Our Terms & Conditions | Our Privacy Policy

Revenue receipts drop 11% in July-Aug

The government’s revenue collection in the first two months of the current fiscal year has been 11 percent lower year-on-year, which the tax administration attributed to the recent political unrest and the interim government’s emphasis on doing away with inflated figures.

The National Board of Revenue (NBR) logged Tk 42,106 crore in the July-August period of fiscal year 2024-25.

For all latest news, follow The Daily Star’s Google News channel.

This resulted in a shortfall of around Tk 15,069 crore from its own target for the two months.

By the end of the fiscal year, the tax administration aims to collect Tk 480,000 crore in revenue.

The interim government will not cut the revenue collection target set by the past government for this fiscal year, Finance Adviser Salehuddin Ahmed recently said.

“The slowdown in revenue growth in July-August is driven by the political unrest,” said Ashikur Rahman, principal economist of the Policy Research Institute of Bangladesh.

The massive political unrest that ousted the Awami League government on August 5 significantly hampered the nation’s economic activities, including trade through ports.

However, Rahman thinks the NBR has been sincerely coming up with accurate data ever since the interim government came to office.

State bodies like the NBR, the Export Promotion Bureau and Bangladesh Bureau of Statistics have come under intensive scrutiny, he said.

They are alleged to have provided inflated economic indicators in the past in an effort to project a scenario that everything was going well, he added.

“Consequently, I believe the state bodies are now trying to be as accurate as possible as data governance has become a critical discussion point across concerned stakeholders,” he said.

“We are now producing revenue data in tune with the Office of the Controller General of Accounts, which takes into account actual collections through iBAS++,” informed an official of the NBR.

The iBAS++, or Integrated Budget and Accounting System, is an integrated financial management information system used by the government.

It is a centralised internet and Oracle based software that allows budget preparation, fund releases, payment processing through electronic fund transfers, accounting of all receipts, payments of the government and so on.

The system essentially provides a complete picture of the financial assets and liabilities of the government at any given point in time.

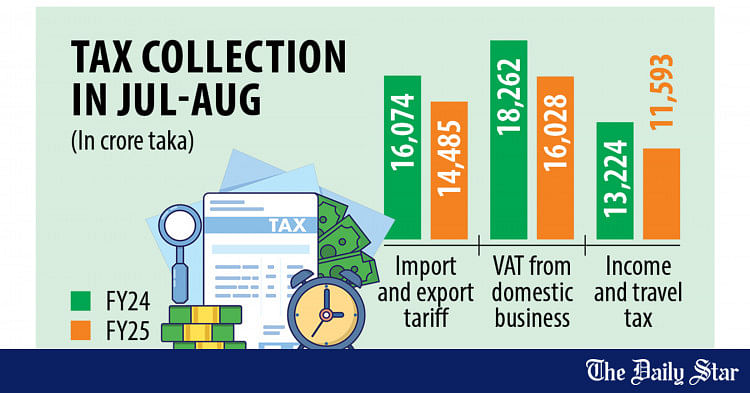

The year-on-year drop in revenue generation emanated from all three sources — income tax, value added tax and customs duties.

Collection of duties from international trade fell 9.8 percent to Tk 14,485 crore owing to a fall in imports during the political turmoil.

Income tax receipts also declined by 12 percent to Tk 18,634 crore.

Meanwhile, the collection of value added tax, the biggest source of revenue, fell 12 percent to Tk 16,028 crore.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.