Our Terms & Conditions | Our Privacy Policy

Why this 20-Year-Old Multi Cap Fund Is A Worthy Investment

Benchmarks across the board have recovered sharply over the past couple of months. After a six-month correction that lasted till early April, key indices are up 15-28 per cent from their recent lows.

After a period marked by weak consumption, slowing corporate earnings and geopolitical tensions, there has been a revival of sorts on multiple fronts.

GDP growth has been positive in the fourth quarter, the RBI has cut interest rates steeply, inflation is under control, monsoon is on course and FPI investors are getting back to buying mode.

Though the possibility of a weak global demand, slowing US economy and the adverse impact of reciprocal trade tariffs lay ahead, the domestic scenario seems fairly healthy on the macro front.

Therefore, a multi-cap approach would be suitable for investors with a high-risk appetite, looking for better long-term returns.

Nippon India Multicap (Nippon India India Opportunities Series A earlier), with a track record of over 20 years, can be a good addition to your portfolio as the fund has delivered strong and consistent performance over the past 10 years.

Using the systematic investment plan (SIP) mode for a time period of 7-10 years would help ride out volatility reasonably and average costs.

Above-average performance

The multi-cap category itself has a relatively shorter track record, only from 2021. However, Nippon India Multi Cap has had a mixed market cap approach all through its years of existence. It is benchmarked to the Nifty 500 Multicap 50:25:25 TRI. However, since data on this index is not readily available, we have taken the Nifty 500 TRI for comparison with the scheme’s performance.

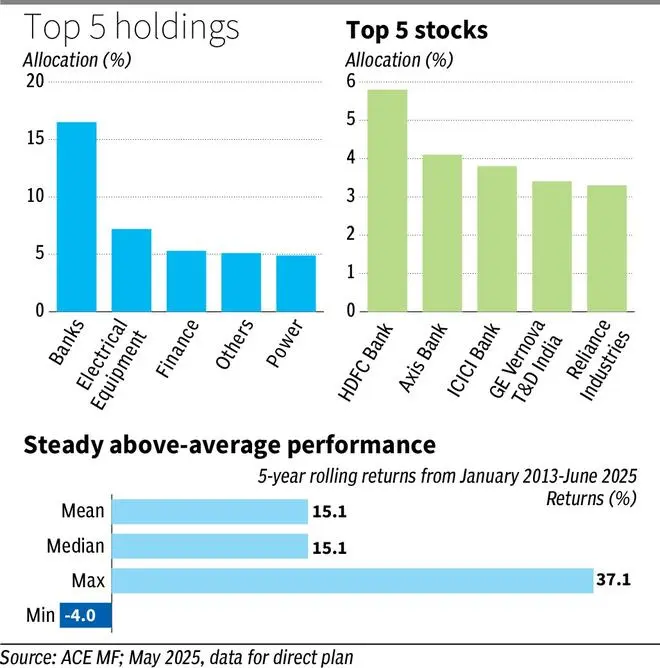

When five-year rolling returns over the past 12-odd years (Jan 2013-June 2025) are considered, the fund has delivered mean returns of 15.1 per cent, which is reasonably healthy. Over the same timeframe and aforementioned rolling return period, the scheme’s benchmark, Nifty 500 TRI delivered average returns of 14.1 per cent.

Over the Jan 2013-June 2025 period, on a five-year rolling basis, Nippon India Multi Cap has beaten the Nifty 500 TRI 62 per cent of the time. It has delivered more than 15 per cent nearly half the time and more than 12 per cent for almost 73 per cent of the time.

The fund’s SIP returns (XIRR) over the past 10 years are fairly robust at 20.4 per cent. An SIP in the Nifty 500 TRI would have returned 16.4 per cent over this period.

All return figures pertain to the direct plan of Nippon India Multi Cap fund.

The fund has an upside capture ratio of 105.7, indicating that its NAV rises a bit more than the benchmark during rallies. But more importantly, it has a downside capture ratio of just 72.2, suggesting that the scheme’s NAV falls much less than the benchmark during corrections. A score of 100 indicates that a fund performs in line with its benchmark. This inference is based on data from June 2022 to June 2025.

Mix of styles

Nippon India Multi Cap fund spreads its bets across market segments, in keeping with its mandate. The proportion is usually a function of market dynamics among a few other considerations. Large-caps form about 40-45 per cent of the portfolio at most times, while the proportion of mid and small-caps totals to 54 per cent or more. Going heavy, especially on small-caps, has helped the fund in its outperformance over the past few years.

When key indices turned volatile late last year and early this year, the fund upped stakes in large-caps within the portfolio and trimmed exposure to other market cap segments.

The overall portfolio is highly diffused and individual stocks barring the top one or two account for less than 5 per cent of the portfolio. In the May 2025 portfolio, the fund held as many as 129 stocks in its portfolio, thus managing to keep concentration risks at bay.

Banks have always been the top holdings of the fund across market cycles. Interestingly, electrical equipment companies also figure in prominence, as do power firms during most times.

The fund was able to get into hotels and leisure companies early on and gained from their rally, before clipping exposure over the last one year. It was able to time the entry and exit into pharma and biotech stocks as well.

Nippon India Multi Cap has always had low exposure to FMCG and IT stocks, which helped it avoid the underperformance in these segments.

Overall, the fund’s choices are governed by mix of momentum, value and growth styles, with a diffused portfolio to keep risks manageable.

The scheme remains invested for most part with hardly any significant cash positions taken even during volatile phases.

Published on June 14, 2025

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.