Our Terms & Conditions | Our Privacy Policy

Sora Ventures Unveils Asia’s First Bitcoin Treasury Fund With $1 Billion Buying Plan

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Sora Ventures, a Taiwan-based investment firm, has unveiled Asia’s first dedicated Bitcoin (BTC) treasury fund. The firm plans to deploy the fund’s proceeds to purchase BTC over the next six months.

Sora Ventures Launches Massive Bitcoin Treasury Fund

Speaking at Taipei Blockchain Week, Sora Ventures announced its goal of raising up to $1 billion for BTC acquisitions within the next six months. The firm has already secured $200 million in initial commitments from regional partners.

Sora’s new fund follows the trend of individual Bitcoin treasury firms that have gained prominence in Asia over the past year or so, such as Japan’s Metaplanet, Hong Kong’s Moon Inc., Thai firm DV8, and South Korea-based BitPlanet, to name a few.

However, unlike the aforementioned firms – which hold BTC directly on their balance sheets – Sora’s treasury fund will operate as a central pool of institutional capital. Its dual purpose is to support existing Bitcoin treasury firms and foster the development of similar entities worldwide.

The fund seeks to position Bitcoin as a global reserve asset by creating synergies between Asian and international treasury players. To achieve this, Sora’s management team plans to onboard additional institutional partners.

Sora’s strategy underscores the shift in Bitcoin adoption from North America toward Asia. While companies like Strategy – formerly MicroStrategy – have led BTC adoption in North America, Asia is increasingly becoming a focal point. Jason Fang, founder and Managing Partner at Sora Ventures, commented:

Asia has been one of the most important markets for the development of blockchain technology and Bitcoin. We have seen a rise in interest from institutions investing in Bitcoin treasuries in the US and EU, while in Asia efforts have been relatively fragmented. This is the first time in history that institutional money has come together, from local to regional, and now to a global stage.

Notably, Sora Ventures has previously backed this trend. In 2024, the firm invested in Metaplanet to support its $6.5 million BTC allocation, and earlier this year, it acquired both Moon Inc. and DV8.

Will BTC Rise In The Coming Months?

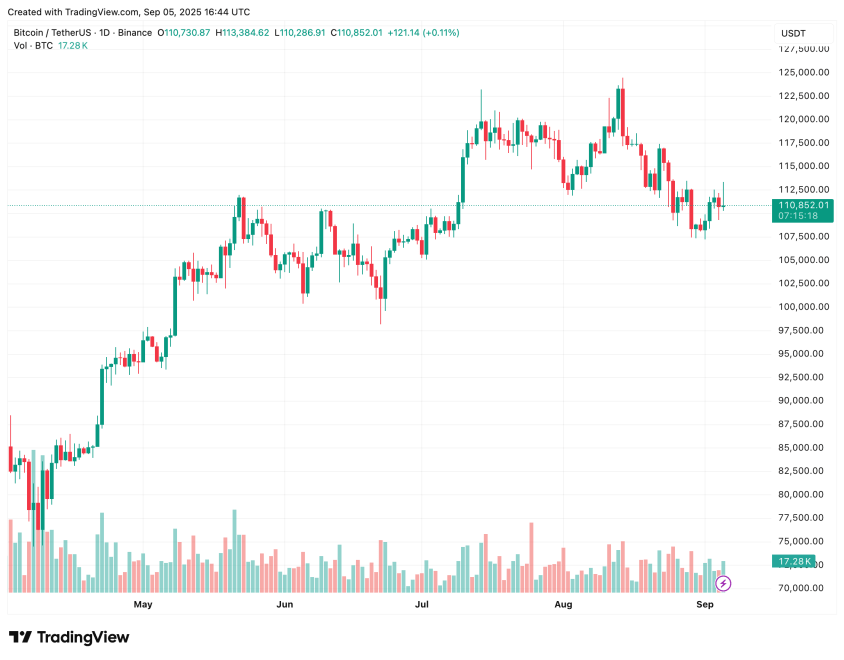

Sora’s announcement of a near $1 billion Bitcoin purchase has reignited bullish sentiment, with many expecting fresh all-time highs. To recall, BTC’s most recent peak was $124,128 on August 14.

Meanwhile, total BTC holdings of publicly-listed companies recently surpassed 1 million BTC, highlighting growing institutional confidence in the asset as a store of value. With Sora’s initiative, this figure is expected to rise even further.

Adding to the momentum, recent reports suggest that institutional adoption is accelerating so quickly that Bitcoin miners are struggling to meet demand. At press time, BTC trades at $110,852, up 1.3% in the past 24 hours.

Bitcoin trades at $110,852 on the daily chart | Source: BTCUSDT on TradingView.com

Bitcoin trades at $110,852 on the daily chart | Source: BTCUSDT on TradingView.com

Featured image from Unsplash.com, charts from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.