Our Terms & Conditions | Our Privacy Policy

How Nutrabay Became An INR 100 Cr Profitable Brand With Its Lean & Frugal Playbook

“It’s a round ball and a round bat, and you got to hit it square.” That was American baseball icon and manager Pete Rose. On the other face of the planet, the square is hit when it comes to the platter of the quintessential gourmet Indian. The luscious fantasies of the discerning Indian foodie have withered away over the years to make space for a square meal – to stay fit, not just on track and field, but also in everyday life.

It’s not just the millennials or the GenZ, often tagged fitness freaks, staying fit has slowly become a mindset for an expanding middle class, which is likely to reach 1 Bn in strength by the time India turns 100 in 2047. Marked within an annual household income bracket of INR 5 Lakh to INR 30 Lakh, the upwardly mobile middle class – defined as the biggest consumer class in the $4.3 Tn Indian economy – has fostered the rise of a $1.79 Bn market for sports nutrition products and set it on course to reach $3.31 Bn by 2033.

Sports nutrition products that include supplements, sports drinks, energy bars, and protein powders were primarily consumed by professional athletes and bodybuilders. In fact, the concept of supplements and scientifically formulated nutrition remained niche until the early 2000s, when the shift in mindset to stay fit pushed an increasing number of people to buy gym memberships and participate in sporting events.

What further encouraged the Indian consumer was the exposure to international fitness trends and endorsements from global athletes. All these catalysed the demand for sports nutrition products.

As international brands like Optimum Nutrition (ON) and GNC (General Nutrition Centers) started gaining traction in Indian markets, HealthKart launched MuscleBlaze in 2012, offering locally manufactured supplements at competitive prices. Yet, the segment remained largely unorganised.

“Around 2011-12, counterfeit, unregistered, and unapproved products and misleading labels were widespread in the market. This made it extremely difficult for consumers to identify genuine products,” said first-time entrepreneur Shreyans Jain.

The market was dominated by international brands, with very few reliable Indian alternatives. On top of this, high import costs made these supplements expensive, often costing INR 5,000 to INR 8,000 a month. “What made it worse was that even after spending so much, most of these products were either fake or unregulated.”

The turning point came around 2017-18, when the market saw a sharp spurt in sports nutrition products. Shreyans positioned his brainchild Nutrabay at this juncture as a marketplace designed to ensure end-to-end control over the brands and products offered to consumers.

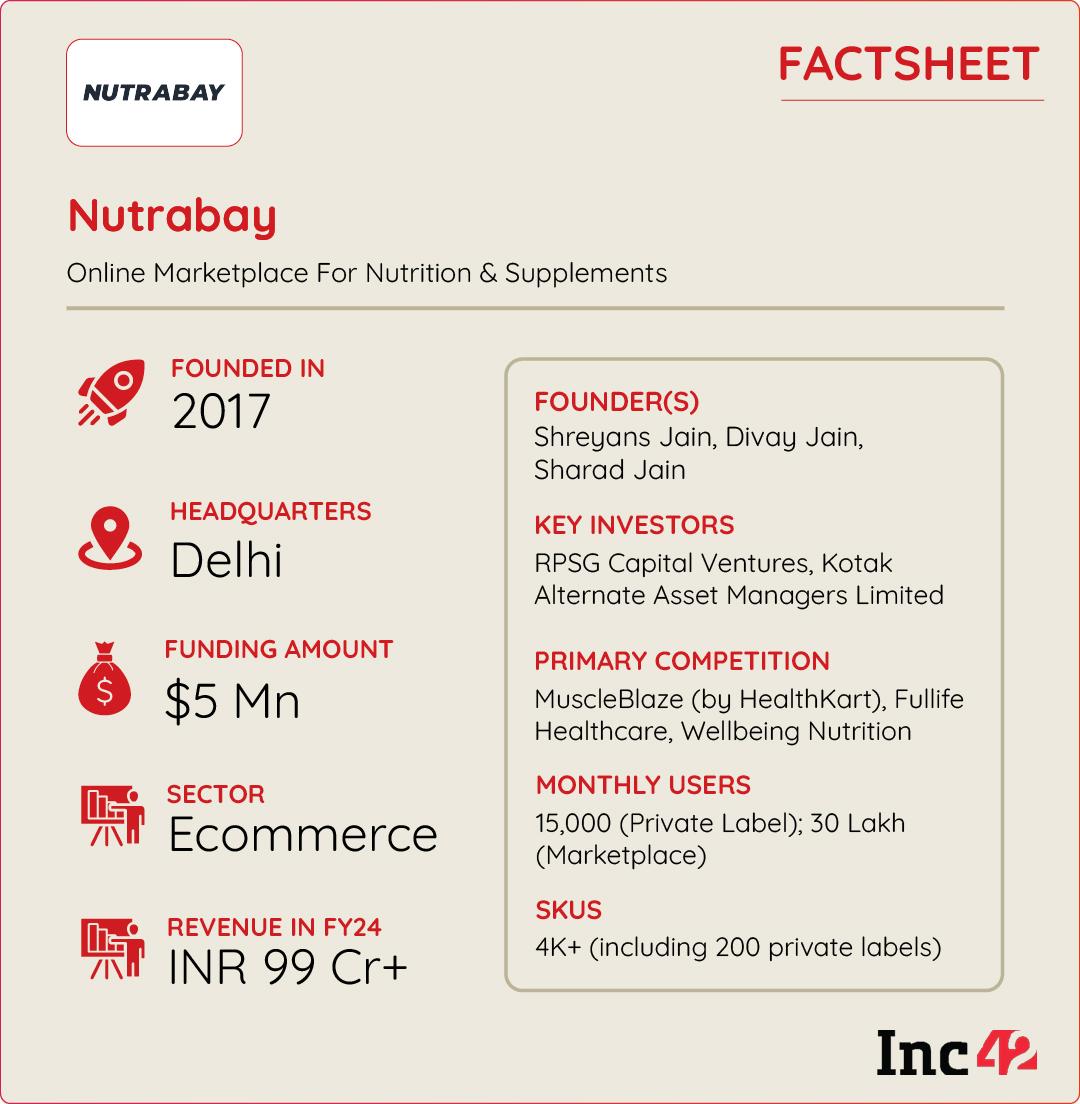

Nearly eight years on, Nutrabay reported an annual recurring revenue (ARR) of INR 100 Cr reached in FY24. The brand also runs an eponymous private label offering clean products that are natural, minimally processed, transparent and without any artificial ingredient, and lab-tested supplements at competitive prices, targeting middle class consumers in Tier-II and Tier-III cities.

Nutrabay’s total revenue grew over 45% from INR 68 Cr in FY20 to INR 99 Cr in FY24. The startup turned profitable in FY24 with a net profit of INR 1.22 Cr, making a sharp turnaround from an INR 5.80 Lakh loss a year back. In the one year to FY24, its EBITDA too surged nearly four-fold, reaching INR 2.26 Cr.

Nutrabay’s private label offers more than 200 SKUs and has a customer base of over 1.5 Mn, growing rapidly at 80% on-year in FY24. Its marketplace has over 150 brands and more than 4,000 SKUs, including Superfyou, Gladful, Setu, MuscleTech, and Athlab. It delivers over 3 Mn orders a month. Observing the potential in the market, investors like RPSG Capital Ventures and Kotak Alternate Asset Managers parked over $5 Mn in the startup last year.

Setting A Brand On Speed Track To INR 100 Cr Turnover

The birth of Nutrabay traces back to Shreyans’s college days when he was doing computer engineering. As a regular gym-goer and fitness enthusiast, he would consume a lot of supplements. “It was difficult for a college student to afford those expensive, imported brands,” he said. To address this pain point, Shreyans made his first attempt in 2012 by becoming a distributor and reseller of some supplement brands. “It didn’t, however, give me control over marketplace logistics and product authenticity.”

A couple of years later, in 2015, an ASSOCHAM study highlighted that approximately 60-70% of dietary supplements sold in India were fake, counterfeit, unregistered, or unapproved. Shreyans had identified these issues well before this study was published.

The rise in ecommerce around 2016 unlocked an open field for him to thrash out a solution. He found that though online shopping was booming, the supplement options available weren’t reliable. Despite platforms like Amazon and Flipkart, trust deficit ran high in the market.

“Consumers typically had two types of online options: vertical marketplaces focussed on health and supplements, or horizontal marketplaces like Amazon and Flipkart. The latter had only just started building their supplement categories, and it wasn’t a key focus for them,” Shreyans said. “But anyone could sign up as a seller and start selling products – even if they weren’t authorised resellers. That led to highly mixed consumer experiences, with many receiving fake or expired products.”

After Shreyans reached out to his cousin Sharad, who was dealing in vitamin-related products in the offline space and had some experience selling on online platforms, they spent 4–5 months researching the market and studying the consumer. Later, they roped in cousin Divay to launch Nutrabay as a marketplace. They tied up directly with brands, became authorised retailers, and made a conscious decision not to onboard any third-party sellers. The startup was officially founded in January 2017.

span {

margin: 0;

padding: 3px 8px !important;

font-size: 10px !important;

line-height: 20px !important;

border-radius: 4px !important;

font-weight: 400 !important;

font-style: normal;

font-family: noto sans, sans-serif;

color: #fff;

letter-spacing: 0 !important;

}

.code-block.code-block-55 .tagged {

margin: -4px 0 1px;

padding: 0;

line-height: normal;

}

@media only screen and (max-width: 767px){

.code-block.code-block-55 {

padding:20px 10px;

}

.code-block.code-block-55 .recomended-title {

font-size: 16px;

line-height: 20px;

margin-bottom: 10px;

}

.code-block.code-block-55 .card-content {

padding: 10px !important;

}

.code-block.code-block-55 {

border-radius: 12px;

padding-bottom: 0;

}

.large-4.medium-4.small-6.column {

padding: 3px;

}

.code-block.code-block-55 .card-wrapper.common-card figure img {

width: 100%;

min-height: 120px !important;

max-height: 120px !important;

object-fit: cover;

}

.code-block.code-block-55 .card-wrapper .taxonomy-wrap .post-category {

padding: 0px 5px !important;

font-size: 8px !important;

height: auto !important;

line-height:15px;

}

.single .code-block.code-block-55 .entry-title.recommended-block-head a {

font-size: 10px !important;

line-height: 12px !important;

}

.code-block.code-block-55 .card-wrapper.common-card .meta-wrapper .meta .author a, .card-wrapper.common-card .meta-wrapper span {

font-size: 8px;

}

.code-block.code-block-55 .row.recomended-slider {

overflow-x: auto;

flex-wrap: nowrap;

padding-bottom: 20px

}

.code-block.code-block-55 .type-post .card-wrapper .card-content .entry-title.recommended-block-head {

line-height: 14px !important;

margin: 5px 0 10px !important;

}

.code-block.code-block-55 .card-wrapper.common-card .meta-wrapper span {

font-size: 6px;

margin: 0;

}

.code-block.code-block-55 .large-4.medium-4.small-6.column {

max-width: 48%;

}

.code-block.code-block-55 .sponsor-tag-v2>span {

padding: 2px 5px !important;

font-size: 8px !important;

font-weight: 400;

border-radius: 4px;

font-weight: 400;

font-style: normal;

font-family: noto sans, sans-serif;

color: #fff;

letter-spacing: 0;

height: auto !important;

}

.code-block.code-block-55 .tagged {

margin: 0 0 -4px;

line-height: 22px;

padding: 0;

}

.code-block.code-block-55 a.sponsor-tag-v2 {

margin: 0;

}

}

]]>

Nutrabay was rolled out with whey protein and later expanded to sports nutrition products, vitamins and supplements, health foods and drinks, and even workout equipment.

In India, where the gym and training market is pegged at $598.86 Mn and projected to average an annual growth rate of 4.86% till 2030, orders started pouring in on Nutrabay within weeks. The company reached a revenue of INR 2.4 Cr in the first year and reached INR 48.3 Cr in FY19.

“The next logical step for us was to launch our own private label,” Sheyans said. The Nutrabay private label spans across categories such as shaker bottles, whey protein, weight gainers, peanut butter, shilajit, fat burners, and digestive fibres.

Clearing Hurdles Along The Growth Turf

The biggest challenge for the founders has been building consumer trust and ensuring authenticity. The presence of third-party sellers only made the problem worse.

They also faced major hurdles on the operational and technology fronts. As the brand tried to scale rapidly, the hurdles turned steeper. “Since we were operating on a full inventory model, there were multiple instances where the number of incoming orders exceeded our capacity to fulfill them,” said Shreyans.

They first set up a small fulfillment centre to resolve the issue but it was choked within a few months as volumes surged. It took a while to identify and move to a new facility, around four to five times the previous one. Even this expanded space soon proved insufficient. “The growth was happening at such a rapid pace that we had to relocate once again to a much larger centre. It turned into a continuous process of upgrading infrastructure to keep up with the rising demand,” said the founder.

He added that back in 2019, they didn’t have a tech team – everything on the website was built by the founder himself. “As traffic surged, especially during campaigns, the site often crashed because it couldn’t handle the load. Managing scale without proper tech support was one of our early challenges.”

On the operational side, the company built a tightly controlled supply chain by sourcing products directly from brands or official importers, eliminating third-party sellers. “This ensured 100% authenticity – a major concern in the supplements industry.”

Every product today is quality checked for hygiene and damage, packed under video surveillance, and secured using tamper-proof Nutrabay-branded tapes. For their private label, products come with an authenticity sticker featuring a scratch code that customers can verify online. Additionally, its jars are sealed with a neck band and vacuum barrier to prevent tampering during transit.

In terms of R&D, the company follows a hybrid model. While the core research and formulation ideas are developed by its in-house nutritionists, the execution happens collaboratively with 6–7 exclusive manufacturing partners who work closely with them to bring those formulations to life.

On the tech side, after early setbacks, they eventually built a more robust platform with proper tech support to manage the scale more efficiently.

Building Up The Playbook, Mapping The Way Forward

As athletes and fitness enthusiasts increasingly stress on the need for a balanced, science-backed approach to diet to remain physically fit on a global scale, the link between sports performance and nutrition comes to the fore, making sports nutrition all the more important.

The sports nutrition market in India is on the boil with a host of emerging and seasoned supplement brands vying for a slice of the pie that’s expanding 8.1% every year. Nutrabay operates at the centre of this boom, where new-entrant D2C players like SuperYou and Gladful are taking on several strong brands.

The successful growth stories in the sports nutrition space includes that of health and wellness supplements brand HealthKart which runs MuscleBlaze and HK Vitals. The company saw remarkable growth since its launch in 2011 and surpassed INR 1,000 Cr in revenue in FY24.

While fast-scaling D2C player Wellbeing Nutrition looks to close FY25 with an INR 140 Cr revenue, ayurvedic nutrition brand Kapiva has crossed the INR 200 Cr mark in FY24.

To achieve their long-term vision of becoming an INR 500 Cr brand in such a competitive market, the Nutrabay founders are clear that they need to double down on their digital presence while simultaneously building a strong omnichannel strategy. According to Shreyans, the INR 100 Cr ARR milestone was reached because of consistent growth, control over product quality and check on operational costs. By the time they reached this mark, Nutrabay had laid out a solid foundation for expansion, he said.

“Today, we have over 1.5 Mn customers, with 15,000 to 20,000 people joining us every month. Our private label has seen an 80% growth over the last year, we have delivered over 3 Mn monthly orders across channels, and our average order value stands at INR 2,000.”

Nutrabay aims for a 15-20 Minute delivery across the country using quick commerce or its own D2C channel powered by decentralised fulfillment centres. The startup expanded to the quick commerce space by launching on Zepto two months ago. It now plans to be present across all major quick commerce platforms.

“The goal is to aggressively scale this channel, offering faster delivery and a superior customer experience. A key milestone for 2025 is to go live across all major Indian cities on every leading quick commerce platform. These combined efforts are expected to boost customer trust, expand the reach, and accelerate growth,” added the founder.

For its omnichannel play, Nutrabay recently opened its first exclusive brand outlet (EBO) in Uttam Nagar, New Delhi. Moving ahead, the brand plans to open 10 more EBOs across Delhi NCR, which accounts for 35% of its total customer base.

Nutrabay aims to deepen its presence in the existing markets while expanding into high-potential regions. Its long-term retail expansion strategy follows a four-quadrant approach. First, prioritising areas where both category size and brand share are high. Second, regions where the brand is strong but the category is still emerging. Third, areas with lower brand share but higher category presence. And finally, low-priority markets where both brand and category presence are limited.

An EY India study a couple of years back showed that the average Indian began prioritising health and wellness since COVID, with many willing to spend more on fitness classes, natural foods, health supplements, and specialised diets. As the need for a nutritious square meal gains mindspace, the market for sports nutrition products matures, throwing up room for startups like Nutrabay to achieve ambitious growth targets.

[Edited By Kumar Chatterjee]

[ad_1]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

[ad_2]

Comments are closed.