Our Terms & Conditions | Our Privacy Policy

India’s Electric Two-Wheeler Market Accelerates Amid Policy Shifts, Premiumisation Trend: CRISIL

India’s electric two-wheeler industry has reached a significant milestone, with retail sales hitting 1.15 million units in fiscal 2025, marking a remarkable 86% compound annual growth rate since fiscal 2019, according to a new report by Crisil Intelligence. The industry’s evolution from a subsidy-dependent market to one driven by consumer demand and product innovation signals a maturing ecosystem poised for further expansion.

While early growth was significantly fuelled by government subsidies under the FAME-II scheme and various state incentives, the segment has demonstrated resilience and matured into a value-driven market. The report notes a clear shift in consumer demand from the price-sensitive economy category to executive and premium offerings, reflecting a broader trend of premiumisation.

From Subsidy-Driven to Value-Focused

The central government’s phased subsidy reduction from FAME II to the Electric Mobility Promotion Scheme and PM-eBus Sewa (PM E-Drive), has not dampened the segment’s growth trajectory. Despite fluctuations in per-kWh incentives, the industry showed strong adaptability, buoyed by diverse model launches, better performance, and improved consumer awareness.

The shift is evident in sales composition: the economy segment’s share dropped sharply from over 26% in Q1 to around 12% in FY25, while the executive and premium categories accounted for nearly 88% of sales. This marks a significant departure from the early days when affordability was the prime motivator.

OEM Landscape and Market Share Dynamics

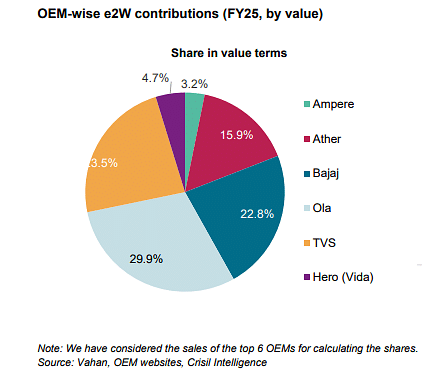

In terms of volume, Ola Electric retained its position as the largest e2W OEM in FY25. However, when viewed by value which considers the ex-showroom price of units sold, TVS Motor and Bajaj Auto strengthened their presence, capturing 23.5% and 22.8% of the market, respectively. Ather Energy, with its premium-focused lineup, secured a 15.9% share by value, even though its volume share was lower, underscoring its upmarket positioning.

Ampere, largely focused on budget-friendly products, had a stronger volume share than value share, while Hero MotoCorp (Vida) held a modest 4.7% value share, reflecting its mid-segment tilt.

Notably, market consolidation has been rapid. The combined value market share of Ola, TVS, and Bajaj now stands at over 76%, while early movers like Hero Electric and Okinawa have seen their share plummet from 86.3% in FY19 to just 0.5% in FY25.

Regional Disparities and Trends

Regionally, South India emerged as the dominant contributor to e2W sales, with South 3 (led by Kerala) and South 2 (Goa and Karnataka) showing the highest penetration rates at 12.9% and 11.5%, respectively. Western clusters such as Maharashtra (West 1) also saw strong uptake (10.2%), aided by a wider network of charging infrastructure and heightened environmental awareness.

In contrast, regions like East India and parts of North India lagged, with penetration rates of just 3–5%, indicating scope for further market development.

OEM performance varied across regions: Ola led in the North and East clusters, Bajaj dominated in West 1, and Ather commanded a strong presence in South 2 and 3. TVS maintained a balanced footprint nationwide, while Ampere remained largely confined to economy-seeking buyers in South 1 and East.

Changing Consumer Preferences

The report reveals that consumer evaluation metrics have evolved. Earlier driven largely by subsidies and pricing, purchase decisions now hinge on factors such as range, design, performance, and after-sales support. Increasing urban air pollution and rising costs of ICE two-wheelers due to emission compliance norms like BS-VI and OBD have also played a catalytic role.

From a cost perspective, e2Ws had a 52% lower total cost of ownership (TCO) than ICE counterparts in FY25, assuming 8,000 km of annual usage. Even without subsidies, TCO advantages are expected to remain strong through FY30, thanks to falling battery costs and improved economies of scale. Battery-as-a-Service (BaaS) models are also gaining traction, further reducing upfront purchase costs.

Vertical Integration

The report highlights a trend towards vertical integration among OEMs, particularly new-age entrants like Ather and Ola, who are investing in in-house technologies such as Battery Management Systems (BMS), controllers, and software platforms. While this requires higher upfront investment, it offers long-term control over quality, innovation, and costs.

Traditional ICE players are also gradually adopting similar strategies, though their vertical integration, especially in software is yet to match that of newer entrants. This could emerge as a key differentiator as the market matures.

Outlook and Projections

Looking ahead, CRISIL projects e2W penetration in total two-wheeler sales to rise from 5.8% in FY25 to 22–25% by FY30. The upward trajectory will be supported by expanding sales networks, improving charging infrastructure, and increasing customer confidence in EV technology.

The executive segment is expected to remain dominant, bridging affordability and aspirations, while premium segments could further expand in southern and western clusters. The economy segment, while shrinking, will still play a role in markets prioritising basic mobility solutions.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.