Our Terms & Conditions | Our Privacy Policy

Michael Saylor’s Strategy To Raise $2 Billion To Buy Bitcoin

Michael Saylor’s Strategy, previously MicroStrategy, is again looking to expand its Bitcoin holdings with a new $2 billion raise. This follows an upsize in its STRC stock offering, which it announced earlier this week.

Strategy To Raise $2 Billion Through STRC IPO

According to a Bloomberg report, the company has increased the size of its STRC IPO from $500 million to $2 billion, citing someone familiar with the matter. Saylor’s company plans to price the Series A Perpetual Stretch preferred shares today.

As CoinGape reported, Strategy had announced the STRC initial public offering earlier this week, marking the fourth in its lineup of preferred stocks following the launch of STRD, STRF, and STRK. The company initially planned to offer 5 million shares to investors at $100 per share.

The STRC stock will take precedent over the Strike, Stride, and MSTR stocks, but will still rank lower than the Strife preferred stock. This latest raise comes just as Saylor’s company acquired 6,220 BTC for $739 million, expanding its treasury to 607,770 BTC.

It is worth noting that Strategy also has an impending $4.2 billion raise through its STRD offering. The company has yet to use proceeds from this raise to buy Bitcoin, as its recent purchases have been from MSTR stock sales.

Meanwhile, this latest capital raise plan comes amid Bitcoin miner MARA Holdings’ plans to raise $850 million to purchase more BTC. Both companies rank as the first and second largest Bitcoin treasuries, although Saylor’s company is well ahead, with MARA boasting 50,000 BTC.

MSTR Stock Trade Flats

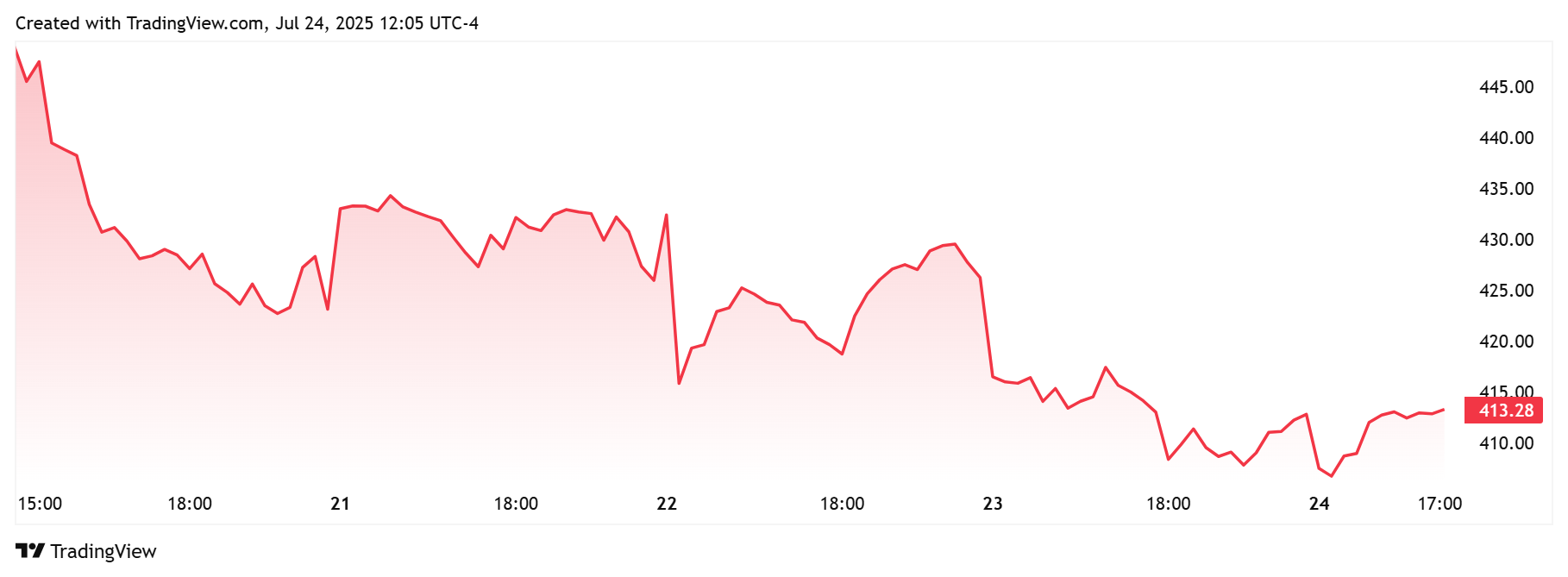

The MicroStrategy stock is trading flat on the day amid this development. TradingView data shows that the Strategy stock is trading around $413, up less than 1% on the day. The stock is down 8% from a 5-day high of $445.

Source: TradingView

Source: TradingView

This coincides with the Bitcoin price correction, with the flagship crypto down from its recent high of around $123,000. However, the MSTR stock is still up 10% in the past month and up over 37% year-to-date (YTD). All eyes are also on the company’s earnings report, which comes up on July 31, with the company set to report an unrealized $14 billion gain on its Bitcoin investment.

✓ Share:

![]()

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across several niches. His speed and alacrity in covering breaking updates are second to none. He has a knack for simplifying the most technical concepts and making them easy for crypto newbies to understand.

Boluwatife is also a lawyer, who holds a law degree from the University of Ibadan. He also holds a certification in Digital Marketing.

Away from writing, he is an avid basketball lover, a traveler, and a part-time degen.

Why trust CoinGape: CoinGape has covered the cryptocurrency industry since 2017, aiming to provide informative insights to our readers. Our journalists and analysts bring years of experience in market analysis and blockchain technology to ensure factual accuracy and balanced reporting. By following our Editorial Policy, our writers verify every source, fact-check each story, rely on reputable sources, and attribute quotes and media correctly. We also follow a rigorous Review Methodology when evaluating exchanges and tools. From emerging blockchain projects and coin launches to industry events and technical developments, we cover all facets of the digital asset space with unwavering commitment to timely, relevant information.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.