Our Terms & Conditions | Our Privacy Policy

Vietnam Replacing China As Key Link In Global Supply Chains

Vietnam is turning into a production powerhouse for the world as a result of the U.S. trade war, , according to Caixin.

For example, once a farming region, Bac Ninh has become northern Vietnam’s industrial hub, driven by Chinese manufacturers relocating operations south to avoid U.S. tariffs and diversify supply chains.

The shift began with the U.S.-China trade war and has accelerated as clients pressure suppliers to set up in Vietnam. “When the trade tensions began in 2018, one client suggested we look into Vietnam,” said Li Fangting of Mingjie, a Dongguan-based plastics maker. “After the pandemic, those suggestions turned into demands. Some clients said we wouldn’t be considered for new orders unless we had a presence in Vietnam.” Mingjie now produces in Bac Ninh for U.S. and European markets.

But costs are rising. Industrial land in Bac Ninh is pricier than in many Chinese regions, and wages are catching up. Some firms now produce goods costlier than their Chinese equivalents, relying on tariff gaps that could vanish overnight. In April, the U.S. slapped a 46% tariff on Vietnamese exports, later trimmed to 20%.

Despite these pressures, northern Vietnam is emerging as a “world assembler.” Samsung, which has invested over $23 billion since 2008, anchors a cluster of electronics producers, joined by Apple suppliers like Foxconn, Goertek, and Luxshare. “Over the past few years, we’ve seen a surge in supply chain companies, logistics providers, and packaging firms entering Vietnam, following in the footsteps of their major clients,” said Anchalee Prasertchand of Thailand’s WHA Group.

Caixin writes that supply chains remain incomplete, forcing many manufacturers to import components from China. In textiles, 80% of yarn still comes from China, said Tian of Hechang Threads Dyeing. Furniture is more self-sufficient, with 90% of inputs sourced locally, though steel and panels remain scarce. As one factory owner put it: “In fact, the global center of furniture production shifted from Dongguan to Binh Duong by 2018. This industry won’t be going back to China.”

Even with higher costs, Vietnam’s tariff advantage sustains momentum. Executives estimate Vietnamese goods are 15% more expensive than Chinese ones, but with U.S. tariffs averaging 57.6% on Chinese products versus 20% on Vietnamese, the gap is decisive.

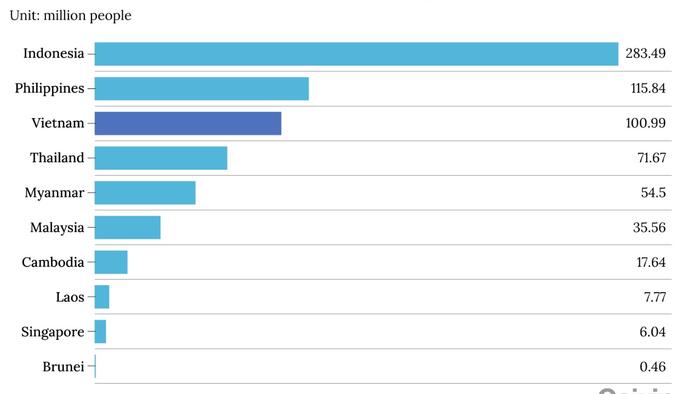

Chinese firms are also eyeing Vietnam’s domestic market of 100 million people. “Trade wars may be the spark, but going overseas is really about tapping global markets — not just the U.S., but also Europe and Southeast Asia,” said Niu Qiang of KCN Investment Consulting. “For Chinese companies, this is the true start of globalization.”

Automakers highlight the shift. Shineray Motors, which entered in 2018, adapted trucks for local roads and weather. Its mini-commercial vehicles now hold 30% of Vietnam’s market. “Now is a good time to lay the groundwork for the passenger car and new energy vehicle market,” said general manager Wang Lu. Giants like Geely and Great Wall are also investing, cementing Vietnam’s role as both a manufacturing hub and consumer battleground.

Loading recommendations…

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.