Our Terms & Conditions | Our Privacy Policy

Peter Brandt Sees 30% Chance Bitcoin Has Topped This Cycle

Veteran trader Peter Brandt says it’s likely that Bitcoin has reached its highest price point during the current cycle. His prediction coincides with BTC price drop below $117,500.

Bitcoin May Have Already Peaked Despite $200,000 Cycle Target Says Peter Brandt

Peter Brandt believes there is a 30% chance that Bitcoin has already peaked for the current bull market cycle. In a recent X post, the veteran trader suggested that the next significant move could see Bitcoin falling back to between $60,000 and $70,000 by November 2026.

He then expects a major rally that could push the cryptocurrency to $500,000 in the following bull market. This reinforces Brandt’s previous argument of Bitcoin being the ultimate store of value and not gold.

I think there is a 30% chance that BTC has topped for this bull market cycle. Next stop then back to $60k to $70k by Nov 2026, then next bull thrust to $500k

— Peter Brandt (@PeterLBrandt) August 15, 2025

Peter Brandt’s comments were in response to a model shared by analyst Colin Talks Crypto, which predicts Bitcoin’s peak based on historical cycle patterns. The model suggests each Bitcoin market cycle has been lengthening by roughly four months compared to the previous one.

According to the chart, the current cycle began after the market bottom in November 2022. If the pattern holds, the cycle could last 37 months from that low, placing the potential top around December 22, 2025. The predicted December 22, 2025 BTC peak matches a pattern seen in past market cycles. Each of these bull market lasts longer than the previous one.

The Bitcoin Cycle Chart used in the analysis shows previous peaks occurring 24, 28, and 33 months after prior market bottoms. A projection of this gives a 37-month price estimation of the leading cryptocurrency based off the on-going cycle. The model also predicts a price target of about $200,000 towards the period.

When will BTC top? Here’s an interesting model.

Per the chart below, it could be 37 months from the low of the cycle. This is because each cycle appears to lengthen by 4 months.

The cycle bottom was around Nov 22, 2022.

37 months from November 22, 2022, will be December 22,… pic.twitter.com/nlz0ABVafg

— Colin Talks Crypto (@ColinTCrypto) August 15, 2025

The present price of Bitcoin is quite distant to the $200,000 mark in the cycle forecast. Whether the next major peak occurs in late 2025 or has already passed, both analysts agree that sharp price changes will remain a defining feature of the cryptocurrency’s path.

BTC Slips to $117,000 but Holds Strong Year-to-Date Gains

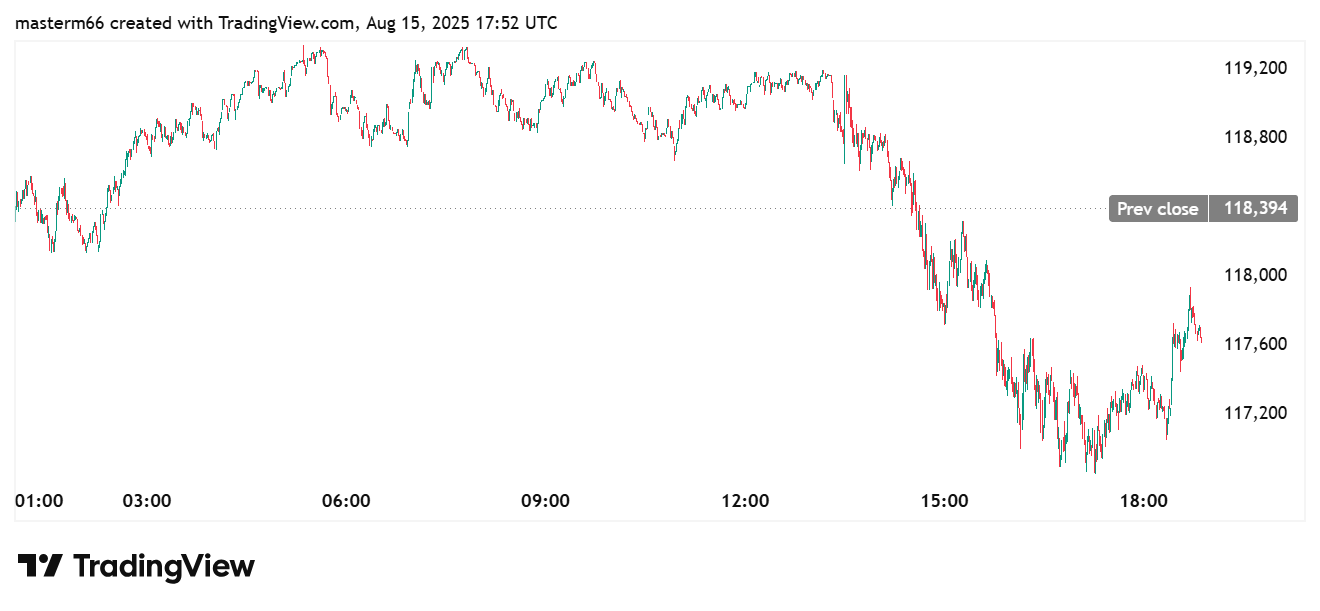

Peter Brandt’s caution comes as Bitcoin price trade at $117,283 as of this writing. This marks a 0.94% decline over the past 24 hours. The gain was sharp during earlier trading sessions. However, there was a pull back and price fell below $117,200 before it started recovering.

Bitcoin has declined by 0.20% in the last seven days and 0.42% in the last thirty days. Also, the asset is still up 20.17% in the last six months and 25.64% year to date.

Bitcoin price chart displaying intraday drop and rebound.

Bitcoin price chart displaying intraday drop and rebound.

✓ Share:

![]()

Paul

Paul Adedoyin is a crypto journalist with 4+ years experience who provides timely news, in-depth research, and insightful content to inform and empower his audience. His works have been featured on sites such as CryptoMode, CryptoNewsFlash among others.

He holds a degree in Geophysics from OAU, Nigeria. When he’s not writing, he loves watching soccer and reading educative journals.

He can be reached via [email protected]

Why trust CoinGape: CoinGape has covered the cryptocurrency industry since 2017, aiming to provide informative insights to our readers. Our journalists and analysts bring years of experience in market analysis and blockchain technology to ensure factual accuracy and balanced reporting. By following our Editorial Policy, our writers verify every source, fact-check each story, rely on reputable sources, and attribute quotes and media correctly. We also follow a rigorous Review Methodology when evaluating exchanges and tools. From emerging blockchain projects and coin launches to industry events and technical developments, we cover all facets of the digital asset space with unwavering commitment to timely, relevant information.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.