Our Terms & Conditions | Our Privacy Policy

Metaplanet Buys The Bitcoin Dips With a 18.67x BTC Rating

Metaplanet, popular as Japan’s MicroStrategy, has bought the recent Bitcoin price dip, acquiring an additional 775 Bitcoin earlier today. Through its consistent Bitcoin purchases, the company has now achieved a BTC rating of 18.67x, which puts it at a very healthy position against the BTC volatility. After hitting all-time highs last week, BTC price has corrected over 7% and is currently finding support at $115,000.

Metaplanet Buys More Bitcoins, Hitting 18.67x BTC Rating

On August 18, Japan’s MicroStrategy announced an additional BTC purchase of 775 BTC, taking its total Bitcoin holdings to 18,888 BTC. As per the data from Bitcoin Treasuries, Metaplanet is the seventh-largest Bitcoin holder, and is on the verge of overtaking Bitcoin miner Riot platforms. Peter Thiel-backed crypto exchange Bullish is the new entrant in the top five list after a successful IPO last week.

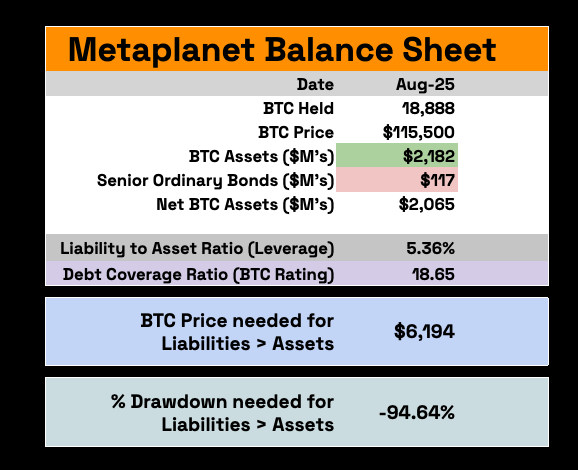

Following its recent BTC purchase, the Japanese firm has reported a year-to-date Bitcoin yield of 480.2% for 2025. Furthermore, the average BTC purchase price for the company stands at $102,653 per coin. Dylan LeClair, the company’s Bitcoin strategist, recently noted that Metaplanet’s Bitcoin holdings have reached approximately $2.18 billion, significantly outweighing its outstanding 0% ordinary bonds of about $120 million. The company’s 19th Series Ordinary Bonds are over-collateralized by 18.67 times through its BTC reserves.

Thus, the company’s BTC rating has reached a massive 18.67x, which means that the firm’s Bitcoin Treasury is over 18 times its outstanding debt. Adding further, Dylan LeClair stated:

“As it currently stands, the price of Bitcoin would have to decline 94.6% to ~$6,200 for our $BTC NAV to match our outstanding senior bond obligations.”

Source: Dylan LeClain

Source: Dylan LeClain

Metaplanet Stock In Demand After Strong Q2

Metaplanet stock has been in demand after reporting the strongest quarterly results in the second quarter of 2025. During the last week, the company’s stock stood as the Number 1 stock purchased on NISA accounts. Thus, investors see it as a strong proxy bet for Bitcoin exposure. However, the stock price has been under pressure, correcting 17% last week, and is currently finding a base at 850 JPY.

Last week, delivered its strongest quarterly performance to date, fueled by aggressive Bitcoin accumulation and improved financial metrics. CEO Simon Gerovich emphasized the achievement in an X post, stating, “This is the strongest quarter in Metaplanet’s history.”

Source: Metaplanet

Source: Metaplanet

For Q2, the company reported an ordinary profit of ¥17.4 billion, a sharp turnaround from a ¥6.9 billion loss in the previous quarter. Net income climbed to ¥11.1 billion, compared to a ¥5.0 billion loss a year earlier.

Revenue increased 41% quarter-on-quarter to ¥1.239 billion, while gross profit rose 38% to ¥816 million. Total assets surged 333% to ¥238.2 billion ($1.61 billion), and net assets jumped 299% to ¥201.0 billion ($1.36 billion), resulting in an equity ratio of 84.2%.

Bitcoin Price Sees Strong Pullback

Following Bitcoin price all-time high last week at $124,500, amid Fed rate cut expectations, BTC has seen a strong pullback of 7%, and is currently finding support at $115,000. Today’s BTC selling pressure comes with 22% upside in daily trading volume to $57 billion. Market analysts believe that BTC could slip further to take support at $110K, before bouncing back.

✓ Share:

![]()

Bhushan Akolkar

Bhushan is a seasoned crypto writer with over eight years of experience spanning more than 10,000 contributions across multiple platforms like CoinGape, CoinSpeaker, Bitcoinist, Crypto News Flash, and others. Being a Fintech enthusiast, he loves reporting across Crypto, Blockchain, DeFi, Global Macros with a keen understanding in financial markets.

He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Bhushan has a bachelors degree in electronics engineering, however, his interest in finance and economics drives him to crypto and blockchain.

Why trust CoinGape: CoinGape has covered the cryptocurrency industry since 2017, aiming to provide informative insights to our readers. Our journalists and analysts bring years of experience in market analysis and blockchain technology to ensure factual accuracy and balanced reporting. By following our Editorial Policy, our writers verify every source, fact-check each story, rely on reputable sources, and attribute quotes and media correctly. We also follow a rigorous Review Methodology when evaluating exchanges and tools. From emerging blockchain projects and coin launches to industry events and technical developments, we cover all facets of the digital asset space with unwavering commitment to timely, relevant information.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.