Our Terms & Conditions | Our Privacy Policy

India Market Wrap: Nifty Ends Above 24,650 As Midcaps, Metals, Defense Stocks Shine

synopsis

Easing inflation at home and abroad bolstered rate-cut hopes, lifting the benchmark indices following Tuesday’s profit-booking.

Indian equity markets ended higher on Wednesday, lifted by broad-based buying across midcaps, metals, real estate, tech, and defense sectors.

The gains came on the back of encouraging macroeconomic data and global cues.

A significant drop in April CPI inflation to 3.16%, the lowest in over a year, increased expectations of additional rate cuts by the Reserve Bank of India (RBI).

The Nifty 50 ended at 24,666, up 88 points, while the Sensex gained 182 points to close at 81,330.

Broader markets outperformed, with the Nifty Midcap index rising 1%. Sector performance was broadly positive. All indices closed in the green, except for private banks.

Metal stocks led the rally, aided by cooling retail inflation in India and the U.S. and signs of easing trade tensions between Washington and Beijing. Tata Steel jumped 4%, emerging as the top Nifty gainer.

Defense stocks continued their winning streak for the third session, powered by earnings optimism and sector tailwinds. Garden Reach Shipbuilders & Engineers (GRSE) surged 15% following its results announcement, while Cochin Shipyard rose 8%, and Mazagon Dock, BEL, and Zen Technologies gained between 3% to 5%.

Railway stocks were also in demand, with Titagarh Wagons rallying 9%, followed by strong moves in IRFC and RVNL (both +5%) and Railtel and IRCON (up to +8%).

Meanwhile, the rebalancing of MSCI’s India Domestic Smallcap Index drove fresh interest in names like Acme Solar (+8%) and Authum Investment (+10%).

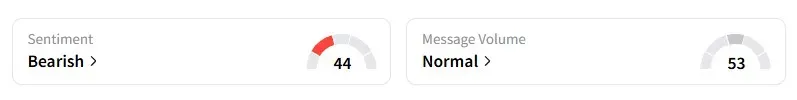

Despite the gains, retail sentiment on Stocktwits surrounding the Nifty 50 remained ‘bearish’, as investors maintain caution in the wake of emerging tariff updates.

Nifty sentiment and message volume on May 14 as of 3:30 pm IST. | source: Stocktwits

Nifty sentiment and message volume on May 14 as of 3:30 pm IST. | source: Stocktwits

Globally, European markets traded lower, and U.S. futures pointed to a muted open.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read Full Article

[ad_1]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

[ad_2]

Comments are closed.