and passenger hubs. RVNL is executing key station modernisation projects, tapping a ₹20,000-crore market opportunity.

- Government focus on infrastructure: ₹11.21 trillion of infra spending in FY26 reaffirms policy continuity.

- Make in India and National Capital Goods Policy: Policies promoting domestic manufacturing and technological self-reliance support infrastructure development, creating a predictable demand environment and reducing input volatility for players such as RVNL.

Key growth drivers

- Strong and expanding order book: RVNL’sorder book crossed ₹96,000 crore in January 2025, offering 4x revenue visibility. Half of orders came from competitive bidding, improving credibility and scope.

- Strategic diversification into new sectors: Expanding into metros, roads (HAM projects), renewable energy, logistics park, and international markets.

- Leveraging public-private partnerships: Multiple SPVs formed for railway, road, and logistics projects under PPP and design, build, finance, operate and transfer (DBFOT) models.

- Rising share of non-railway projects: Gradual shift from a rail-only focus to infrastructure-wide services, including urban mobility and logistics. Reducing dependence on ministry nominations and de-risking revenue streams.

Risks investors should know

While RVNL presents a compelling growth story, investors must consider several inherent risks associated with it:

- Project execution risk: Large infra projects often face design changes or approval delays. RVNL’s Vande Bharat JV faced this, leading to losses and delays.

- Working capital and liquidity pressure: Despite a healthy current ratio, diversification into HAM and international projects may stretch RVNL’s working capital. New models demand upfront investment, needing tighter financial planning and cash flow discipline.

- Client concentration risks: The railway ministry remains RVNL’s primary client. While diversification is underway, exposure to new state and private entities introduces new credit, operational and political risks that need active monitoring.

- Margin pressure from competitive bidding: Shift from nominations to competitive bidding means tighter margins. Private players such as L&T intensify pressure.

- Policy and regulatory uncertainty: As a PSU, RVNL is highly policy-sensitive. Election-year paralysis, land acquisition issues, and regulatory bottlenecks can slow execution, affecting cash flow, order inflow, and investor confidence.

Conclusion

RVNL isn’t laying tracks anymore, it’s laying the groundwork for a bigger infra story. With its strong PSU roots and diversification beyond railways, the company has real potential. But new sectors bring new challenges. The real game is balanced diversification.

Investors should always check if a stock aligns with their investment objectives before deciding whether to invest.

Happy investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.