Our Terms & Conditions | Our Privacy Policy

India’s capital market leaders: Top 5 firms shaping India’s financial future – Stock Insights News

The market capitalization of listed companies on the Bombay Stock Exchange (BSE) recently crossed US$ 4 trillion (tn), placing India among the top five global equity markets.

As of early 2025, over 140 million (m) demat accounts have been opened in the country—more than double the number just five years ago—indicating growing retail engagement.

India’s capital markets are witnessing a remarkable phase of expansion, driven by a surge in retail investor participation, regulatory reforms, and rapid digital transformation.

Amid this growth, several capital market companies have distinguished themselves through innovation, scale, and performance.

Let’s examine 5 such stocks selected from Equitymaster’s screener – Top Capital Market Companies in India.

#1 BSE

First on this list is BSE.

Bombay Stock Exchange (BSE Ltd) is Asia’s oldest Indian stock exchange and a prominent part of India’s financial ecosystem.

It provides a platform for the trading of equity, debt, equity, currency and commodity derivatives, small and medium enterprises (SME), interest rate futures, and e-agricultural spot market.

Additionally, the company provides book-building services for initial public offering (IPO), offer to buy, offer for sell, new bond platform, insurance, and mutual funds.

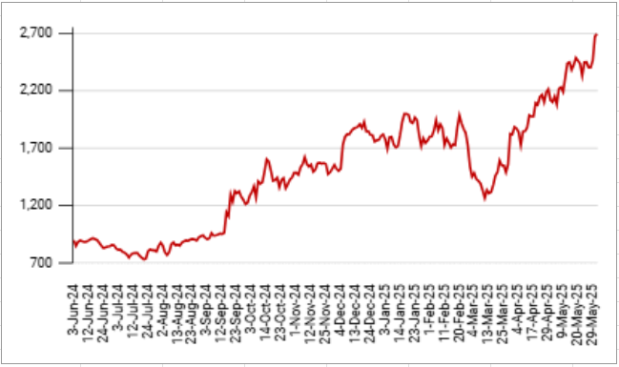

BSE Stock Price – 1 Year

Data Source: ACE Equity

Data Source: ACE Equity

Coming to the financials, the company’s revenue has grown at a CAGR of 16.9% in the last five years while its net profit has grown at a CAGR of 30.2%.

The five-year average return on equity (RoE) and return on capital employed (RoCE) were 11.5% and 14.1%, respectively.

The company’s consolidated revenue reached Rs 32.4 billion (bn), a 103% year-on-year (YoY) growth. This growth made it the strongest year in the company’s 150-year history.

BSE expanded its co-location infrastructure—from 100 to 300 server racks—to meet rising demand. Co-location allows clients to place their servers close to the company’s systems for faster data access. Server racks are physical units that house this computing equipment.

The management prioritizes meaningful and diverse participation—through high-frequency trading, co-location, and foreign investors—over simply increasing market share.

BSE has invested over Rs 5 bn in technology and infrastructure in recent years, viewing it as a key driver of its current performance.

Additionally, the company is building reserves to strengthen confidence in BSE’s clearing corporation, aiming to enhance its capacity to serve the largest and most demanding market participants.

#2 HDFC Asset Management Company (HDFC AMC)

Second on this list is HDFC AMC.

HDFC AMC is a major mutual fund house in India.

As of March 2025, HDFC Bank holds a 52.5% stake in the company.

Additionally, it offers portfolio management, segregated account services, and alternative investment funds to a diverse client base, including high net worth individuals (HNIs), family offices, domestic corporations, trusts, and provident funds.

HDFC AMC Stock Price– 1 Year

Data Source: ACE Equity

Data Source: ACE Equity

Coming to the financials, the company’s net profit has grown at a CAGR of 15.9% in the last five years.

The five-year average RoE and RoCE were 29.6% and 38.6%, respectively.

As of Q4 FY25, the assets under management (AUM) were Rs 7.6 tn, a strong increase from Rs 6.1 tn in Q4 FY24.

Despite market volatility, systematic investment plan (SIP) flows remained resilient. The March 2025 figure was 98% of the December 2024 peak. The management attributed this to growing maturity, confidence, and long-term orientation, among Indian investors.

The new fund offer (NFO) flows were strong in FY25 (18% of net new equity flows), but recent months saw a slowdown. The management expects NFO flows to be cyclical and less material for HDFC AMC due to its comprehensive product suite.

Additionally, the management is bullish on the long-term prospects, citing resilient investor behavior, robust AUM growth, strong digital adoption, and a healthy pipeline in alternatives and international business.

The company’s balance sheet remains strong, enabling investments in new products and merger and acquisitions (M&A).

#3 Motilal Oswal Financial Services Ltd (MOFSL)

Next on this list is Motilal Oswal Financial Services.

The MOFSL group offers services in capital markets (broking and distribution, institutional equities, and investment banking), asset management, private equity, real estate, wealth management, and housing finance.

Motilal Oswal Financial Services Stock Price – 1 Year

Data Source: ACE Equity

Data Source: ACE Equity

Coming to the financials, the company’s revenue has grown at a CAGR of 28.8% in the last five years while its net profit has grown at a CAGR of 35.7%.

The five-year average RoE and RoCE were 18.4% and 15.9%, respectively.

In FY25, the group’s operating revenue crossed Rs 50 bn for the first time, up 31% YoY. The operating profit was also up 31% YoY.

The assets under advice was Rs 5.5 bn (up 33% YoY), the recurring revenue was equal to 56% of total net revenue (vs 31% in FY24), and fee-based revenue was 37% of total revenue (vs 31% YoY).

The wealth management segment recorded net flows of Rs 102.8 bn, a threefold YoY increase. The overall book grew 33% YoY.

In the asset management and alternatives segment, net flows surged to Rs 484.5 bn, a tenfold increase from Rs 51.9 bn in FY24. The AUM reached Rs 1.2 bn as of March 2025. The management anticipates further market share gains in FY26.

Going forward, the management expects the private wealth segment to contribute a larger share of the group’s profits.

The housing finance segment reported an AUM of Rs 48.8 bn as of March 2025, a 20% YoY growth. The asset quality remained healthy, with gross non-performing assets (NPA) at 0.8% and net NPA at 0.4%.

The capital adequacy of this business remains strong, with growth expected to be funded through internal accruals.

Going forward, the management believes all building blocks are in place to drive strong AUM and profit growth over the next 2–3 years.

#4 Nippon Life India Asset Management (NAM)

Fourth is Nippon Life India Asset Management.

Nippon Life India Asset Management is engaged in managing mutual funds including exchange traded funds (ETFs); managed accounts, including portfolio management services, alternative investment funds and pension funds; and offshore funds and advisory mandates.

The company is promoted by Nippon Life Insurance Company, one of the leading private life insurers in Japan, with assets of over JPY 97 tn as of FY25.

Nippon Life India Asset Management Stock Price – 1 Year

Data Source: ACE Equity

Data Source: ACE Equity

Coming to the financials, the company’s net profit has grown at a CAGR of 17.1% in the last five years.

The five-year average RoE and RoCE were 23.1% and 29.1%, respectively.

As of March 2025, total AUM including mutual funds, managed accounts, offshore, and GIFT city stood at Rs 6.5 tn.

The company was the fastest-growing AMC among the top ten in FY25 and recorded the highest market share gain over the past two years.

In FY25, the company achieved its highest-ever net profit of Rs 12.9 bn, up 16% YoY, and a record operating profit of Rs 14 bn, rising 47% YoY.

Its SIP market share doubled over three years, rising from 5.2% in March 2022 to 10.2% in March 2025. The monthly SIP book stood at Rs 31.8 bn, a 37% YoY growth, translating to an annualized figure of Rs 382 bn.

The company has deliberately avoided launching large NFOs or thematic funds on the active side, to prioritise the scaling of existing products and build a sticky, long-term AUM base, while selectively continuing with passive NFOs where relevant.

Going forward, the management remains confident on sustaining growth momentum, citing strong SIP franchise, digital leadership, robust ETF business, and international expansion especially in Japan.

#5 Central Depository Services (India) Ltd

Finally, we have Central Depository Services (India).

Central Depository Services Ltd (CDSL) is a market infrastructure institution (MII), part of the capital market structure. It provides services to all market participants – exchanges, clearing corporations, depository participants (DPs), issuers and investors.

It facilitates holding and transacting securities in electronic form and facilitates the settlement of trades executed on stock exchanges.

These securities include equities, debentures, bonds, units of mutual funds, certificates of deposit (CDs), commercial papers (CPs), treasury bills (T-Bills), and others.

CDSL Stock Price– 1 Year

Data Source: ACE Equity

Data Source: ACE Equity

The company’s revenue has grown at a CAGR of 10.3% in the last five years while its net profit has grown at a CAGR of 28.9%.

The five-year average RoE and RoCE were 10.2% and 13.6%, respectively.

In FY25, the company’s consolidated revenue reached an all-time high of Rs 1.2 bn, up 32% YoY.

The management has stated that the company is spending on technology to build and consolidate systems as well as introduce new tools and techniques to enhance market efficiency, speed, and user experience.

Technology spending is a continuous process, not a one-off initiative, in line with regulatory expectations for the adoption of cutting-edge technology.

The FY25 dividend payout stood at 61.3% of standalone profits – Rs 12.5 per share – adjusted for the 1:1 bonus issue, this amounts to Rs 25 per share. This was the highest dividend ever declared by the company.

The management reiterated their commitment to maintain a dividend payout of 60% of operating profits.

Going forward, regulator’s ongoing move towards implementing Central Know Your Customer (CKYC) norms could potentially subsume the KYC Registration Agency (KRA) business, though the pricing and business model implications remain unclear.

Snapshot of Top Capital Market Companies on Equitymaster’s Stock Screener

Here’s a table that shows the top capital market companies across various parameters.

Source: Equitymaster

Source: Equitymaster

Conclusion

As India’s capital markets continue to mature and integrate with global financial systems, the role of top-performing capital market companies becomes even more critical.

The five firms highlighted above are not only shaping the present but also setting the course for the future of investing in India.

Whether through technological innovation, strong governance, or expanding investor outreach, they’re well-positioned to capitalise on the sector’s momentum in 2025 and beyond.

Keeping an eye on these rising leaders could offer opportunities in the ever-evolving world of Indian finance.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decision.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.

[ad_1]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

[ad_2]

Comments are closed.