Our Terms & Conditions | Our Privacy Policy

Global rice price heads up as Thailand, Pakistan stocks drop

According to the Food Corporation of India, rice buffer stocks with the government are at a record high of 38.01 mt as of April 1 in addition to 37.15 mt of paddy (equivalent to 24.89 mt of rice)

| Photo Credit:

istock

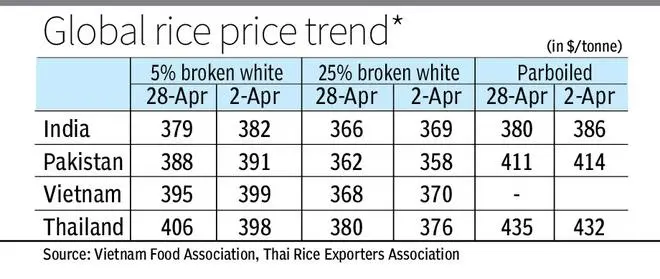

Rice prices have begun to rise after falling to two-year lows in the global market, as stocks with some exporters such as Thailand and Pakistan have declined.

“Prices have begun to rise over the past couple of days, particularly in Thailand, as stocks have declined,” said Rajesh Jain Paharia, a New Delhi-based exporter.

However, BV Krishna Rao, President of The Rice Exporters Association (TREA), said the Indian market is currently under pressure since Chhattisgarh is set to float two tenders to sell 3.5 million tonnes (mt) of its rice stocks in the open market.

Trade’s worry

“The trade is worried that prices may be quoted lower in the tenders,” he said. On the other hand, Myanmar’s price is more competitive than India, though the neighbouring nation has limited stocks.

Rao said exports in the second quarter of 2025 are expected to be slow and will likely pick up from June. “Too much of cargo had been shipped out in the first quarter,” he said.

Countries such as Benin have huge inventories of Indian rice that they are not looking to import the cereal from here now. However, India’s re-entry into the rice market after curbs on exports were lifted has affected competitors.

Currently, India’s 5 per cent broken white rice is quoted at $379 a tonne, down $3 from three weeks ago. Pakistan and Vietnam, too, have cut their prices by $3 and $4 a tonne, but Thailand has increased rates by $8. It is in the parboiled section that India holds a huge advantage of $31/tonne over Pakistan and $55 over Thailand.

Pressure easing

Initially, Vietnam and Pakistan lowered their prices, but they have now raised them. Reports from Vietnam said short-term pressure on prices has eased as its domestic supply has been limited due to saline intrusion in the Mekong Delta.

In addition, China is now expected to import over 5 million tonnes (mt) of rice, while the Philippines around 4.5 mt. Vietnam expects prices to rebound because of this.

A New Delhi-based trade analyst said prices had declined initially because buyers hammered them down on surplus production. “After being under pressure the whole of last year as prices increased, it was their turn now to dictate terms,” he said.

According to the US Department of Agriculture (USDA), India’s rice exports are expected to be around 22.5 mt this year after lifting curbs on shipments. In September 2022, India imposed 20 per cent duty on white rice exports and banned shipments of broken rice. In July 2023, it banned exports of white rice and came up with a 20 per cent duty on parboiled rice exports. It also fixed a minimum export price of $950 a tonne on basmati.

Record stocks

However, all these curbs were lifted between October 2024 and March 2025. This is because India’s rice production has been estimated at a record high of 137.82 mt in 2023-24. During the current crop year to June, the output is expected to reach a fresh high of 140 mt.

According to the Food Corporation of India, rice buffer stocks with the government are at a record high of 38.01 mt as of April 1 in addition to 37.15 mt of paddy (equivalent to 24.89 mt of rice).

Meanwhile, Thailand has reported a 30 per cent drop in exports in the first quarter this year. Its white rice epxorts have dropped by 50 per cent since India has resumed exports, while countries such as the Philippines have adopted a “wait and watch” policy to import.

Published on April 29, 2025

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.