Our Terms & Conditions | Our Privacy Policy

Retail Says Stock In Rocket Mode

One Blockchain will continue to operate under its existing management team, led by Chairman and CEO Jerry Tang.

Shares of recruitment platforms developer Signing Day Sports Inc. (SGN) skyrocketed on Wednesday morning after the company announced an agreement to merge with One Blockchain LLC, the operating entity of BlockchAIn Digital Infrastructure.

This move aims to position the combined entity in the rapidly evolving digital infrastructure sector, encompassing crypto mining, artificial intelligence (AI), and high-performance computing (HPC) data hosting markets.

The merger is set to be executed through a holding company structure, resulting in the formation of BlockchAIn Digital Infrastructure, Inc. (PubCo).

Upon completion, PubCo’s common shares are expected to be listed on the NYSE American. Notably, Signing Day Sports will not be required to make any cash payment to One Blockchain or its securityholders in connection with the transaction.

One Blockchain will continue to operate under its existing management team, led by Chairman and CEO Jerry Tang.

In the fiscal year 2024, BlockchAIn Digital Infrastructure reported audited revenue of approximately $26.8 million and a net income of approximately $5.7 million.

The company’s operations include a 40 megawatt (MW) crypto mining hosting facility in South Carolina, with expansion capabilities up to 50 MW, subject to utility approval.

Additionally, BlockchAIn is in the process of commissioning a new 150 MW facility in Texas, anticipated to be operational in late 2026.

This facility is designed to be modular, allowing for flexible allocation between crypto mining and AI/HPC data hosting activities.

“In the near term, blockchAIn Digital Infrastructure will look to bring bitcoin mining in-house, expand our South Carolina facility to 50MW, and build out our proposed 150MW facility in Texas to support the large demand for hosting services driven by various AI and mining applications,” said One Blockchain CEO, Jerry Tang.

Under the terms of the deal, One Blockchain’s investors are set to receive roughly 91.5% of the combined entity’s outstanding common stock, while shareholders of Signing Day Sports will retain around 8.5%.

In addition, the agreement features an earnout clause, which allows for the issuance of extra shares to One Blockchain’s holders if PubCo reaches or surpasses $25 million in earnings before interest, tax, depreciation, and amortization (EBITDA) for the fiscal year ending Dec. 31, 2026.

The merger is expected to close in the latter half of 2025.

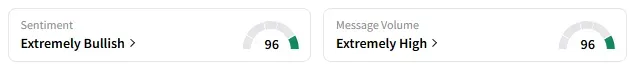

On Stocktwits, retail sentiment around Signing Day Sports remained in ‘extremely bullish’ territory.

SGN’s Sentiment Meter and Message Volume as of 09:50 a.m. ET on May 28, 2025 | Source: Stocktwits

A Stocktwits user said the shares are in rocket mode.

Another bullish user expects the stock to hit $4.

Signing Day Sports stock has gained over 40% year-to-date and lost over 71% in the last 12 months.

Also See: Abercrombie & Fitch Stock Soars After Upbeat Q1 Results: Retail Turns More Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.