45-year-old Arunram realized this while planning a long weekend with his family recently. He needed a star hotel close to the heritage site and near the highway as he wanted to drive from Chennai.

While researching, his first stop was Agoda, an international online travel booking portal. Unhappy with the choices the site returned, he fell back on MakeMyTrip, India’s largest online travel agency (OTA) and a platform he had used in the past.

This time, Arunram wasn’t disappointed. He found a small hotel, Merrytale, with a rating of over 4, just off the national highway 36, and under 50km from Gangaikonda Cholapuram.

Arunram’s successful booking appears to be a simple affair, executed in a few clicks. But back in Gurugram, nearly 2,500km away, every such transaction is a validation for executives at MakeMyTrip’s headquarters. The company, ever since the covid-19 pandemic, has pivoted from air ticket bookings to the hotels and homestays category, quietly building up a massive inventory of 95,000 accommodations in over 2,000 locations across India. This is what allows the aggregator to cater to travellers like Arunram, who venture beyond the big cities and into small corners like Gangaikonda Cholapuram.

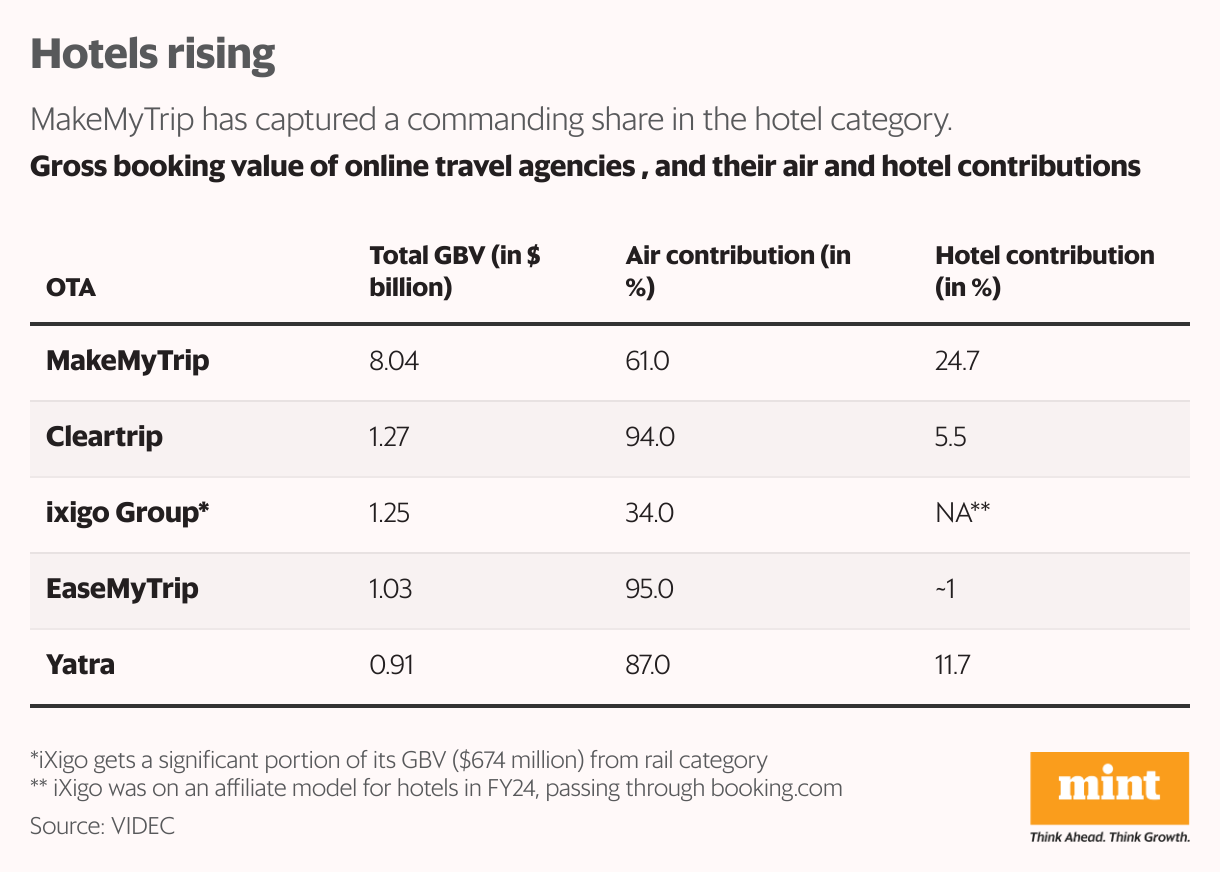

Hotels are the second-largest category in travel after air. According to VIDEC, a travel advisory and analytics firm, gross booking value (GBV) in India’s air market totalled $27.5 billion in 2023-24. Hotels and rail followed with GBV of $14.6 billion and $8.5 billion, respectively. The intercity bus segment is the smallest, with GBV totalling only $5.7 billion that year.

View Full Image

A screengrab from MMT’s app.

While MakeMyTrip is already a market leader in air, hotel and intercity bus travel, the competition in hotels is heating up. In early October, Dutch investor Prosus took a 15% share in MakeMyTrip’s rival iXigo. While 5% of the stake was via the secondary route, Prosus invested ₹1,295 crore for the remaining 10.1% stake. These funds, iXigo disclosed, will partly be used to fuel its expansion in the hotel category.

Hotels, which offer far higher margins than air ticket bookings, are crucial for MakeMyTrip’s future growth and its ‘super app’ ambition—the company harbours dreams of being a one-stop shop for everything in travel, from tickets and accommodation to forex and visas.

So, how is the aggregator going about consolidating this business? Before we delve deeper, let’s look at its commanding market share and recent financial performance.

Market juggernaut

MakeMyTrip, founded by Deep Kalra in 2000, with a focus on the US-India travel market, listed on the Nasdaq nine years later, in 2010. The company pursued an aggressive strategy of acquisitions, swallowing up key players across the travel ecosystem. The list of targets, over the years, include Goibibo (OTA), BookMyForex (travel forex), Savaari (ground transport) and Happay (expense management platform), among others.

This year, it executed a $3.1 billion share buyback to reduce Trip.com’s stake and board influence. The Chinese travel company is MakeMyTrip’s largest shareholder and the buyback reduced the stake from just over 45% to “between 16.90% to 19.99%.”

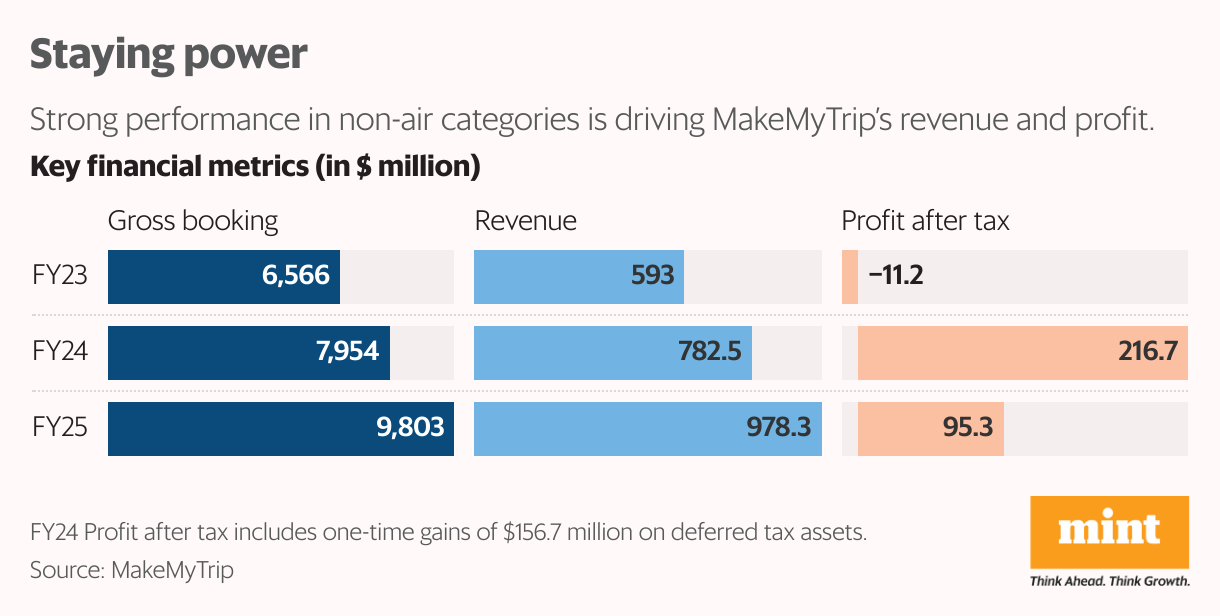

MakeMyTrip, meanwhile, is nearing a billion dollars in revenue—in 2024-25, it generated $978 million in topline, growing 25%. It is also within touching distance of crossing $10 billion in GBV this fiscal year. About 85 million people have used its platform and the company claims that 70% of them are ‘repeat customers.’

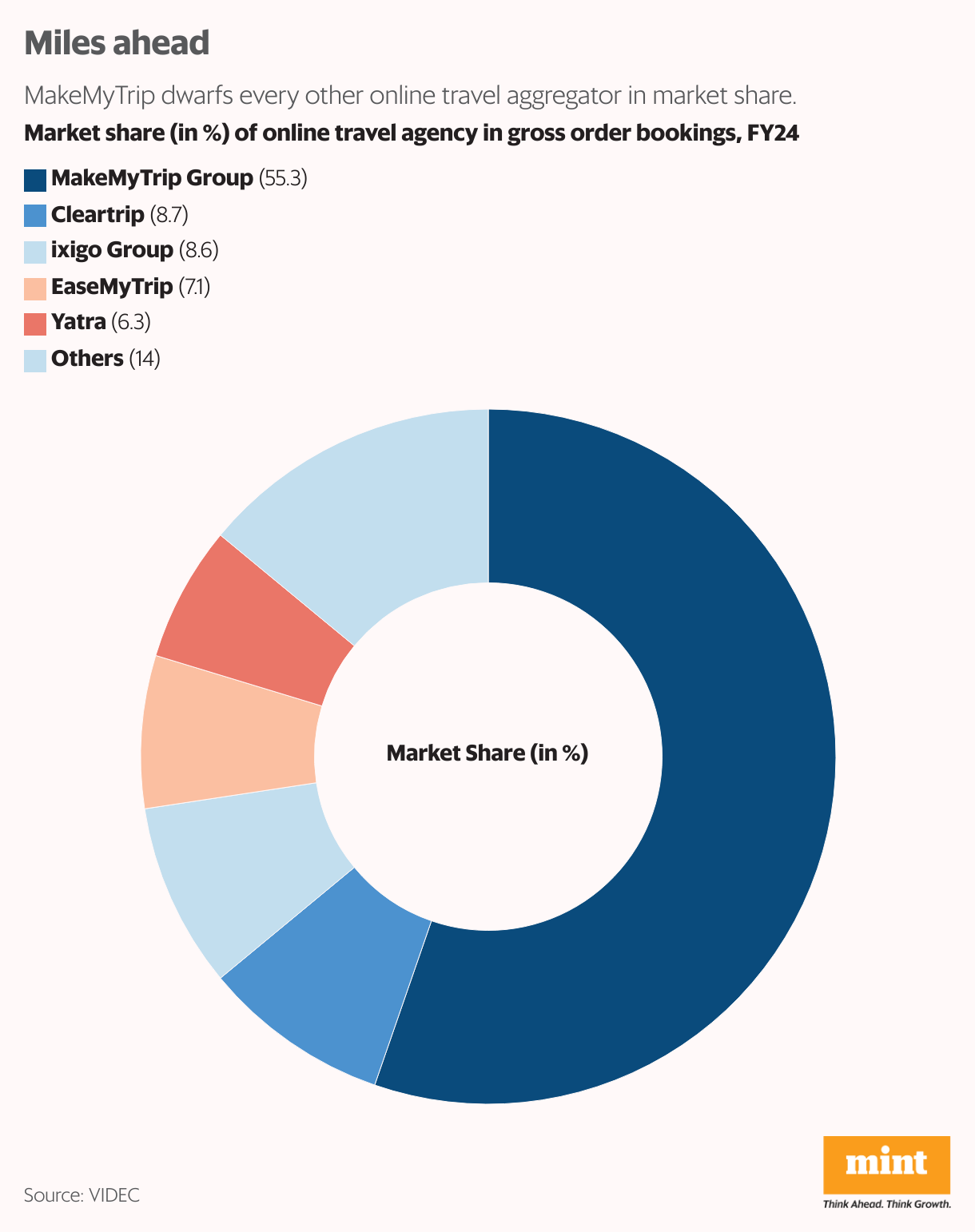

Meanwhile, it dwarfs every other OTA, commanding a massive 55.3% share of all bookings in 2023-24, according to data from VIDEC. The next two players, Cleartrip and Ixigo, have shares in single digits, 8.7% and 8.6%, respectively.

While air is MakeMyTrip’s biggest business in terms of bookings (61%), the margins tell a different story.

Until about 2022, adjusted margins in the air business hovered in the range of 46-48%. However, by 2024, the combined segment of hotels and packages became the largest contributor to its adjusted margins, accounting for 42.7% compared to the air category’s 38.9%, according to the company’s financial disclosures.

Adjusted margin is a non-IFRS financial metric MakeMyTrip uses to measure its business profitability by adding back certain costs deducted from IFRS revenue, such as customer incentives, and deducting the cost of procuring services.

IFRS is short for International Financial Reporting Standards—accounting standards that provide a common global language for financial reporting.

“IndiGo enjoys a leadership position in the domestic sector but has a very lean commercial model, making airline sales a wafer-thin margin product for the online intermediaries,” said Virendra Jain, co-founder and chief executive officer (CEO) of VIDEC. MakeMyTrip started doubling down on non-air products as early as 2010. But for rivals like Cleartrip and EaseMytrip, air’s contribution to GBV is as high as 90% even now, Jain added.

This shift underlines MakeMyTrip’s evolving strategy, one that could fuel its next phase of growth.

New battleground

Apart from offering higher margins, the hotels sector offers vast headroom for growth due to its severe lack of online penetration.

Just around 27% of the total hotel GBV of $14.6 billion is sourced through online channels. This is largely due to the fact that only 9% of the 2.1 million rooms available currently in India are with the chain hotels, according to VIDEC. In short, this is a highly fragmented industry.

“The headroom for growth is significant in the hotel category,” said Rajesh Magow, CEO of MakeMyTrip, during an interaction with Mint. Post-pandemic, much of the company’s focus was on increasing hotel supply on its platform.

As the number of Indian travellers increase with more disposable income in the years ahead, these small, independent hotels wouldn’t have the resources to run international loyalty programmes like Marriott’s Bonvoy.

“All the hotels in India rely significantly on OTAs for distribution. The value of OTAs is in their ability to drive a pan-India demand, across cross-sections of business and leisure traveller cohorts,” said Jain. “Unlike in airlines, where we have a duopoly, hotels will continue to rely upon OTAs to a phenomenally higher degree because of the high fragmentation,” he added.

Hotels also make sense from a simple demand-supply dynamic. A report by Booking.com, MakeMyTrip’s rival in the hotel category, stated that hotel demand will continue to grow at 10.5% annually till 2027, outpacing the 8% growth in supply.

The local hero

Niraj Sharan, 36, got into the hospitality business in 2010 with a top branded hotel chain. In 2019, he transformed his mother’s property in Dehradun, Uttarakhand, into a homestay and has been running it since.

Mango Tree Courtyard, as the 11-room property is called, has tariffs ranging between ₹3,000 and ₹5,500, depending on the room and season. The aftermath of the pandemic proved to be a blessing. Travellers, he found, increasingly preferred smaller and more secluded properties rather than large hotels due to safety concerns.

Sharan has been listed on MakeMyTrip from the very beginning. “From an online perspective, MakeMyTrip was the place to be because of their presence and size,” he said. His property is also listed on other OTAs, including international ones like Booking.com. Since he has a high repeat customer rate, direct bookings accounted for 55% of overall bookings in 2024. Of the OTAs, MakeMyTrip and GoIbibo together accounted for over 55% of the bookings, with the rest split among other online platforms. Sharan said that the MakeMyTrip Group also takes less commissions, up to 8% lower, compared to other OTAs, underscoring the aggressive nature of supply aggregation in the business.

View Full Image

A file photo of Mango Tree Courtyard in Dehradun.

But the real secret weapon for MakeMyTrip isn’t the price; it’s the human at the centre of its ecosystem. Sharan calls that a “big game-changer.”

“As a homestay operator, we struggle with international platforms since they don’t have a local presence and you can’t call them,” he explained.

MakeMyTrip, on the other hand, provides a dedicated account manager who visits Mango Tree Courtyard every two weeks. This boots-on-the-ground support ensures listing accuracy and provides a customer care number that travellers can call for issue resolution. This support not only helps Sharan manage communication errors but also allows the company to enforce quality control on non-standardized properties.

Sharan’s choice is exactly what Magow and his team are banking on. Slowly but surely, India’s largest aggregator is building out its homestays and vacation rentals business, apart from hotels. And similar to hotels, this is also a severely supply-constrained market. Many Tier-II and beyond destinations, especially in pilgrimage centres, just do not offer enough hotel rooms, like Arunram realized in Gangaikonda Cholapuram.

MakeMyTrip has invested in an onboarding team and a platform, Connect, that offers end-to-end onboarding for homestay hosts to list their property. With regional and zonal offices across the country, these teams are tasked with ensuring what’s listed is accurate. A ‘quality score’ mechanism is followed for each new property, which checks the content (used in the listing), inventory, amenities and other property details.

View Full Image

A screengrab from MMT’s app. The company is building out its homestays and vacation rentals business.

Magow is clear that the company will not get into the fulfilment part of managing or running home stays. However, it is investing in technology to ensure there is no mismatch between customer expectation and reality. “Our position is to aggregate all of the (homestay) inventory and bring in all the quality checks that we possibly can,” the CEO said.

On a run-rate basis, alternate accommodation is already at about 10% of the company’s daily business-to-consumer volumes, he added. MakeMyTrip also offers travel solutions to corporations.

The headaches

Challenges lurk despite MakeMyTrip’s dominant position in hotels and the aggressive push into high-growth areas like homestays. The company faces three hurdles: scaling its complex supply, warding off friction with hotels, and getting past technological disruption.

“Scaling in this category (homestays) comes with its own unique set of challenges. Standardization, safety assurance and consistent service quality remain major hurdles,” said Mandeep Lamba, president at HVS Anarock, an advisory firm.

Guests expect reliability, irrespective of the property type or location, and ensuring this across a largely unorganized and independently owned inventory is complex. “Trust becomes a key currency here, especially for first-time users who may be hesitant to try lesser-known or unconventional options,” Lamba added.

Standardization, safety assurance, and consistent service quality remain major hurdles. — Mandeep Lamba

Companies like Booking.com and Airbnb have successfully used measures such as customer reviews and the rating system to solve this problem to a certain extent. Airbnb is the market leader when it comes to homestays in India, said VIDEC’s Jain, followed by MakeMyTrip and Booking.com.

On the supply-side, the hotels sector runs the risk of disputes around contract clauses, and at times, payments.

In 2022, based on a complaint filed by the Federation of Hotel and Restaurant Associations of India, the Competition Commission of India held MakeMyTrip-GoIbibo and OYO guilty of unfair business practices, and slapped a fine of ₹223.48 crore on the former. One of the key issues was that MakeMyTrip-GoIbibo had imposed price parity on hotel partners. Price parity clauses bar hotels from offering their rooms at lower prices, or on better terms, on their own websites or on other platforms. The appeal process is ongoing.

“High commission structures remain a major friction point between OTAs and hotels,” said Lamba.

At an overall business level, challenges and challengers can rise from anywhere. The existential threat may not be a rival OTA; it could be someone outside of the travel industry, trying to own the customer journey.

Premium credit card programmes, for instance, can chip away at juicy customers. Take the example of a 47-year-old Bengaluru based investment banker, who spoke to Mint on the condition of anonymity because he has partners who work with MakeMyTrip. A regular user of the platform, he recently tried out SmartBuy, an HDFC Bank platform that displays offers extended by merchants to the bank’s customers. He used his HDFC Infinia card rewards points to purchase air tickets from a rival OTA.

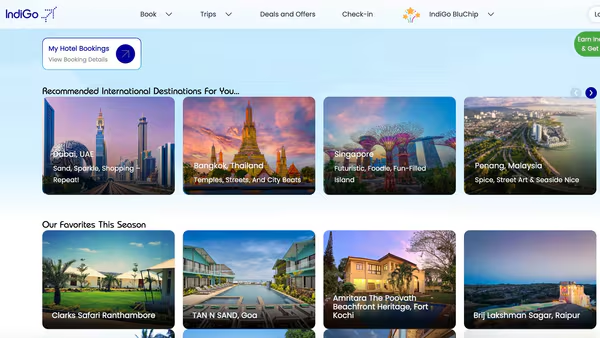

Meanwhile, both airlines and large hotel chains are trying to own the consumer by aggressively using loyalty programmes and price parity guarantees to drive direct-to-consumer bookings, effectively bypassing the OTA altogether. IndiGo has partnered with Expedia to offer hotel bookings through its portal and has also launched a trips and experiences marketplace.

View Full Image

A screengrab from IndiGo’s hotels booking page.

Finally, there’s the threat of generative artificial intelligence (AI) platforms, like ChatGPT, Gemini and Perplexity, which could capture the user’s planning journey even before they fire up the MakeMyTrip app. If a user plans their entire trip—from ideation to itinerary—within an AI chatbot, MakeMyTrip could be reduced to a mere transaction layer, at the very end of the process.

This is why Magow refers to “constructive paranoia” during internal meetings. He wants to not only lead in supply aggregation and quality but also in technology—leverage the latest available—to stay ahead.

In August, the company released a multilingual voice based AI assistant that assists in trip planning and in executing the booking. A network of specialized AI agents, or software that performs autonomous tasks, run across all major travel categories in the back end, ensuring that an user’s journey on the platform is always “accompanied.”

“There should be enough sense of urgency, enough paranoia to be able to make sure that I make the maximum out of the technology that is available for my customers and before anyone else does it,” Magow said.

Staying ahead of generative AI platforms could be the true test of its dominance.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.