Our Terms & Conditions | Our Privacy Policy

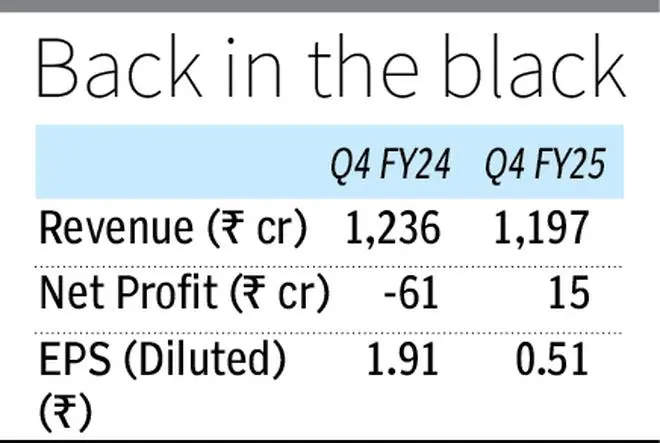

India Cements logs ₹15 cr profit in Q4 on exceptional income

India Cements, an Aditya Birla Group company, has reported a consolidated net profit of ₹15 crore in the March quarter against the net loss of ₹61 crore logged in the same period last year.

Revenue was down at ₹1,197 crore ( ₹1,235 crore). The company has registered an exceptional income of ₹93 crore from sale of subsidiaries Coromandel Electric Company and Coromandel Travels.

The company registered a total expenses of ₹1,313 crore ( ₹1,319 crore).

For the financial year ended March, the company net loss dipped to ₹144 crore against ₹227 crore logged in the same period last year. However, total income declined to ₹4,357 crore compared to FY24.

Last year, the country’s largest cement producer UltraTech Cement acquired the promoter stake, making India Cements its subsidiary from last December.

India Cements’ board also approved a draft Scheme of Amalgamation involving the merger of its subsidiaries—ICL Financial Services, ICL Securities, ICL International, and India Cements Infrastructures—with the parent company. The appointed date for the scheme has been set as January 1, 2025. Following the merger, the share capital of the merging companies held by India Cements will be cancelled without the need for any further formalities.

The company has appointed E Jayashree as Company Secretary and Compliance Officer with effect from June. She will replace S Sridharan who retire in May.

The Board also appointed Makarand M Joshi & Co as Secretarial Auditors for five consecutive years from FY’26 to FY’30, subject to approval of the members at the ensuing Annual General Meeting, it said.

Published on April 26, 2025

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.