Our Terms & Conditions | Our Privacy Policy

Used Tata Punch retains value due to strong new car demand: Autocar-Spinny study

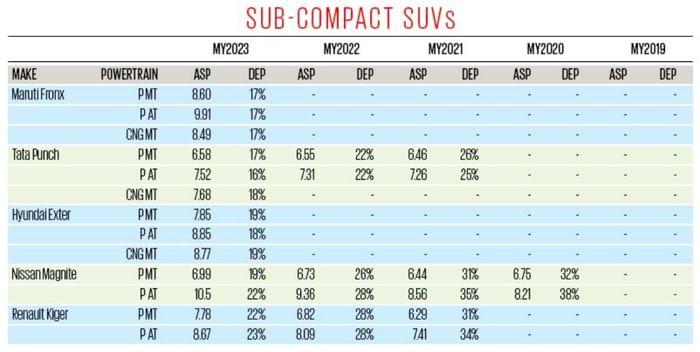

Based on current trends, the Maruti Fronx appears to depreciate slower than the Hyundai Exter.

The Nissan Magnite, launched in 2020 with aggressive pricing, was strategically positioned below all other sub-4-metre offerings, effectively carving out a niche in the market. Its mechanically identical sibling, the Renault Kiger, followed in 2021, adopting a similar value-driven approach. However, it was the launch of the Tata Punch later that year that truly defined and popularised the “sub-compact SUV” category.

Used sub-compact SUVs resale value study results

While the rate of depreciation is similar, Nissan Magnite’s average resale prices are higher than Renault Kiger’s.

*ASP stands for average selling price; DEP stands for Depreciation.

In 2023, Maruti Suzuki and Hyundai entered the segment with the Fronx and Exter, respectively. Though it is early to draw definitive conclusions, current trends suggest that the Fronx is depreciating at a slower rate than the Exter, likely due to strong demand in the new car market.

The Tata Punch, a best-seller in this category, holds its value well in the pre-owned market too. Interestingly, its petrol variants paired with an automated manual transmission (AMT), in particular, retain their value better than most competitors, indicating that used car buyers are willing to pay a premium for the convenience of a clutch-free driving.

The Nissan Magnite and Renault Kiger, positioned at the premium end of the segment, offer a choice of naturally aspirated and turbo-petrol engines, with AMT and more refined CVT automatic transmission options. These models exhibit similar depreciation trends, with three-year-old examples losing 31–35 percent of their original value. Notably, the Nissan Magnite commands higher average resale prices than the Renault Kiger. Despite sharing platforms and powertrains, the Magnite appears to have a stronger presence in the used car market.

Autocar India-Spinny Resale Value Study

This finding is based on a joint study conducted by Autocar India in collaboration with Spinny, a leading used car platform operational in 22 cities across India, including Delhi, Gurugram, Noida, Bangalore, Mumbai, Pune, Hyderabad, Chennai, Kolkata, Ahmedabad, Lucknow, Jaipur, Chandigarh, and Indore. Spinny provided average selling prices (ASP) derived from actual transactions of 21,944 cars sold across its network during the 2024 calendar year. For the purpose of the study, if a particular model had multiple engine options of the same fuel type, or came in multiple variants, these were merged and averaged. Depreciation was calculated as the percentage difference between a car’s on-road price in its year of manufacture and its resale price in 2024.

Also see:

Used Toyota Glanza prices similar or lower than Maruti Baleno: Autocar-Spinny study

Maruti Dzire holds 70 percent of its price after 5 years: Autocar-Spinny study

Maruti Eeco CNG commands strongest resale prices among MPVs: Autocar-Spinny study

[ad_1]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

[ad_2]

Comments are closed.