Our Terms & Conditions | Our Privacy Policy

Metaplanet Buys 6796 Bitcoins Surpassing El Salvador, Will BTC Price Rally This Week?

On Monday, Metaplanet announced a further acquisition of 1271 Bitcoins for a $126.7 million investment at a BTC price of $102,111. The announcement comes in days after the company announced its $25 million worth of bond issuance at 0% to further its BTC acquisition plans. As a result of its recent purchase, the Japanese firm has surpassed El Salvador in total BTC holdings.

Metaplanet Approaches Closer to 10,000 BTC Goal

Popular as Japan’s MicroStrategy, Metaplanet has bolstered its Bitcoin holdings with a recent acquisition of 1,241 BTC, valued at approximately $126.7 million, while highlighting the company’s continued confidence in BTC’s long-term potential.

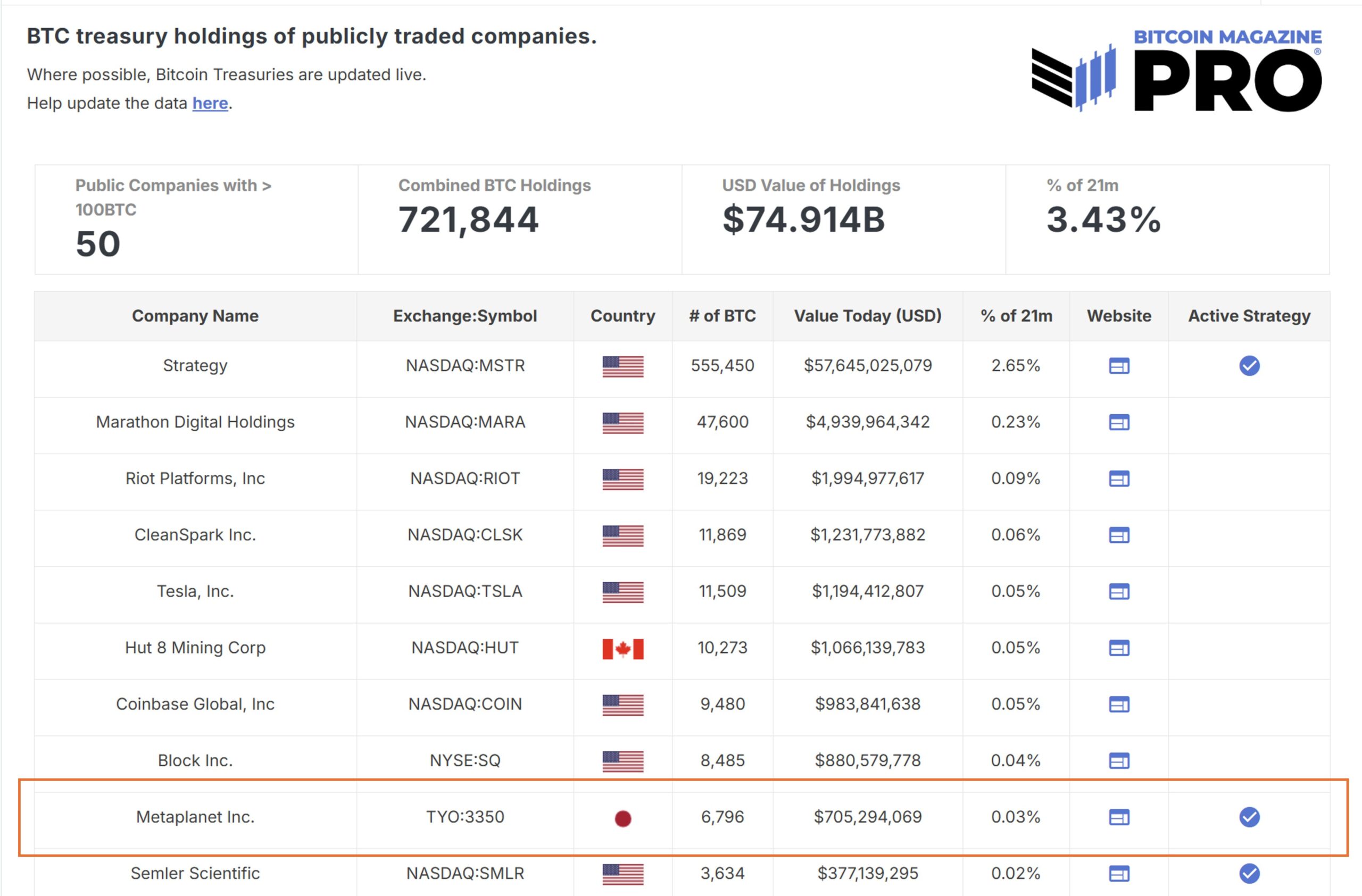

As of May 12, 2025, the firm’s total Bitcoin reserves stand at 6,796 BTC, acquired for a cumulative investment of approximately $608.2 million at an average cost of $89,492 per Bitcoin. Company CEO Simon Gerovich also noted that with their Bitcoin acquisition strategy over the past year, they have attained an impressive 170% BTC yield.

Some market veterans like Adam Back argued that their BTC acquisition strategy is better than that of MicroStrategy. Furthermore, after overtaking El Salvador, the Japanese firm is looking to challenge giants like Coinbase, Block Inc, etc. by raising its BTC holdings.

Source: Bitcoin Magazine

Source: Bitcoin Magazine

Today’s development comes a week after the Japanese firm announced plans to issue its 13th Series of Ordinary Bonds, aiming to raise $25 million for additional Bitcoin purchases. The company has been consistently leveraging its EVO FUND to issue bonds as part of its ongoing strategy to expand its Bitcoin holdings. The Japanese firm is quickly approaching its target of having 10,000 BTC in treasury by 2026 end.

Following today’s development, the Metaplanet stock jumped another 3%moving past 550 JPY. Since adopting the BTC strategy last year in mid-2024, the stock has been up by a staggering 1700% since then, and also more than 51% since the beginning of 2025.

BTC Rally Ahead This Week?

With strong 10.63% gains on the weekly chart, BTC price climbed all the way to $105,000 earlier today, as US-China trade talks proceed in a positive direction. Market analysts are turning hopeful for fresh all-time highs ahead this week.

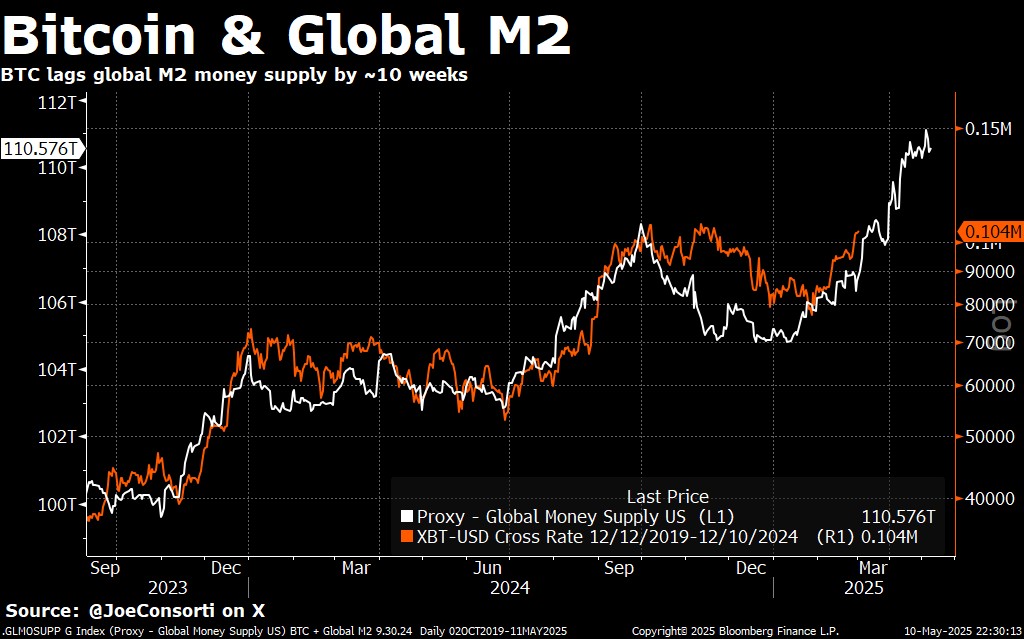

Financial analyst Joe Consorti has observed a strong correlation between Bitcoin’s price movement and the Global M2 Money Supply with a 70-day lag. The analyst acknowledged that although M2 is a “poor measure of money supply,” it remains a fascinating trend to monitor.

Source: Joe Consorti

Source: Joe Consorti

Apart from Metaplanet buying, Bitcoin whale purchases have continued at a staggering pace. Blockchain analytics platform LookonChain has reported significant activity from a major Bitcoin whale.

The investor recently purchased an additional 821 BTC, valued at $85.42 million, following a similar acquisition the previous day. In total, the whale has accumulated 1,721 BTC worth approximately $179 million over the past two days.

Source: LookonChain

Source: LookonChain

✓ Share:

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.