Our Terms & Conditions | Our Privacy Policy

The Ultimate Guide for M&A Success: How People Power Deals | Opportune LLP

Mergers and acquisitions (M&A) often come with bold promises, streamlined operations, enhanced market share, and increased profitability. But here’s the hard truth: more often than not, these promises fall short. Studies show that M&A deals frequently fail to deliver expected value. The primary reason? People are often overlooked.

While financial metrics and tax efficiencies are meticulously analyzed, the human element, crucial for seamless integration and long-term success, is frequently underestimated. By prioritizing the human aspect and fostering a culture of collaboration and trust during the transition, organizations can unlock the true synergy potential of M&A.

The Human Factor

Research backs this up. A joint study by E&Y and Oxford University revealed that focusing on critical human factors increases the probability of transformational success by a staggering 70%! Similarly, findings published in the Human Resource Management Review highlight that employee commitment and involvement significantly reduce turnover and improve retention during M&A transitions. The message is clear: prioritizing people isn’t just something leaders say—it’s the linchpin of M&A success.

The Human Challenge

Mergers and acquisitions disrupt lives as much as they do processes. Individuals bring diverse personalities, communication styles, business habits, and emotions. This human challenge can derail even the best M&A strategy without a comprehensive change management plan. Success hinges on engaging the workforce, fostering involvement, and maintaining clear, two-way communication throughout the entire transition.

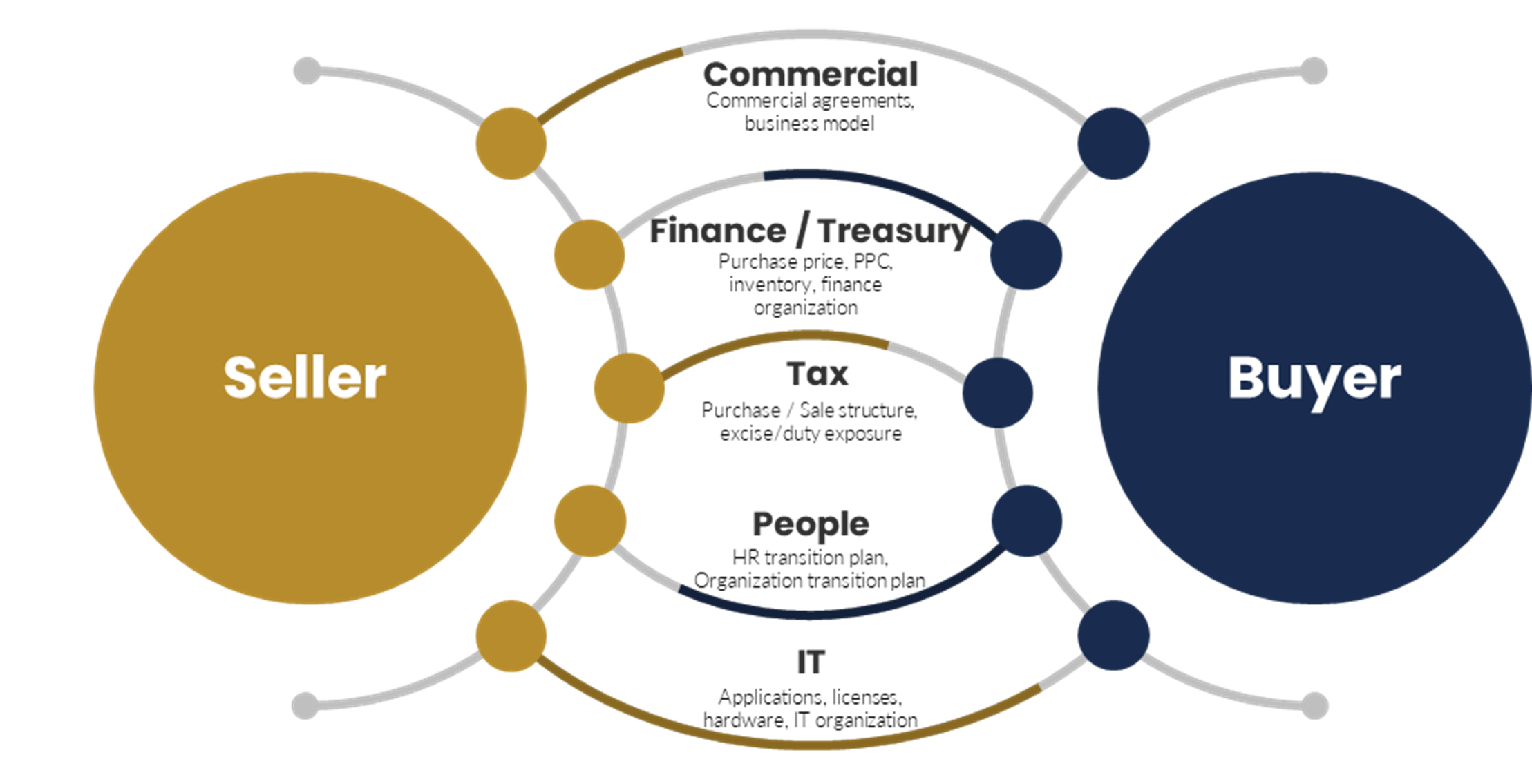

M&A integration work in the Energy industry is often built around five key transition pillars:

- Commercial: Ensuring seamless alignment of market strategies and commercial operations.

- Finance/Treasury: Streamlining financial operations and accounting to support strategic goals.

- Tax: Managing compliance and maximizing tax efficiency.

- People: Supporting talent, culture, and organizational structure transition to achieve business objectives

- IT: Integrating technologies and simplifying operations.

While addressing commercial, financial, and tax issues is essential for successful M&A activity, neglecting people and technology is dangerous. By thoroughly addressing all five elements, organizations can ensure seamless integration and align all business areas to move forward cohesively. This holistic approach lays the foundation for sustained growth, competitive advantage, and value creation.

To comprehensively address the integration of people, two detailed transition plans need to be developed early in the transaction process to organize and guide all essential work:

The Human Resources Transition Plan

This plan focuses on engaging employees and creating transparency by:

- Consolidating legal and workplace compliance

- Integrating performance management and compensation models

- Harmonizing benefits, HR policies, and career development practices

The Organization Transition Plan

This plan ensures leadership alignment and operational readiness by:

- Leveraging organization capability and individual talent

- Driving leader sponsorship and commitment

- Delivering communication and receiving feedback early and often in the transition process

- Addressing changes across processes, technologies, cultures, leadership styles, and the organizational structure, and valuation

- Empowering employees to make the required changes not just by thinking and then changing, but by thinking, feeling, and changing

By prioritizing people and implementing comprehensive change management strategies, organizations can navigate the complexities of integration and unlock the full potential of their deals. By fostering collaboration, transparency, and employee engagement, leaders can ensure a smooth transition, minimize disruption, and achieve long-term success.

[ad_1]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

[ad_2]

Comments are closed.