India’s largest lender, State Bank of India, continues to maintain its leadership in the debit card market, holding a 24 per cent market share in September 2025, while HDFC Bank remained the top player in credit cards with a 22 per cent share, according to analysis by 1Lattice basis the RBI data.

Source: 1latticeOther top banks in debit cards included Bank of Baroda with a 9 per cent market share, followed by Canara Bank, Union Bank of India, and HDFC Bank, each with about 6 per cent, and Bank of India, Axis Bank, and Punjab National Bank at 4 per cent.

While Public Sector lender, Bank of Baroda’s market share of debit cards remained at 9 per cent in september 2025; it showed a de-growth of 10 per cent on an annual basis, the decline has been constant for months.

In the debit card segment, Private Lender Axis Bank experienced the strongest year-on-year growth, registering approximately 10 per cent, followed by HDFC Bank that grew at 8 per cent. State owned lender Canara Bank reported a 5 per cent annual growth, while Punjab National Bank grew at 4 per cent year on year. Union Bank of India showed 2 per cent annual growth. SBI retained its top position, and as opposed to declining trends observed before, it saw a year-on-year growth of 5 per cent in September.

SBI and HDFC Bank continued to dominate the debit cards and credit cards market shares respectively, in August 2025. In terms of Year-on-Year growth, in the debit cards segment, Axis Bank and HDFC Bank recorded the highest growth at 11 per cent and 8 per cent respectively while in the credit cards segment public lender Bank of Baroda showed a growth of 10 per cent on an annual basis.

Bank of India has been experiencing a larger drop, with a 7 per cent de growth in september on an annul basis, holding a current market share of 4 per cent.Debit and credit card transactions in India have seen a steady compound annual growth rate (CAGR) of 20 per cent and 19 per cent, respectively, over the past four years.

HDFC Bank leads Credit Card market

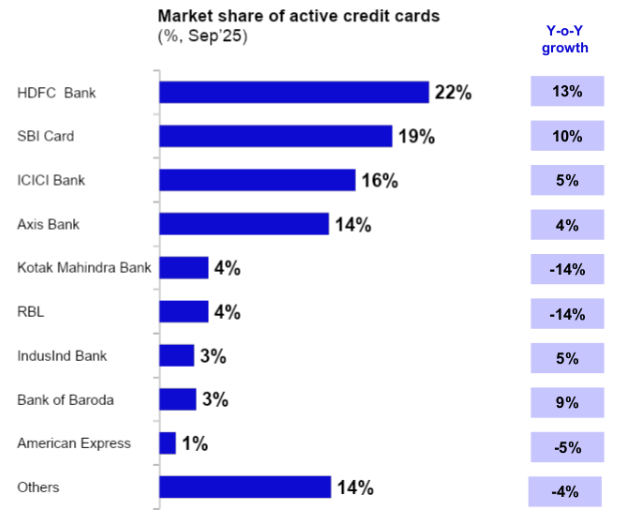

As India’s largest private-sector lender, HDFC Bank continued to dominate the credit card market, maintaining a 22 per cent share in September 2025. It was followed by SBI Card, ICICI Bank, and Axis Bank, which held market shares of 19 per cent, 16 per cent, and 14 per cent, respectively.

ICICI Bank for long held a market share of 17 per cent in Credit Cards until May 2025 when it saw a dip by 1 per cent in June, and stays the same for August 2025.

While holding the largest market share in credit cards, HDFC Bank also witnesses the highest year-on-year growth of 13 per cent, followed by SBI Card and Bank of Baroda, at 10 per cent and 9 per cent year-on-year growth respectively, holding shares of 19 per cent and 3 per cent, respectively.

SBI and HDFC Bank continued to dominate the debit cards and credit cards market shares respectively, in July 2025. In terms of Year-on-Year growth, in the debit cards segment, Axis Bank and HDFC Bank recorded the highest growth at 12 per cent and 7 per cent respectively while in the credit cards segment public lender Bank of Baroda showed a growth of 12 per cent on an annual basis.

ICICI Bank posted a year-on-year growth of 5 per cent. RBL Bank’s credit cards’ market share remained stagnant with a de-growth of 14 per cent on a year-on-year basis. On the other hand, Kotak Mahindra Bank saw a 14 per cent decline in growth, holding a 4 per cent share in the credit card market. Earlier in February 2025, the Reserve Bank of India lifted the ban on Kotak Mahindra Bank on its credit card business. The ban was imposed in April 2024 due to an IT shortage.

“Because there were no new card issuances, spends, which normally come from new acquisitions, were impacted. It was only natural to see a decline in spends and hence ANR (Annualised Net Revenue),” Kotak Mahindra Bank’s MD & CEO Ashok Vaswani had said during Q2 FY26 earnings press conference.

The CEO added that the bank has relaunched and expanded its credit card portfolio with multiple new products, including “Solitaire” and a refreshed co-branded Indigo card. Momentum is being rebuilt with technology upgrades. “September-end was encouraging, with spends rising post the GST rate cut and festive demand. We are hopeful that momentum will continue into the third quarter,” he said.

Global player American Express posted a year-on-year de growth of 5 per cent in September, accounting for only a 1 per cent market share.

- Published On Oct 29, 2025 at 03:01 PM IST

Join the community of 2M+ industry professionals.

Subscribe to Newsletter to get latest insights & analysis in your inbox.

All about ETBFSI industry right on your smartphone!

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.