Our Terms & Conditions | Our Privacy Policy

Motorcycle Sales Down 6% to 3.7 Million Units in April-July, Dragged by Entry-Level Segment

The Indian two-wheeler market, after the first four months of FY2026, has registered wholesales of 6.24 million units, down 2.9% YoY (April-July 2024: 6.42 million units). The overall two-wheeler segment’s (motorcycles, scooters and mopeds) sales have essentially been dragged down by the tepid performance of the largest volume category – motorcycles.

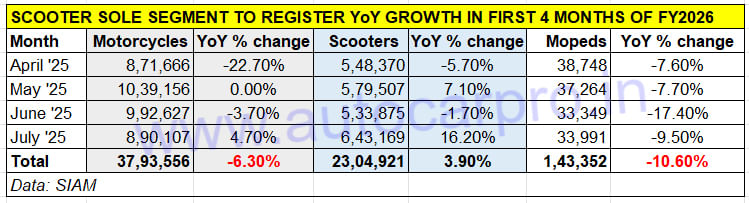

At 37,93,556 units in April-July 2025, motorcycle OEM dispatches to their dealers are lower by 6.3% YoY (April- July 2024: 40,48,411 units). With mopeds (143,353 units, down 10% YoY) also down, the only 2W category to register growth is scooters – the 23,04,921 units are up 3.9% (April-July 2024: 22,18,636 units) as per the data table depicted below.

At 3.79 million units in April-July 2025, the motorcycle industry’s wholesales are lower by 6.3% YoY, resulting in its share of overall 2W sales reducing to 61% from 64% a year ago.

This performance has meant that the share of the motorcycle segment in the first four months of the current fiscal has reduced to 61% from 64% a year ago, as compared to scooters, whose share of the 2W market has risen to 37% from 34% in April-July 2024 with TVS Motor Co and Hero MotoCorp being the only two scooter OEMs to register a market share increase.

While the scooter share of the two-wheeler market has increased to 37% in the first four months of FY2026 compared to 34% a year ago, the share of motorcycles stands reduced to 61% from 63% in April-July 2024. Put this down mainly to the performance of the two entry level categories – the volume-generating, fuel-sipping 100cc and 125cc segments. At a combined 28,14,384 units, wholesales were down 8% YoY (April-July 2024: 30,48,157 units), with their share of the overall 2W market reducing to 74% from 75% a year ago.

Combined sales of the 100cc and 125cc segments at 2.81 million units were down 8% YoY, as a result of which their share of the overall 2W market stands reduced to 74% from 75% a year ago.

Combined sales of the 100cc and 125cc segments at 2.81 million units were down 8% YoY, as a result of which their share of the overall 2W market stands reduced to 74% from 75% a year ago.

Seven of the 10 bike makers have registered a sales decline in the first four months of FY2026. The Top 3 OEMs’ dispatches have been dragged down by tepid demand for entry-level 100cc and 125cc motorcycles.

Seven of the 10 bike makers have registered a sales decline in the first four months of FY2026. The Top 3 OEMs’ dispatches have been dragged down by tepid demand for entry-level 100cc and 125cc motorcycles.

SEGMENT-WISE PERFORMANCE

Delving into the motorcycle segment’s 12 separate cubic capacity categories reveals that six of them have seen a YoY sales decline. This includes the big-volume, entry level, fuel-sipping 100cc category along with the 125cc and even the executive 150cc segment. The 100-110cc segment with sales of 1.71 million units is down 8%, what with lesser wholesales of 152,874 units – this comprises 60% of the total 254,855 fewer units the 10 OEMs dispatched to their dealers in the past four months. As a result, its share of the overall bike segment drops to 45% from 46% a year ago. While Hero MotoCorp, the mover and shaker of this segment, sold 14,15,273 units (-3%), Bajaj Auto dispatched 128,764 units (-19%), TVS Motor Co 94,173 units (-6%) and Honda 73,975 units (-48%).

It’s a similar scenario in the 110-125cc segment – the 1.10 million units are down 7% YoY albeit its share of the 2W market remains unchanged at 29 percent. Three of the four key OEMs have registered sales declines. Segment leader Honda with 571,245 units posted 8% YoY growth but Bajaj Auto (254,775 units, -10%) and TVS (1,30,421 units, -9% YoY) have been a drag on this category’s wholesales.

The 125-150cc segment, which is ranked fifth in volume terms, sold 138,287 units, is down by a substantial 33% YoY (April-July 2024: 207,723 units) as a result of reduced offtake for Bajaj Auto and TVS. This marks a resultant decline in its 2W share to 3.64% from 5% a year ago.

The 150-200cc segment, with 440,087 units saw marginal growth (up 1%) with an increase of just 2,734 units, which sees its 2W share grow to 11.60% from 10.79% a year ago. What has saved the blushes is the continuing strong demand for segment leader TVS’ Apache series of motorcycles. At 173,684 units sold and robust 15% YoY growth, the Apache remains TVS’ best-selling motorcycle, ahead of the Raider 125 (130,421 units). In April-July 2025, the Apache series – RTR 160, RTR 160 4V, RTR 180 and RTR 200 – has a 39% share of this segment’s sales, a tad below its FY2025 performance when it had 40 percent. What would have revved up demand is TVS launching the updated Apache RTR 160 with dual-channel ABS and RTR 200 4V in June this year.

Honda (102,610 units, up 9.50%) and Bajaj Auto (93,278 units, up 15%) were the only two other OEMs to register growth, while Hero MotoCorp, Yamaha and Suzuki saw their sales decline.

The 200-250cc segment witnessed good demand in the past four months – the 51,968 units are a 15% YoY increase. While segment leader Bajaj Auto sales fell 13% to 28,714 units, TVS saw a 170% jump in sales of the Ronin to 20,047 units, giving it a 39% share of the segment. Hero MotoCorp with 1,264 units was down 15% and Suzuki by 17% to 1,712 units. Kawasaki though bucked the trend with 231 units, up 5675% on just four bikes a year ago.

The 250-350cc segment, fourth in volume terms in India’s motorcycle market, remains the preserve of Royal Enfield. The Chennai-based midsize motorcycle major sold a total of 277,995 units, up 17% YoY, to increase its segment share to 95%, up from 94% a year ago. Honda is the faraway No. 2 OEM here with 13,446 units (up 4%) and a 5% market share. TVS, with 1,186 units of the RR 310 and the 310 series bikes for BMW, is down 5% YoY.

Dealer body FADA, in its near-term outlook for the two-wheeler market announced on August 7, opined that the convergence of major festivals — Raksha Bandhan, Janmashtami and Ganesh Chaturthi along with India’s Independence Day — alongside targeted promotional schemes, aggressive rural engagement and healthy stock levels will drive incremental sales, even as monsoon rains temper footfalls.

However, the news that the government is reviewing the Goods & Services Tax (GST) and exploring a two-slab structure from the existing four-tiered one for rollout by Diwali this year has both the industry and consumers awaiting clarity on the same.

Two-wheelers, like passenger cars, fall under the 28% GST category and a likely reduction to 18% GST will bring relief, particularly to buyers in the entry-level motorcycle segment who will delay their purchase decisions to the Diwali festival which is in the third week of October. This also means that the tepid sales movement in commuter bikes could persist in August and September.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.