Our Terms & Conditions | Our Privacy Policy

GST Rate Cut to Boost Auto Sales by 200 Basis Points for Two-Wheelers

The Goods and Services Tax Council’s decision to implement a simplified two-rate structure of 5% and 18% from September 22, 2025, is projected to increase demand for two-wheelers by approximately 200 basis points and passenger vehicles by 100 basis points, according to credit rating agency Crisil Ratings.

The tax restructuring will result in two-wheeler sales volume growth of 5-6% in the current fiscal year, while passenger vehicle sales are expected to rise 2-3%. Two-wheelers and passenger vehicles together account for 90% of India’s domestic automobile industry volume.

Price Impact Across Segments

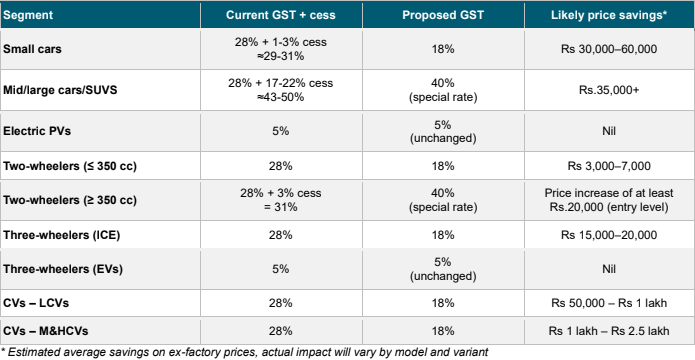

Vehicle prices are expected to drop significantly following the GST reduction. Small passenger vehicles will see price reductions of Rs 30,000-60,000, while two-wheelers will become cheaper by Rs 3,000-7,000. The price cuts represent a 5-10% reduction across affected segments.

Under the revised structure, small passenger vehicles, two-wheelers up to 350cc (representing nearly 90% of segment sales), commercial vehicles, and three-wheelers will see GST rates drop from 28% to 18%. Mid-size and larger passenger vehicles will also benefit from a 3-7% rate reduction.

Tractors will see rates reduced to 5% and 18% from the current 12% and 28% respectively.

Market Recovery Following Slowdown

The GST cuts come at a critical time for the automobile sector, which experienced challenges in the first quarter of fiscal 2026. Two-wheeler sales, particularly entry-level commuter models, declined due to regulatory disruptions from On-Board Diagnostics II implementation and heavy monsoon conditions that affected rural demand.

Passenger vehicle and small car sales also slowed during June-August 2025 due to affordability concerns, rare-earth mineral shortages, and consumers deferring purchases in anticipation of the announced GST rate cuts.

Says Anuj Sethi, Senior Director, Crisil Ratings, “With the GST cut fully passed on, vehicle prices are expected to drop 5-10% (Rs 30,000–60,000 on small PVs; Rs 3,000–7,000 on two-wheelers). With the rate cut coinciding with the Navratri and the festive season, sentiment would get a timely boost. Coupled with new launches, softer interest rates and improved affordability, this should drive a stronger second half for the automobile sector.”

Impact on Premium Motorcycles

Motorcycles above 350cc will face increased costs under the new structure, with rates rising to 40% from the current 31% (including compensation cess). This represents a price increase of at least Rs 20,000 for entry-level models in this category.

Operational Benefits for Industry

Beyond demand revival, the simplified GST structure is expected to streamline compliance and reduce logistics costs through smoother interstate taxation, supporting profitability across the automotive value chain.

For commercial vehicles, the lower GST rate should help offset cost increases from the mandatory air conditioning cabin requirement effective October 1, 2025.

Says Poonam Upadhyay, Director, Crisil Ratings, “Higher volume will improve capacity utilisation and operating leverage, translating to stronger cash flows and healthier margins for automakers, reinforcing their already stable credit profiles. On the distribution side, elevated PV inventory of 50-55 days should ease after the GST cut. Even a modest recovery in PV demand will aid inventory correction, ease working capital pressures and support dealer cash flows.”

Segment Performance Outlook

The two-wheeler segment, which represents approximately 75% of domestic automobile volume, recorded 0-1% growth in the April-August period but is now expected to achieve 5-6% growth for the full fiscal year. Nearly 90% of two-wheelers are sub-350cc commuter models that will benefit most from the GST reduction.

The passenger vehicle segment, accounting for around 15% of domestic volume, experienced a 3-4% decline in the April-August period but is projected to recover with approximately 2% growth for the fiscal year. Small passenger vehicles represent about 30% of the PV market, while compact utility vehicles account for 32%, with both segments set to benefit from the rate cuts.

The timing of the GST implementation, coinciding with the festive season and Navratri celebrations, is expected to provide additional momentum to vehicle sales across segments.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.