India’s automotive industry experienced its strongest quarter in over a year, with deal activity reaching USD 4.6 billion across 30 transactions in the third quarter of 2025, according to Grant Thornton Bharat’s latest Automotive Dealtracker report.

The surge in deal values represents a dramatic shift from the previous quarter, largely propelled by Tata Motors’ landmark USD 3.8 billion acquisition of Italian commercial vehicle manufacturer Iveco S.P.A. This transaction stands as one of India’s largest outbound automotive acquisitions to date and accounted for the lion’s share of the quarter’s activity.

However, the headline figure masks underlying trends in the sector. Excluding the Tata-Iveco deal, transaction values actually declined 36% compared to Q2, suggesting that large strategic acquisitions continue to drive overall momentum rather than broad-based sector growth.

Strategic Pivot Toward Global Expansion and Electrification

The quarter showcased a clear strategic pivot by Indian automotive players toward global expansion, electric vehicle technology, and supply chain transformation. Both strategic acquirers and private equity investors intensified their focus on what industry insiders call “future-ready mobility platforms.”

“The Indian automotive sector is in a phase of strategic reset — balancing policy reform, consumer realignment, and global expansion,” said Saket Mehra, Partner and Automotive Industry Leader at Grant Thornton Bharat. He pointed to the upcoming GST 2.0 rollout and targeted tariff interventions as catalysts for renewed demand.

Mehra added that the strong M&A and private equity activity reflects “India’s growing global ambition in commercial mobility and a clear shift toward scalable, tech-enabled platforms.”

M&A Activity Dominated by Cross-Border Deals

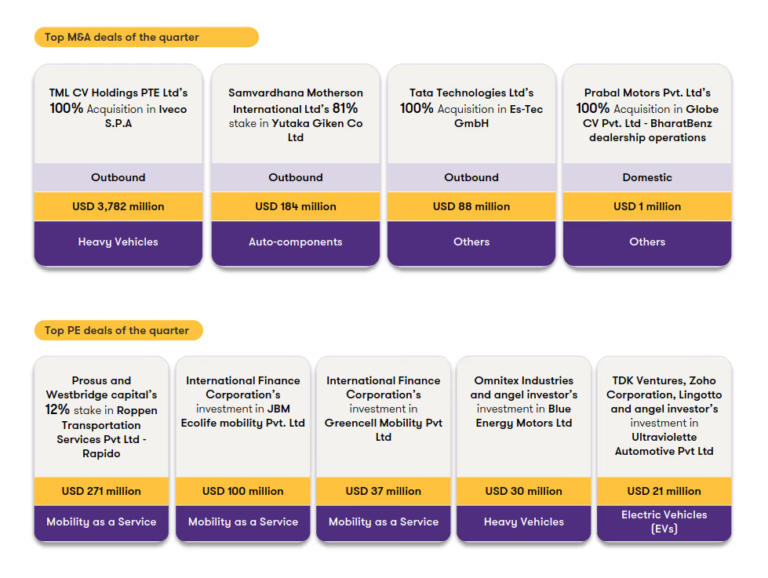

Mergers and acquisitions jumped significantly in value terms, with seven deals worth USD 4.1 billion representing a 1,234% increase over Q2, despite a 13% decline in deal volume. Cross-border transactions dominated the landscape, accounting for 71% of deal volumes and 99% of total values, with Asia and Europe being the primary regions of activity.

Beyond the Tata Motors-Iveco transaction, Samvardhana Motherson International executed three outbound acquisitions during the quarter, reinforcing India’s expanding role in global automotive supply chains. Tata Technologies also strengthened its position in next-generation vehicle innovation with an USD 88.2 million acquisition of Germany’s Es-Tec GmbH, enhancing its capabilities in advanced driver assistance systems and digital engineering.

Inbound investment also remained robust, with Germany’s Schmitz Cargobull investing in Sub Zero Insulation Technologies and Prabal Motors acquiring BharatBenz dealerships, underscoring continued global confidence in India’s automotive ecosystem.

Private Equity Focuses on Electric Mobility and Tech-Enabled Services

Private equity activity remained strong with 23 deals worth USD 531 million, reflecting a 15% increase in volumes but a 17% decline in values compared to the previous quarter. The drop in value stemmed from the absence of large-ticket transactions, with 70% of deals valued below USD 10 million, indicating investor preference for smaller, more focused investments.

Mobility-as-a-Service emerged as the dominant sector for PE investment, commanding nearly 80% of total private equity value. The standout transaction was Rapido’s USD 271 million funding round from Prosus and WestBridge Capital.

Clean mass mobility also attracted significant attention, with the International Finance Corporation backing electric bus operators JBM Ecolife Mobility and GreenCell Mobility with a combined USD 137 million investment. This funding will support the deployment of 4,000 electric buses across 39 cities, creating over 12,000 jobs and reducing carbon dioxide emissions by an estimated 1.6 billion kilograms.

Deep-tech EV innovation also accelerated, highlighted by TDK Ventures’ USD 21 million investment in Ultraviolette Automotive to scale its high-performance F77 platform and expand into global markets.

Public Markets Remain Quiet, But Major IPO on Horizon

Public market activity remained subdued throughout Q3, with no major initial public offerings or qualified institutional placements recorded. However, investor attention is increasingly focused on Toyota’s anticipated IPO in 2026, which is expected to reshape investment flows and reinvigorate sectoral interest.

The preference for private capital and strategic consolidation continued to dominate funding trends, with investors showing confidence in India’s growing clean mobility ecosystem through early-stage funding for EV infrastructure and component manufacturers, including Indigrid Technology, Evamp, PeakAmp, and Xbattery.

Industry experts anticipate sustained momentum across alternative fuel technologies, automotive technology, and supply chain digitization as policy support and festive demand converge. The rollout of GST 2.0 and the government’s focus on electric mobility are expected to provide additional tailwinds for the sector.

As India positions itself as a global hub for electric vehicle manufacturing and innovation, the third quarter’s robust deal activity suggests that both domestic and international investors are betting heavily on the country’s automotive future.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.