Our Terms & Conditions | Our Privacy Policy

From Rs450 to Rs34 Million: Bitcoin’s Scarcity Revolution

Bitcoin is the only commodity in human history with a permanently capped supply—limited to 21 million coins.

This cap is a deliberate design feature embedded in Bitcoin’s blockchain protocol. It serves three key purposes: it ensures scarcity, controls inflation, and strengthens Bitcoin’s value proposition as a decentralized digital currency.

Yes, currency is scarce—but only in a limited sense. There’s an estimated $100 trillion worth of currency in circulation globally. However, there is no cap on the printing of money. The U.S. government, for instance, runs an annual fiscal deficit of over $2 trillion, which it finances in part by printing trillions of new dollars. Similarly, the Pakistani government runs an annual deficit exceeding Rs7 trillion, filled largely by printing trillions of rupees.

Gold, too, is scarce—about 250,000 metric tons have been mined to date, with an estimated market value of $28 trillion. However, unlike Bitcoin, gold has no absolute supply cap. As prices rise, mining activity increases. Moreover, the universe contains an unknown number of celestial bodies rich in gold. If the price climbs high enough, someone will eventually find a way to bring more of it down to Earth.

Gold’s supply is finite, but Bitcoin’s supply is capped—hard-limited to 21 million coins. Both are scarce, but Bitcoin is even more so. Gold is heavy and difficult to transport, limiting its portability. Bitcoin, by contrast, is digital, stored on the blockchain, and can be transferred globally within minutes via digital wallets. While gold can be divided into grams, its physical nature makes small-scale transactions impractical. Bitcoin, however, is divisible down to eight decimal places—1 satoshi equals 0.00000001 BTC—making it ideal for microtransactions. Gold carries a moderate risk of counterfeiting, whereas Bitcoin’s cryptographic design makes counterfeiting virtually impossible. Gold is a time-tested store of value; Bitcoin is rapidly emerging as the digital equivalent.

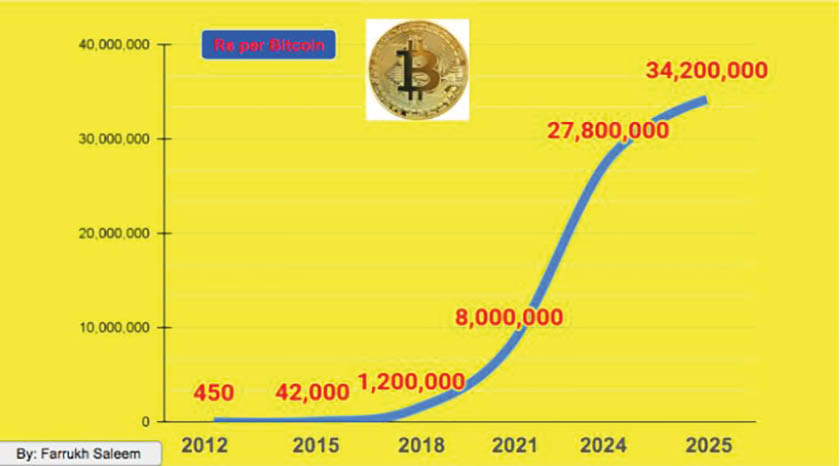

In 2012, one Bitcoin was worth just Rs450. By 2015, its value had surged to Rs42,000—a nearly hundred-fold increase in just three years. As of now, Bitcoin is trading at around Rs34 million per coin, reflecting its exponential rise in value over the past decade and growing recognition as a digital store of wealth.

Over the past ten years, Bitcoin has been the best-performing asset, far surpassing traditional investments like stocks, bonds, gold, and commodities. Data from CoinGecko shows Bitcoin delivered a staggering 26,931% cumulative return, with a $100 investment in 2014 growing to $26,931 by December 2024.

From 2020 to mid-2025, Bitcoin delivered an impressive annualized return of 61.4%, outperforming all major asset classes. U.S. stocks, as measured by the S&P 500, posted a strong 22.2% annual return. Gold, long considered a safe-haven asset, returned 14.6% annually. In contrast, real estate struggled—hindered by high interest rates and oversupply—yielding just 3.3% on an annualized basis.

Bitcoin’s fixed supply of 21 million coins establishes it as the ultimate scarce asset, immune to the inflationary policies that burden economies. With a 26,931% return over the past decade, Bitcoin has outperformed all asset classes. As centralized systems falter, Bitcoin’s decentralized design offers a blueprint for financial freedom, proving that scarcity, not manipulation, drives true wealth.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.