Our Terms & Conditions | Our Privacy Policy

Michael Saylor’s Strategy Adds 155 BTC as Bitcoin Climbs

Michael Saylor’s Strategy, previously MicroStrategy, has again bought more BTC for its Bitcoin treasury. This development comes as the Bitcoin price eyes new all-time highs (ATHs). Meanwhile, the MSTR stock has rebounded from its closing price of $395 last week.

Strategy Acquires 155 BTC for $18 Million

In a press release, the company announced that it had acquired 155 BTC for $18 million at an average price of $116,401 per Bitcoin, achieving a BTC yield of 25% year-to-date (YTD). It now holds 628,946 BTC, which it acquired for $46.09 billion at an average price of $73,288 per Bitcoin.

Notably, this is one of Strategy’s smallest purchases this year. Its smallest purchase came when it bought 130 BTC for $10.7 million, earlier in March. Meanwhile, this purchase is smaller than the 245 BTC buy it made in June.

The SEC filing showed that the company used proceeds from the sale of its STRF stock to fund this Bitcoin purchase. It sold 115,169 shares and raised net proceeds of $13.6 million.

Meanwhile, it is worth mentioning that Saylor had hinted about the purchase yesterday in his usual fashion. In an X post, he remarked that one would continue to make money as long as they don’t stop buying BTC, indicating that they added more to their Bitcoin stack.

If you don’t stop buying Bitcoin, you won’t stop making Money. pic.twitter.com/G9S2gPO1t8

— Michael Saylor (@saylor) August 10, 2025

The purchase comes just a week after Strategy made its largest purchase this year, acquiring 21,021 Bitcoin for $2.46 billion. Meanwhile, the company already filed a $4.2 billion STR offering and plans to use the net proceeds to buy more BTC in the future.

MSTR Stock Up 3% As Bitcoin Rises

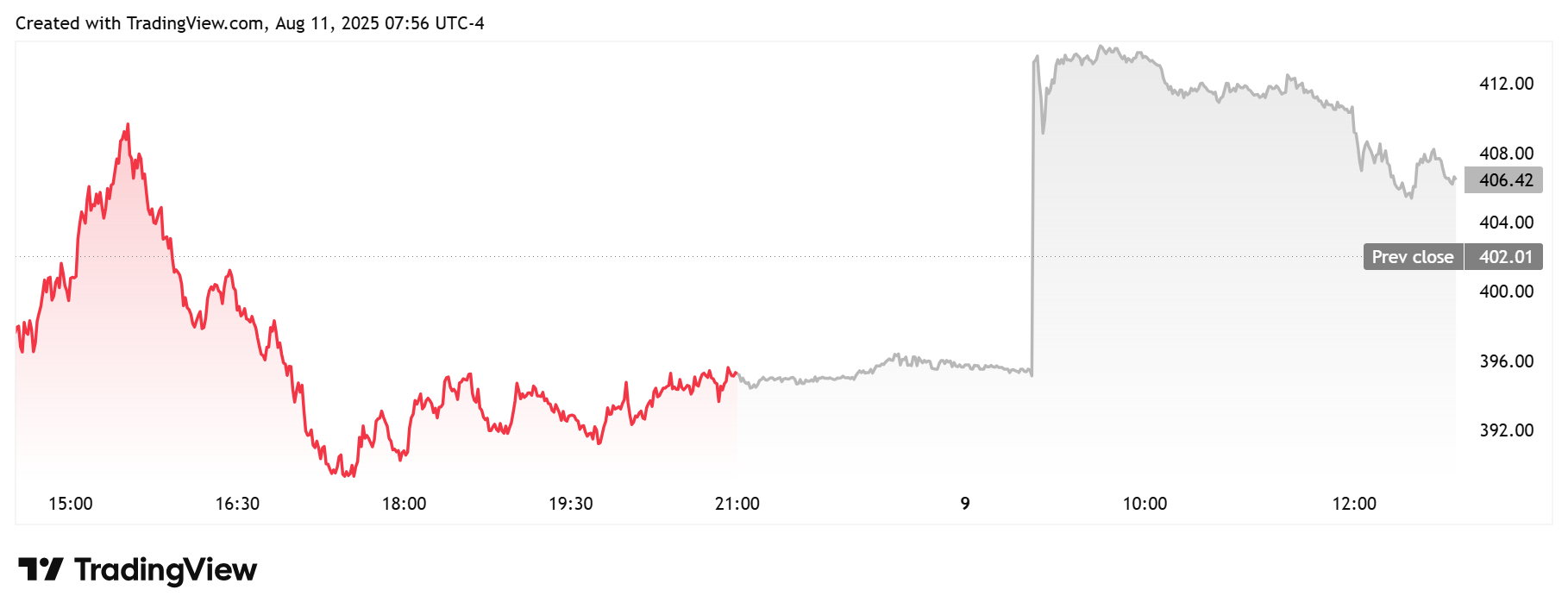

Amid the announcement of the Bitcoin purchase, the MSTR stock is up in premarket trading. TradingView data shows that the stock is currently trading at around $406, up 3% from its last week’s close of $395.

Source: TradingView; MSTR Daily Chart

Source: TradingView; MSTR Daily Chart

The Strategy stock rebound follows the Bitcoin price rally over the weekend. As CoinGape reported, the BTC price had broken above $122,000 earlier in the morning, eyeing a new all-time high.

Given Saylor Company’s Bitcoin exposure, the MSTR stock shares a strong positive correlation with BTC. The stock is up over 31% YTD, outperforming the leading crypto in the process.

Notably, yesterday marked five years since Strategy adopted the Bitcoin model. The MSTR stock has been the best-performing major asset since then, delivering a 100% average annual return during this period.

The company has also raised $46 billion through BTC-backed equity and credit. Its latest Bitcoin-backed security is the STRC stock, whose initial public offering is the largest this year. Strategy raised just over $2.5 billion from the offering.

✓ Share:

![]()

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across several niches. His speed and alacrity in covering breaking updates are second to none. He has a knack for simplifying the most technical concepts and making them easy for crypto newbies to understand.

Boluwatife is also a lawyer, who holds a law degree from the University of Ibadan. He also holds a certification in Digital Marketing.

Away from writing, he is an avid basketball lover, a traveler, and a part-time degen.

Why trust CoinGape: CoinGape has covered the cryptocurrency industry since 2017, aiming to provide informative insights to our readers. Our journalists and analysts bring years of experience in market analysis and blockchain technology to ensure factual accuracy and balanced reporting. By following our Editorial Policy, our writers verify every source, fact-check each story, rely on reputable sources, and attribute quotes and media correctly. We also follow a rigorous Review Methodology when evaluating exchanges and tools. From emerging blockchain projects and coin launches to industry events and technical developments, we cover all facets of the digital asset space with unwavering commitment to timely, relevant information.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.