Our Terms & Conditions | Our Privacy Policy

Over 50% decline: Will Sunil Singhania’s Abakkus continue holding these stocks – Stock Insights News

Sunil Singhania is a very well-known and highly followed super investor of India, who deserves a spot in our list of Warren Buffetts of India. He is known for his strategic focus on midcap and smallcap stocks across varied industries. His investment philosophy is all about finding fairly or under valued companies with strong fundamentals and significant growth prospects. His picks are driven by thorough research and keen market trend analysis.

Singhania does not get affected easily by market sentiments and tends to stick to his picks in thick and thin, just like any true follower of Warren Buffett would. And currently, two of his picks which he holds stake in via his fund, Abakkus Funds, are trading at a discount of over 50%.

What is it in these companies that even a decline of over 50% in the stock prices does not make Singhania take some tough decisions? Is there something more than what meets the eye? Let us try and find out.

Siyaram Silk Mills – Will the Big Shift Change Things

Incorporated in 1978, Siyaram Silk Mills Ltd is a Textile manufacturing company engaged in manufacturing fabrics and readymade garments, especially in the men’s wear section.

With a market cap of Rs 2,585 cr, the company offers a range of apparel including suits, blazers, shirts, and trousers made from the finest yarns for men, attuned to international standards and complementing a unique expression.

Ace investor and one of India’s Waren Buffett, Sunil Singhania’s Abakkus Fund has been holding a stake in Siyaram since March 2020 (as per the data on Trendlyne.com shows). Currently he holds 1.6% stake in the company which is worth almost Rs 41.2 cr.

The company’s sales have been up and low in the last 5 years and have logged in a compounded growth rate of 6%.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Cr | 1,698 | 1,088 | 1,903 | 2,229 | 2,087 | 2,220 |

The EBITDA (earnings before interest, taxes, depreciation, and amortization) also saw some good years but saw a decline in FY25.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| EBITDA/Cr | 169 | 55 | 334 | 369 | 286 | 277 |

When it comes to net profits, the company recorded lows as well as highs. But on a point to point basis, the growth has been solid.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Net Profit/Cr | 72 | 5 | 213 | 252 | 185 | 199 |

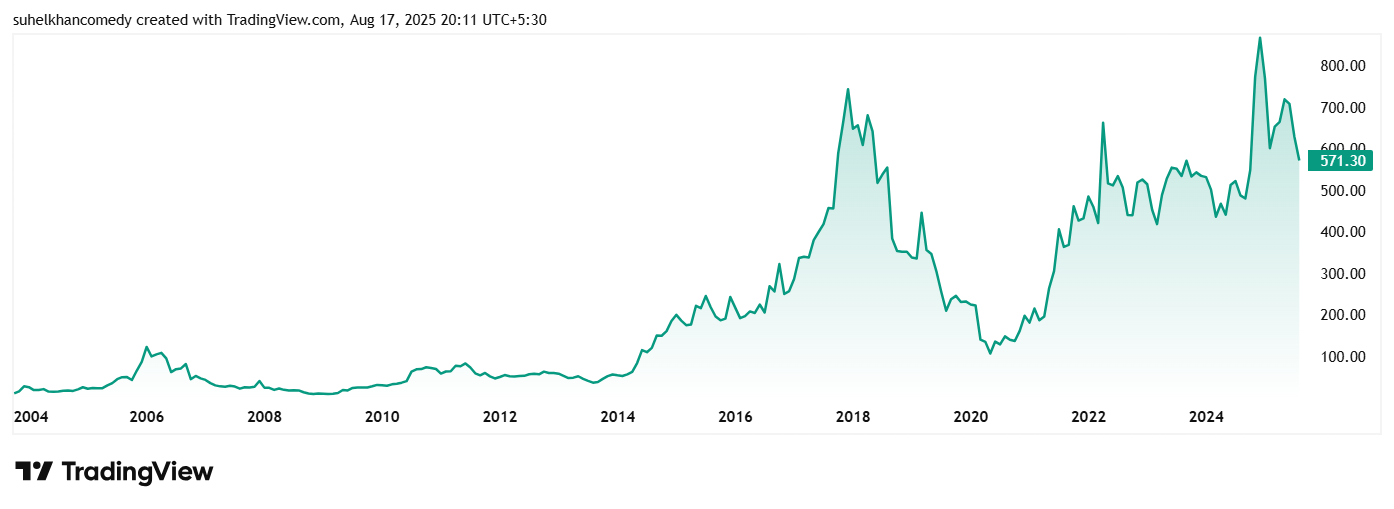

The share price of Siyaram Silk Mills Ltd was around Rs 147 in August 2020, and as on 20th August 2025, it was Rs 623, which is a jump of almost 324%. Rs 1 lac invested in the stock 5 years ago would have been close to Rs 4.25 lacs today.

At the current price of Rs 623, the stock is trading at 47% discount from its all-time high of Rs 1,175.

The company’s share is trading at a PE of 14x currently while the current industry PE is 23x.

The company has a dividend yield of 2.11% which is probably the highest when compared to peers from the industry. It has maintained a healthy dividend payout of 25%.

Siyaram Silk Mills is executing a significant strategic shift from a traditional B2B fabric player to a branded, D2C retail-led apparel company, with early traction in its new ZECODE (fast fashion) and DEVO (ethnic wear) brands. While topline growth is robust, profitability is under pressure due to promotional intensity and the ramp-up costs of new retail formats. Management remains cautiously optimistic, sticking to a 10–12% annual growth guidance, and is focused on operationalizing and scaling its new retail ventures with cluster-based expansion, funded through internal accruals.

Rupa & Company Ltd – Is it Really “Aaram ka Maamla”

Established in 1985, Rupa & Company Limited is engaged in the manufacture of knitted apparel, including hosiery. The Company offers textile, leather, and other apparel products.

With a market cap of Rs 1,563 cr, Rupa % Company Ltd offers a wide range of knitwear products, including innerwear, men’s wear, women’s wear, lingerie, kid’s wear, winter wear, athleisure wear, casual wear, and fashion wear.

Singhania’s Abakkus Funds has held a stake in Rupa & Company since December 2020 as per data on Trendlyne.com. Currently he holds 4.2% stake in the company worth Rs 66 cr.

The company’s sales, like Siyaram’s saw some good years and then some decline as well.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Cr | 975 | 1,313 | 1,475 | 1,143 | 1,217 | 1,239 |

The EBITDA saw a small jump in FY25 from the previous year but has seen a bumpy ride in the last few years.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| EBITDA/Cr | 114 | 257 | 269 | 89 | 118 | 131 |

Similar is the case with the company’s net profits.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Net Profit/Cr | 62 | 175 | 192 | 54 | 70 | 83 |

The share price of Rupa & Company was around Rs 203 in August 2020 which has fallen to its current price of Rs 200 as on 20th August 2025.

At the current price of Rs 200, the company’s share is trading at a discount of about 66% from its all-time high of Rs 590.

The share is trading at a PE of 20x, which is significantly lower than the current industry median PE of 29x.

The company has a dividend yield of 1.6% and has maintained a healthy dividend payout ratio of 36%.

In the recent investor presentation from August 2025, the company’s whole-time director Vikash Agarwal said, “The Company is navigating through complex industry landscape marked by heightened competitive intensity where price under cutting has been a major factor. The ongoing intense pricing competition in the industry has led to substantial increase of price sensitivity amongst dealers and our strategic decision to maintain prices, impacted topline growth.”

He also added, “We remain confident in our ability to navigate the current market environment, supported by our resilient business model, diversified product mix, and deep distribution network. Looking ahead, our focus will be on accelerating growth in high-potential segments, enhancing operational efficiencies, and continuing to deliver differentiated products that cater to evolving consumer preferences.”

Strategic Moves or a Hidden Landmines?

When an investor like Sunil Singhania is loyal towards stocks that he has held for some time, despite big decline in prices, it calls for attention to the stocks. Like any other Warren Buffett of India, Singhania’s strategy is known only to him, but his record speaks volumes of it.

Siyaram’s and Rupa both have seen a rocky road in terms of financials but are also geared for big changes business wise, which could them come back on top of things. But one thing both the companies have in common is the loyalty of Singhania, even after such big declines in share prices. Singhania sees something the average investor is missing.

It would be a wise decision to add these stocks to a watchlist and keep a very vigilant eye on them. After all, they are, so far, trusted by one of the Warren Buffetts of India.

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.