Our Terms & Conditions | Our Privacy Policy

Two ‘Warren Buffetts of India’ just dumped these stocks. Should you be worried? – Stock Insights News

Two of the biggest names in the Indian investors space, Nemish Shah and Rekha Jhunjhunwala have just made big changes to their portfolio. Now, these are names whose smallest movements cause the biggest ripples in the market. So, when they sell off stocks that they held for long, it warrants immediate attention.

Nemish Shah, one of the most revered Value investors of India, who holds just 5 stocks in his portfolio worth Rs 3,150 cr and does not make big changes often, just sold off an auto component manufacturer he had held atleast since December 2015 (as per oldest data on trendlyne.com).

Rekha Jhunjhunwala, wife of late ace investor Rakesh Jhunjhunwala on the other hand holds 25 stocks worth over Rs 40,660 cr, just sold off a diversified gaming and sports media platform. She held the stock since December 2022 as per trendlyne.com.

While the market goes into what we can only call a well of questions, it makes sense to try and find out what triggered these decisions.

Nazara Technologies Ltd

Incorporated in 1999 and listed in 2021, Nazara Technologies Ltd is a leading diversified gaming and sports media platform with presence in India and across emerging and developed global markets such as Africa and North America, and offerings across the interactive gaming, eSports, and gamified early learning ecosystems.

With a market cap of Rs 12,377 cr, Nazara Technologies Ltd was among the first entrants in the Indian market in eSports (through Nodwin) and cricket simulation (through Nextwave).

Rekha Jhunjhunwala held a stake in the company since the quarter ending December 2022. At the quarter ending March 2025, she was holding 7.1% stake, which per the exchange filings made for the quarter ending June 2025, has dropped below 1% meaning a partial or complete exit.

The sales of the company grew at a compounded growth rate of 46% from Rs 248 cr in FY20 to Rs 1,624 cr in FY25. In case of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) the company logged in operating losses of Rs 7cr in FY20 and for the FY25 it was Rs 114 cr.

When it comes to Net profits, the company saw losses of Rs 27 cr in FY20 and showed a turnaround post that, with the FY25 profits number coming to 51 cr.

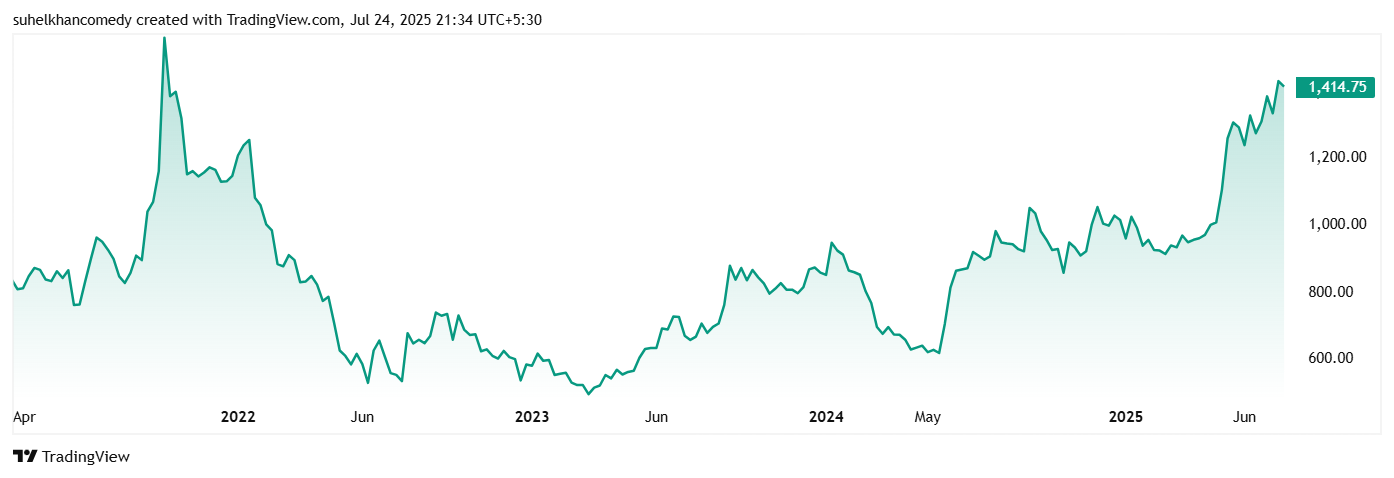

The share price of Nazara Technologies Ltd was around Rs 920 in July 2021, which has jumped to Rs 1,414 as of closing on 24th July 2025.

The stock is trading at a PE of 198x, while the industry median of 98x. The 10-Year median PE for Nazara is 106x and the industry median for the same period is 70x.

According to the latest investor presentation in June 2025, Nazara is executing a multi-pronged strategy: global expansion via M&A, fortifying core gaming and esports assets, building IP-driven businesses, and leveraging technology/AI for operational excellence. FY25 saw record revenues and cash flows, but some margins drag from one-offs and integration costs. However, management remains bullish on FY26, with continued focus on profitability, organic/inorganic scale, and global leadership in gaming and youth media.

The Hi-Tech Gears Ltd

Incorporated in 1986, Hi-Tech Gears Ltd is an auto component manufacturer and a Tier 1 supplier.

With a market cap of Rs 1,309 cr Hi-Tech Gears exports to countries like USA, Brazil, Canada, Mexico, Germany, UK, China, South Korea, Japan. It has an impressive clientele with names like American Axle, Powertrain, Robert Bosch, Borg Warner, Daimler Fuso, Daimler AG, JCB Power internationally and Hero Moto, Tata, Cummins India, JCB India, Honda Car etc domestically.

Nemish Shah held a 7.2% stake in the company till the quarter ending March 2025. However, as per filings made for the quarter ending June 2025, his holding has gone below 1% meaning a partial or complete exit.

The sales of the company grew at a compounded growth rate of just 5% between FY20 and FY25, all while seeing a lot of ups and downs.

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Cr | 722 | 746 | 971 | 1,169 | 1,107 | 927 |

EBITDA also shows a similar rocky pattern with Fy25 seeing a drop.

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| EBITDA/Cr | 84 | 90 | 82 | 141 | 150 | 136 |

As for the Net Profits, the company did saw a compound growth of 37% between FY20 and FY25, however, FY25 did see a big drop.

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Profits/Cr | 8 | 29 | -1 | 23 | 114 | 40 |

The share price of Hi-Tech Gears Ltd was around Rs 107 in July 2020 and as of closing on 24th July 2025 it was Rs 698, which is an over 550% jump.

The company’s stock is trading at a PE of 32, while the industry median is 30x. The company’s 10-year median PE for Hi-Tech Gears 25x and the industry median for the same period is 24x.

The company’s latest annual presentation is yet to be released, but in the last annual presentation, Chairman Deep Kapuria had hinted at the looming risks – “Due to unprecedented Israel conflict, the Red Sea region has become a focal point of concern due to the skirmishes that have developed around it, involving several West Asian countries and non-state factors. This region is highly critical for global trade as the gateway to the Suez Canal, the fastest route for freight movement from Asia to Europe, through which about 12% of global shipping traffic passes. India too, is heavily reliant on the Red Sea for approximately 80% of its exports to Europe. It therefore faces significant challenges due to significant maritime chokehold.”

Follow The Big Exits of The Big Names?

Rekha Jhunjhunwala and Nemish Shah’s exit from Nazara Technologies and Hi-Tech Gears respectively, has thrown the market gurus into a pit of questions from everywhere. Now these are the Warren Buffetts of India, and their exits sound a lot of alarms after all.

While Rekha Jhunjhunwala does not shy away from moving things around every now and then, Nemish Shah is a hardcore Buffett follower, who believes that the best holding period is forever. If these two have made exit calls, it does attract attention from all corners of the market.

Is this a strategic exit or a sign of something big to come, only time will tell. For now, keeping an eye on these stocks could be the best possible way forward. Add to Watchlist?

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.